Question: please help me .... Required: Prepare a consolidated statement of cash flows for this business combination for the vear ending December 31. 2020 Plaster, Inc,

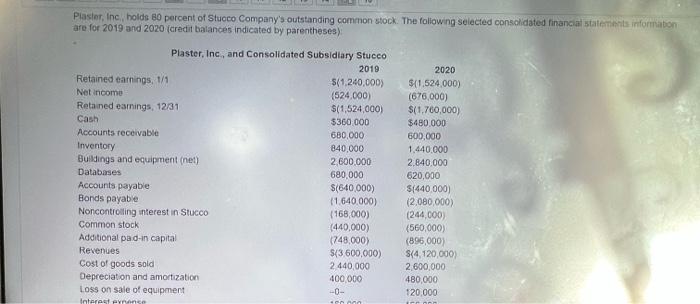

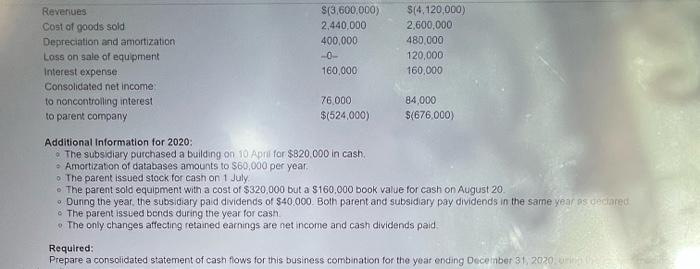

Plaster, Inc, holds 80 percent of Stucco Company's outstanding common stock. The following selected consolidated financial statement information are for 2019 and 2020 (credit balances indicated by parentheses) Plaster, Inc., and Consolidated Subsidiary Stucco 2019 Retained earnings, 1/1 $(1.240,000) Net income (524.000) Retained earings, 12/31 $(1,524,000) Cash $360,000 Accounts receivable 680.000 Inventory 840,000 Buildings and equipment (net) 2.600.000 Databases 680,000 Accounts payable S(640,000) Bonds payable (1.640.000) Noncontrolling interest in Stucco (168,000) Common stock (440,000) Additional pad-in capital (748,000) Revenues ${3 600,000) Cost of goods sold 2 440,000 Depreciation and amortization 400,000 Loss on sale of equipment --0- 2020 $(1.524.000) (676,000) $(1.700,000) $480.000 600,000 1.440.000 2.840,000 620,000 $(440.000) (2,080,000) (244,000) (560,000) (895,000 ${4.120,000 2,600,000 480,000 120,000 Interest Pinance Revenues Cost of goods sold Depreciation and amortization Loss on sale of equipment Interest expense Consolidated net income to noncontrolling interest to parent company S(3.600.000) 2,440,000 400,000 -0- 160,000 S[4,120,000) 2,600,000 480.000 120,000 160,000 76,000 $(524,000) 84,000 ${676.000) Additional Information for 2020: The subsidiary purchased a building on 10 April for $820.000 in cash. Amortization of databases amounts to $60,000 per year The parent issued stock for cash on 1 July - The parent sold equipment with a cost of $320,000 but a S160,000 book value for cash on August 20 Duning the year, the subsidiary paid dividends of $40.000. Both parent and subsidiary pay dividends in the same year as declared The parent issued bends during the year for cash The only changes affecting retained earnings are net income and cash dividends paid Required: Prepare a consolidated statement of cash flows for this business combination for the year ending December 31, 2020 r

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts