Question: IMPORTANT : If youre going to write please make sure your writing is neat and easy to read. Please write in print (not cursive).Please give

IMPORTANT: If youre going to write please make sure your writing is neat and easy to read. Please write in print (not cursive).Please give a detailed explanation for your answers. Thank you

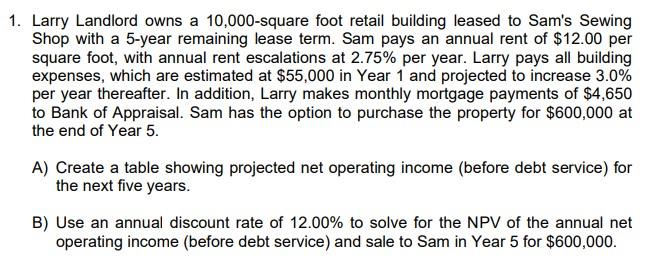

1. Larry Landlord owns a 10,000-square foot retail building leased to Sam's Sewing Shop with a 5-year remaining lease term. Sam pays an annual rent of $12.00 per square foot, with annual rent escalations at 2.75% per year. Larry pays all building expenses, which are estimated at $55,000 in Year 1 and projected to increase 3.0% per year thereafter. In addition, Larry makes monthly mortgage payments of $4,650 to Bank of Appraisal. Sam has the option to purchase the property for $600,000 at the end of Year 5. A) Create a table showing projected net operating income (before debt service) for the next five years. B) Use an annual discount rate of 12.00% to solve for the NPV of the annual net operating income (before debt service) and sale to Sam in Year 5 for $600,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts