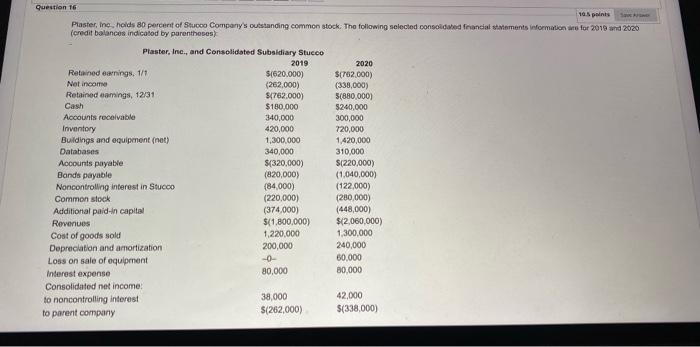

Question: important please Question 16 10.5 points Plaster, Ino, holds 80 percent of Stucco Company's outstanding common stock. The following selected consolide financial statement information for

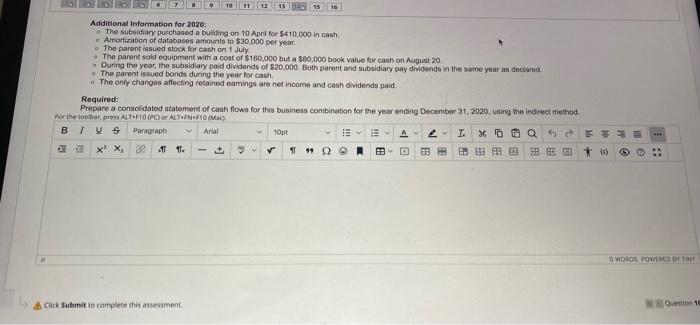

Question 16 10.5 points Plaster, Ino, holds 80 percent of Stucco Company's outstanding common stock. The following selected consolide financial statement information for 2018 und 2020 (credit balances indicated by parentheses) Plaster, Inc., and Consolidated Subsidiary Stucco 2019 2020 Retained earnings. 1/1 $(620.000) $(762.000) Net income (262,000) (338,000) Retained earings, 12/31 $4762.000) 5(880,000) Cash $180,000 $240,000 Accounts receivable 340,000 300,000 Inventory 420,000 720,000 Buildings and equipment (net) 1,300,000 1420,000 Databases 340,000 310,000 Accounts payable ${320,000) $(220,000) Bonds payable (820,000) (1.040,000) Noncontrolling Interest in Stucco (84,000) (122,000) Common stock (220,000) (280,000) Additional paid-in capital (374,000) (448,000) Revenues $(1.800.000) $12,060,000) Cost of goods sold 1.220.000 1,300,000 Depreciation and amortization 200,000 240,000 Loss on sale of equipment 60.000 Interest expense 80,000 80,000 Consolidated net income: to noncontrolling interest 38,000 42,000 to parent company $(262,000) $(338,000) Additional information for 2020: The subsidiary purchased a building on 10 April for $410,000 in cash Amortization of databases amounts to $30,000 per year. The parent issued stock for cash on 1 July The parent sold equipment with a cost of $160,000 but a $80,000 book value for cash on August 20 During the year, the subsidiary paid dividends of $20,000 Both parent and subsidiary pay dividends in the same year as declared. The parent issued bonds during the year for cash . The only changes affecting retained earnings are not income and cash dividendo paid. Required: Prepare a consolidated statement of cash flows for this business combination for the year ending December 31, 2020, using the indirect method. For the toolbar, press ALT FTO POI ALTEN+F30 MG rus Paragraph Arial topt A T. 36 Da 53 x X, 32 T 174 * 15 BE BB EMBE38 E3 v . me D O WORDS POWERED BY TRUY Click Submit to complete this assessment Questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts