Question: In 2 0 1 6 , Minjun, who is single, acquired original issue stock in Blue Corporation at a cost of $ 6 3 ,

In Minjun, who is single, acquired original issue stock in Blue Corporation at a cost of $ This stock meets the definition of both and stock. This year, Minjun sold the Blue stock.

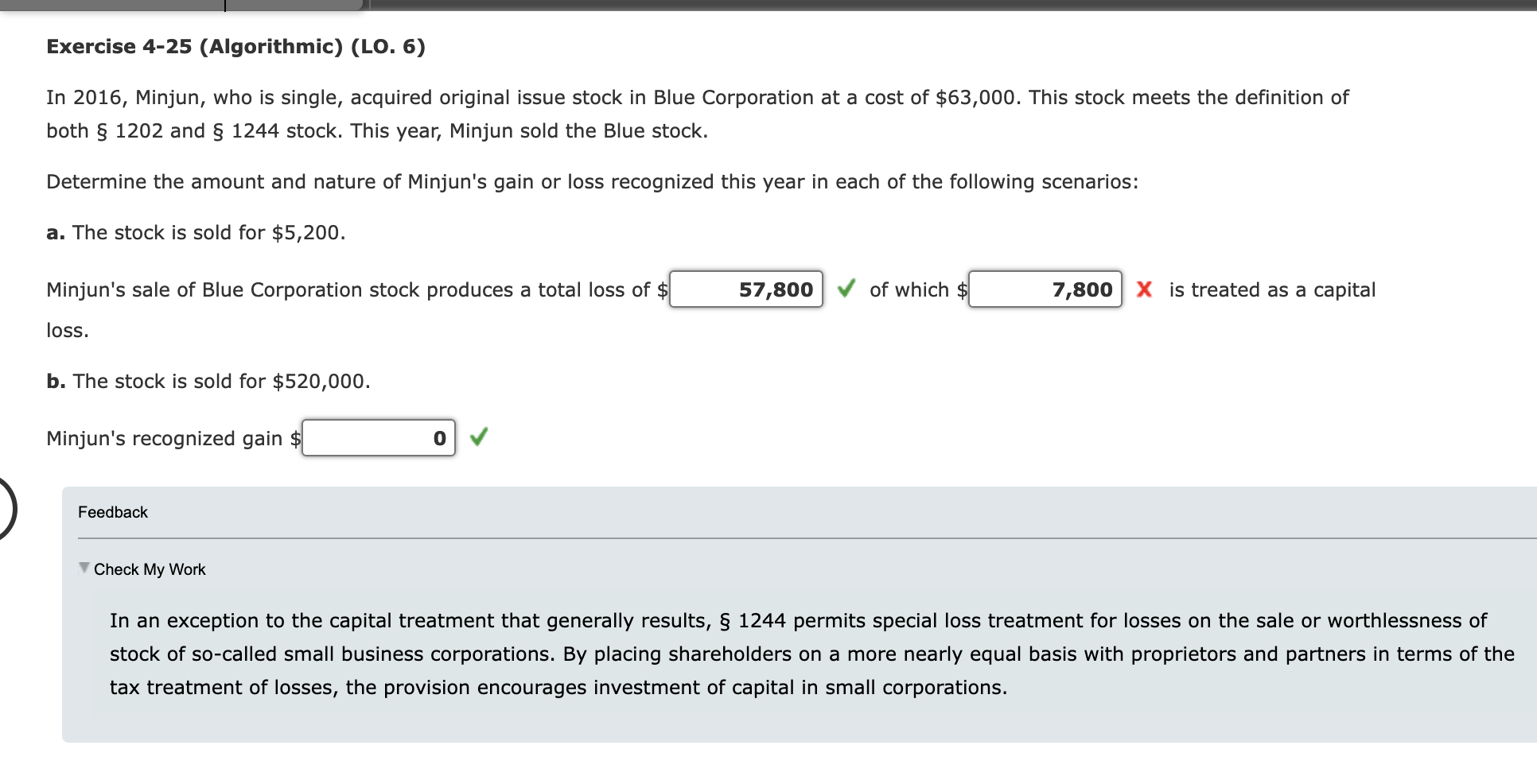

Determine the amount and nature of Minjun's gain or loss recognized this year in each of the following scenarios:

a The stock is sold for $

Minjun's sale of Blue Corporation stock produces a total loss of $fill in the blank of which $fill in the blank is treated as a capital loss.

b The stock is sold for $

Minjun's recognized gain $fill in the blank

Feedback

Check My Work

In an exception to the capital treatment that generally results, S permits special loss treatment for losses on the sale or worthlessness of stock of socalled small business corporations. By placing shareholders on a more nearly equal basis with proprietors and partners in terms of the tax treatment of losses, the provision encourages investment of capital in small corporations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock