Question: In 150 words please explain the following question being ask. The cash flow sheet is attached to get the following answer to the question being

In 150 words please explain the following question being ask. The cash flow sheet is attached to get the following answer to the question being asked.

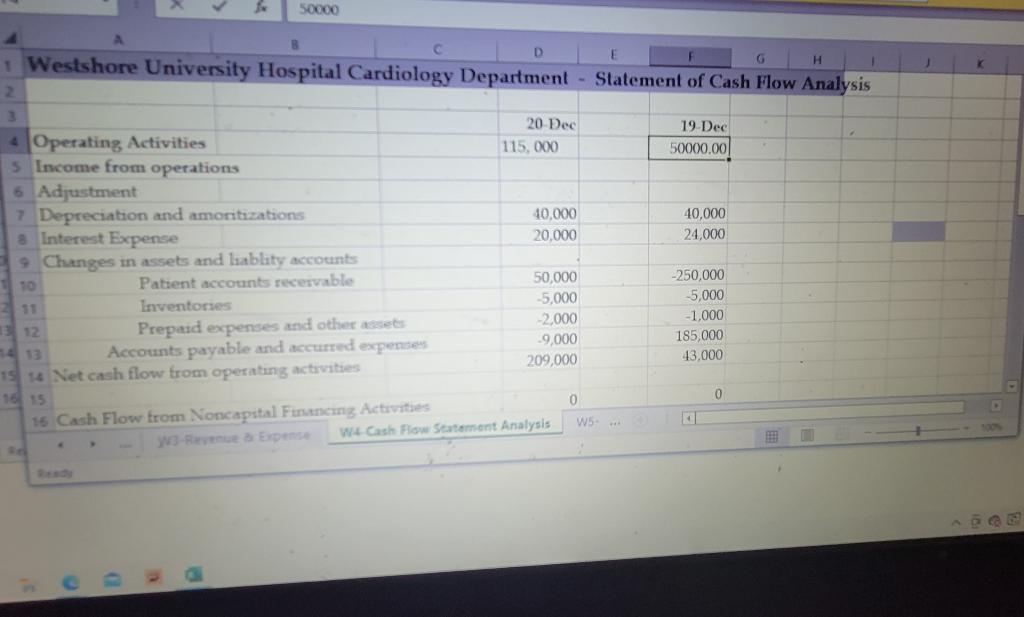

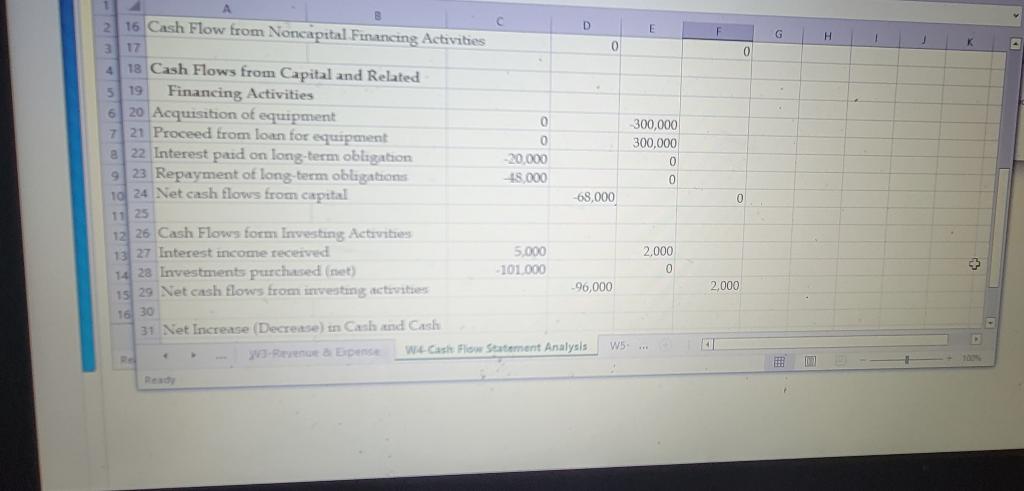

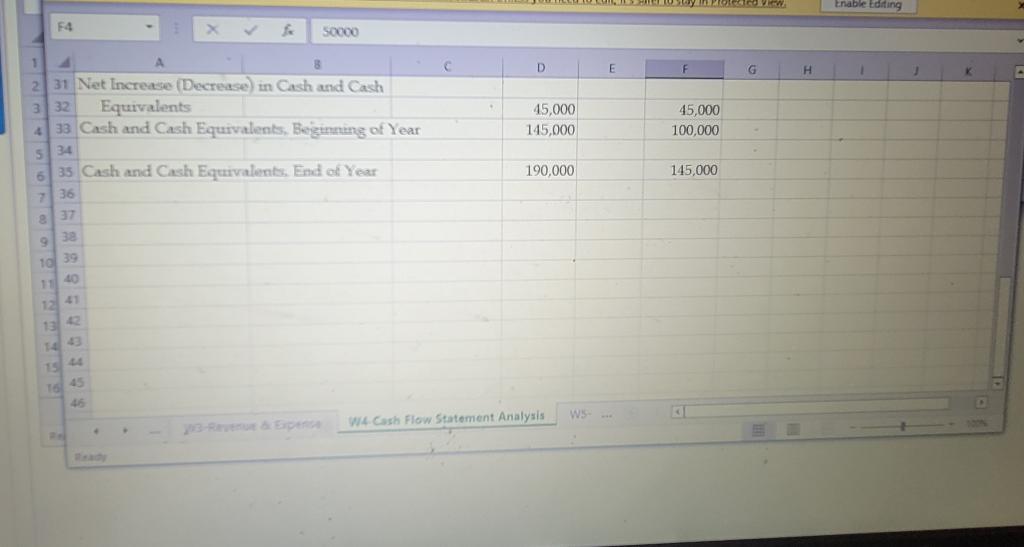

1. Measure the timeframe of income that are being reviewed and provide timeframe

2. what evidence can you find about the significance of the cash flow statement

3. what was the equivalent (items that can be converted to cash immediately) at the end of the year? please state a numerical value

4. explain your conclusion regarding the department profits. justify whether

they made a profit or lost funds using details from the table.

they made a profit or lost funds using details from the table.

50000 D 1 Westshore University Hospital Cardiology Department - Statement of Cash Flow Analysis H 1 3 20-Dec 4 Operating Activities 19-Dec 50000.00 5 Income from operations 6 Adjustment 7 Depreciation and amoritizations 40,000 8 Interest Expense 24,000 9 Changes in assets and liablity accounts -250,000 110 Patient accounts receivable Inventories -5,000 2 11 -1,000 13 12 Prepaid expenses and other assets Accounts payable and accurred expenses 185,000 14 13 43,000 15 14 Net cash flow from operating activities 16 15 0 16 Cash Flow from Noncapital Financing Activities 4 W3-Revenue & Expense C 115, 000 40,000 20,000 50,000 -5,000 -2,000 -9,000 209,000 0 W4 Cash Flow Statement Analysis W5-... 01 J K ADGE 2 16 Cash Flow from Noncapital Financing Activities 3 17 4 18 Cash Flows from Capital and Related 5 19 Financing Activities 6 20 Acquisition of equipment 7 21 Proceed from loan for equipment a 22 Interest paid on long-term obligation 9 23 Repayment of long-term obligations 10 24 Net cash flows from capital 11 25 12 26 Cash Flows form Investing Activities 13 27 Interest income received 14 28 Investments purchased (net) 15 29 Net cash flows from investing activities 16 30 31 Net Increase (Decrease) in Cash and Cash 4 Re D E 300,000 300,000 0 0 2,000 0 W5 ... D 0 0 0 -20,000 48,000 -68,000 5,000 -101.000 -96,000 V3-Revenue & Expense W4-Cash Flow Statement Analysis F 0 0 2,000 G 1077 H 1 J K F4 fo 50000 1 C 2 31 Net Increase (Decrease) in Cash and Cash 3 32 Equivalents A 33 Cash and Cash Equivalents, Beginning of Year 34 35 Cash and Cash Equivalents. End of Year 36 8 37 38 9 10 39 40 11 41 42 13 14 43 1645 46 Ready D 45,000 145,000 190,000 W4 Cash Flow Statement Analysis WS-... E o stay in protected view G 45,000 100,000 145,000 H Enable Editing 1 J

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts