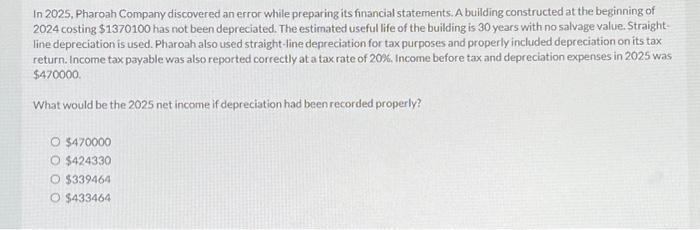

Question: In 2025, Pharoah Company discovered an error while preparing its financial statements. A building constructed at the beginning of 2024 costing $1370100 has not been

In 2025, Pharoah Company discovered an error while preparing its financial statements. A building constructed at the beginning of 2024 costing $1370100 has not been depreciated. The estimated useful life of the building is 30 years with no salvage value. Straightline depreciation is used. Pharoah also used straight-line depreciation for taxpurposes and properly included depreciation on its tax return. Income tax payable was also reported correctly at a tax rate of 20%, Income before tax and depreciation expenses in 2025 was $470000. What would be the 2025 net income if depreciation had been recorded properly? $470000 $424330 $339464 $433464

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts