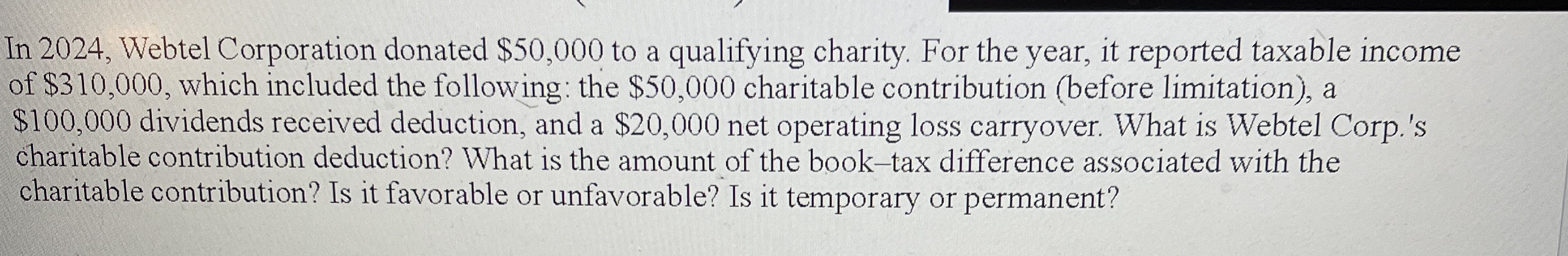

Question: In 2 0 2 4 , Webtel Corporation donated $ 5 0 , 0 0 0 to a qualifying charity. For the year, it reported

In Webtel Corporation donated $ to a qualifying charity. For the year, it reported taxable income of $ which included the following: the $ charitable contribution before limitation a $ dividends received deduction, and a $ net operating loss carryover. What is Webtel Corp.s charitable contribution deduction? What is the amount of the booktax difference associated with the charitable contribution? Is it favorable or unfavorable? Is it temporary or permanent? Hint: is temporary and unfavorable, need an step by step solution and need to know why as well thank you

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock