Question: Important note: Solve the following TWO questions by using the excel sheet on your computer, then copy the tables which you created and paste them

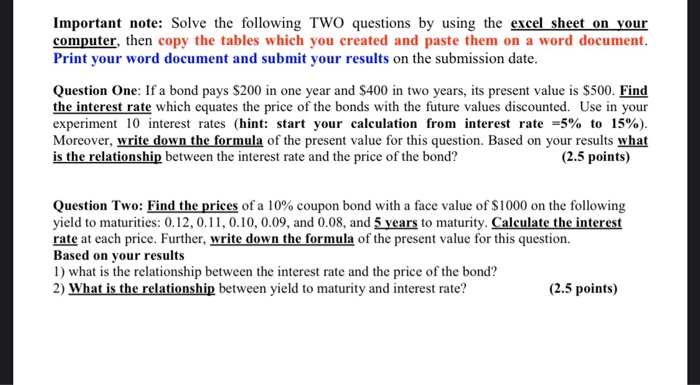

Important note: Solve the following TWO questions by using the excel sheet on your computer, then copy the tables which you created and paste them on a word document. Print your word document and submit your results on the submission date. Question One: If a bond pays $200 in one year and $400 in two years, its present value is $500. Find the interest rate which equates the price of the bonds with the future values discounted. Use in your experiment 10 interest rates (hint: start your calculation from interest rate -5% to 15%). Moreover, write down the formula of the present value for this question. Based on your results what is the relationship between the interest rate and the price of the bond? (2.5 points) Question Two: Find the prices of a 10% coupon bond with a face value of $1000 on the following yield to maturities: 0.12,0.11, 0.10, 0.09, and 0.08, and 5 years to maturity. Calculate the interest rate at each price. Further, write down the formula of the present value for this question. Based on your results 1) what is the relationship between the interest rate and the price of the bond? 2) What is the relationship between yield to maturity and interest rate? (2.5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts