Question: Important: . Please type the number without the comma sign. Keep 2 decimal places. Griffith Inc.'s bond have a maturity of 10 years with a

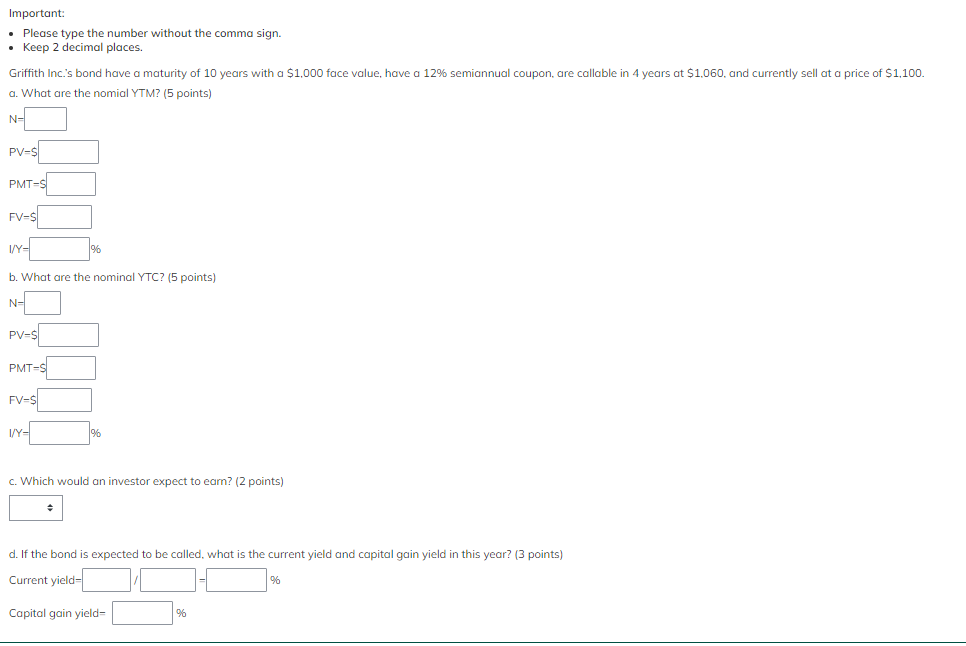

Important: . Please type the number without the comma sign. Keep 2 decimal places. Griffith Inc.'s bond have a maturity of 10 years with a $1.000 face value, have a 12% semiannual coupon, are callable in 4 years at $1.060, and currently sell at a price of $1,100. a. What are the nomial YTM? (5 points) N- PV=s[ PMT- Fv-s[ 1/Y- b. What are the nominal YTC? (5 points) N- Pv=s PMT-S Fv-s[ 1- c. Which would an investor expect to eam? (2 points) the current yield and capital gain yield in this year? (3 points) d. If the bond is expected to be called, what Current yield- Capital gain yield- %

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock