Question: Important Notice: Only do part E and F Important Notice: Only do part E and F 86 INVESTMENTS WE VORMILLE STATEMENT OF FINANCIAL POSITION AS

Important Notice:

Only do part E and F

Important Notice:

Only do part E and F

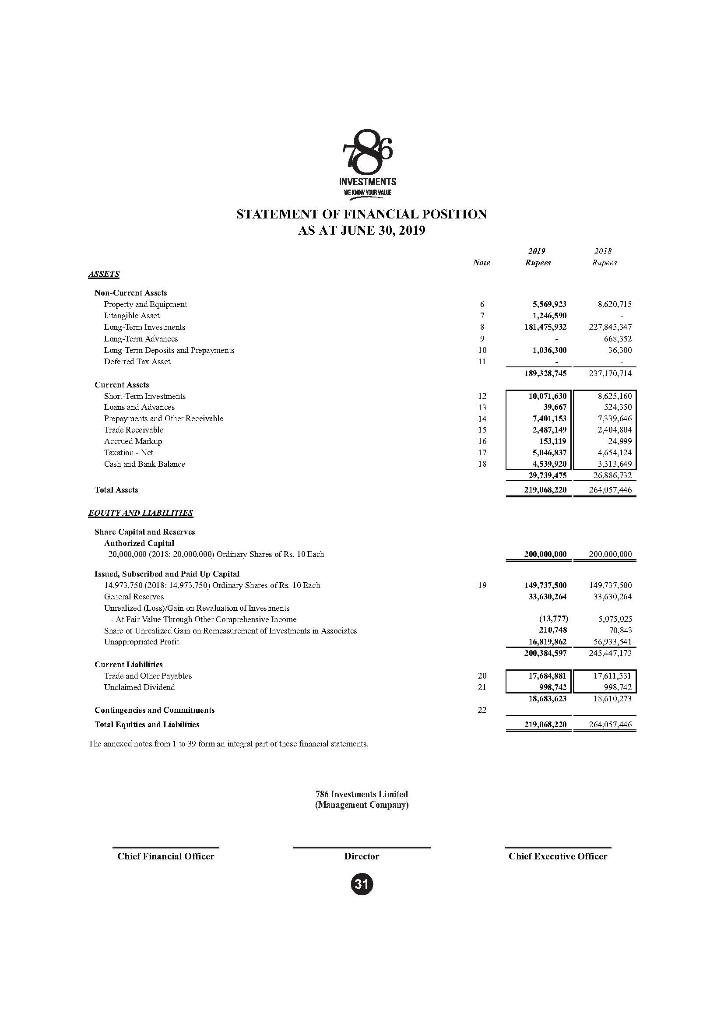

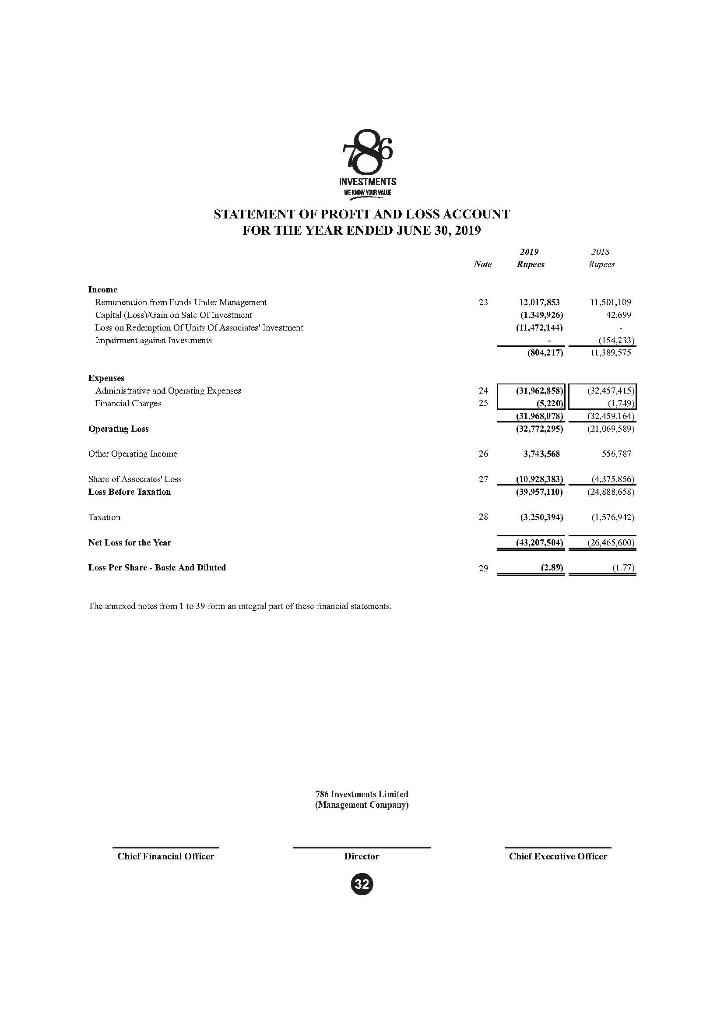

86 INVESTMENTS WE VORMILLE STATEMENT OF FINANCIAL POSITION AS AT JUNE 30, 2019 2019 2018 HU Voce SWS 8.620,715 6 7 Non-Current Assets Toperty and Equipcienu Litangihle Asaxt Luty Toca leves sowel Long-Term Ad Ling Ton Deposits a l'espawners Defend Tee Amt 5,569,992 1,246,500 181,475,932 8 y 9 10 11 227,843,347 663,33% 36,300 1,036,300 189,318,745 237.170,714 Current Assets Sur. Tem Ivestas Lu Adrese Pernyatardor Rassivehle T de Noivable Analec Markup Testinu. Vet Cassal Bank Balme 12 13 14 JS 16 12 18 10,071,630 39,667 39,667 1,401,168 2,487,14 153,119 5,1146,137 4,539.920 29.7.19,475 219,068,220 8.625,160 524,350 7,199,646 2,404,804 24,999 464124 3,313,649 26.886,732 264,057,446 Total Assets EQUITF.1VD LIABILITIES Sluare Capital and Reserve Authorized Capital 20,000,000 (2015: 20.000.000 Oltry Sh T f Rs. 10 200,000,000 200,000,000 19 149,737,500 33,63), 149.737,500 93430,364 Iskred, Subscribed and Paid Up Capital 14.973.750 (2018: 14.975.750. Ordisy Size of Rs 10 D. Gremi keserves Umrize (LussyGatea Rwala ul Luv At Fai: Vele Through the-Comprehensiv Tome Ser Uarcalcisti od kat of Lystents i Associates Unappropriated Prati 113,777) 210,748 16,819,62 200,381,597 5.075.025 20.84 36939,541 245447,172 Current Tallines Tze and Otser Payubles Unclaimed Dividend 20 21 17,684,881 998,743 18,687,623 17611,331 998,742 18610,294 22 Con lingencies and Cvilnis Total Equities and Tablilities Ibe anexe gotes foar la forma inte al pestortes futacial sect3 219,068,220 2.(4.17,446 986 Investiments lineal Mauagenaeut Company) Chic Financial Officer Director Chief Executive Officer 31 86 INVESTMENTS NEWYOR WILLE STATEMENT OF PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED JUNE 30, 2019 2019 we 2015 Rupes Rrpees 2.3 Income Rominention from Finds ther: Mansyereret Capital (Losslau Sale Oravestancat Los on Rederacion Of Units Of Associates' Jovestbeat Cipruiment puimart Tvemmis 12.017.85.2 ( (1.349,426) (11,472,144) 11.50X1.109 12.694 (154.213) 11,389,575 (804,217) Expenses Adanisierative and Operacine Expeasca Financial 24 25 (31,462,858) (8,220 (31.968,078) (32,772,295) 132,457,4151 (1.7-19) (32.154.161) (21.069,5891 Operadu Loss Diber Operatia com 26 3,743,568 556,787 27 Share of Associates' L. Los Before Taxation (10.428,3x3) (39.957,110) (1,375.856) 124,388.6381 Taxis 28 (3.250,394) (1,576.912) Net Loss for the Year (43,209.504 26.4K5.600) Loss Per Share - Raste And Diluted 20 (2.89) 11.77) The smexal asos ben 1 te 19 can an integ-al part of these inancial statements. 98h Investiments 1.inted Management Company) Chict Financial Orlickr Director Chief Executive Officer 32 On the basis of the information provide in the financial statement, each group is required to perform the following analyses for the comparative years. In other words, the analysis has to be performed for two years. a. the current ratio, b. the acid-test ratio, c. the average collection period, d. the inventory turnover ratio, e. the debt-to-net-worth ratio, f. the long-term debt-to-total-capitalization ratio, g. the gross profit margin, h. the net profit margin, and i. the return on equity. The analysis includes the calculations and comprehensive discussion. 86 INVESTMENTS WE VORMILLE STATEMENT OF FINANCIAL POSITION AS AT JUNE 30, 2019 2019 2018 HU Voce SWS 8.620,715 6 7 Non-Current Assets Toperty and Equipcienu Litangihle Asaxt Luty Toca leves sowel Long-Term Ad Ling Ton Deposits a l'espawners Defend Tee Amt 5,569,992 1,246,500 181,475,932 8 y 9 10 11 227,843,347 663,33% 36,300 1,036,300 189,318,745 237.170,714 Current Assets Sur. Tem Ivestas Lu Adrese Pernyatardor Rassivehle T de Noivable Analec Markup Testinu. Vet Cassal Bank Balme 12 13 14 JS 16 12 18 10,071,630 39,667 39,667 1,401,168 2,487,14 153,119 5,1146,137 4,539.920 29.7.19,475 219,068,220 8.625,160 524,350 7,199,646 2,404,804 24,999 464124 3,313,649 26.886,732 264,057,446 Total Assets EQUITF.1VD LIABILITIES Sluare Capital and Reserve Authorized Capital 20,000,000 (2015: 20.000.000 Oltry Sh T f Rs. 10 200,000,000 200,000,000 19 149,737,500 33,63), 149.737,500 93430,364 Iskred, Subscribed and Paid Up Capital 14.973.750 (2018: 14.975.750. Ordisy Size of Rs 10 D. Gremi keserves Umrize (LussyGatea Rwala ul Luv At Fai: Vele Through the-Comprehensiv Tome Ser Uarcalcisti od kat of Lystents i Associates Unappropriated Prati 113,777) 210,748 16,819,62 200,381,597 5.075.025 20.84 36939,541 245447,172 Current Tallines Tze and Otser Payubles Unclaimed Dividend 20 21 17,684,881 998,743 18,687,623 17611,331 998,742 18610,294 22 Con lingencies and Cvilnis Total Equities and Tablilities Ibe anexe gotes foar la forma inte al pestortes futacial sect3 219,068,220 2.(4.17,446 986 Investiments lineal Mauagenaeut Company) Chic Financial Officer Director Chief Executive Officer 31 86 INVESTMENTS NEWYOR WILLE STATEMENT OF PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED JUNE 30, 2019 2019 we 2015 Rupes Rrpees 2.3 Income Rominention from Finds ther: Mansyereret Capital (Losslau Sale Oravestancat Los on Rederacion Of Units Of Associates' Jovestbeat Cipruiment puimart Tvemmis 12.017.85.2 ( (1.349,426) (11,472,144) 11.50X1.109 12.694 (154.213) 11,389,575 (804,217) Expenses Adanisierative and Operacine Expeasca Financial 24 25 (31,462,858) (8,220 (31.968,078) (32,772,295) 132,457,4151 (1.7-19) (32.154.161) (21.069,5891 Operadu Loss Diber Operatia com 26 3,743,568 556,787 27 Share of Associates' L. Los Before Taxation (10.428,3x3) (39.957,110) (1,375.856) 124,388.6381 Taxis 28 (3.250,394) (1,576.912) Net Loss for the Year (43,209.504 26.4K5.600) Loss Per Share - Raste And Diluted 20 (2.89) 11.77) The smexal asos ben 1 te 19 can an integ-al part of these inancial statements. 98h Investiments 1.inted Management Company) Chict Financial Orlickr Director Chief Executive Officer 32 On the basis of the information provide in the financial statement, each group is required to perform the following analyses for the comparative years. In other words, the analysis has to be performed for two years. a. the current ratio, b. the acid-test ratio, c. the average collection period, d. the inventory turnover ratio, e. the debt-to-net-worth ratio, f. the long-term debt-to-total-capitalization ratio, g. the gross profit margin, h. the net profit margin, and i. the return on equity. The analysis includes the calculations and comprehensive discussion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts