Question: In A Random Walk Down Wall Street the author examines several factors, size, momentum, value, and low beta. Which of the following statements is most

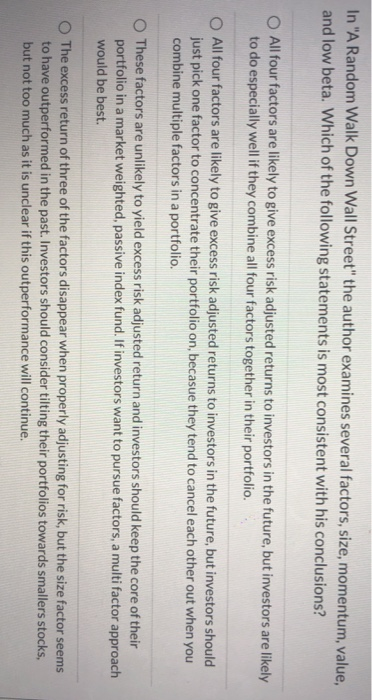

In "A Random Walk Down Wall Street" the author examines several factors, size, momentum, value, and low beta. Which of the following statements is most consistent with his conclusions? All four factors are likely to give excess risk adjusted returns to investors in the future, but investors are likely to do especially well if they combine all four factors together in their portfolio. All four factors are likely to give excess risk adjusted returns to investors in the future, but investors should just pick one factor to concentrate their portfolio on, becasue they tend to cancel each other out when you combine multiple factors in a portfolio. These factors are unlikely to yield excess risk adjusted return and investors should keep the core of their portfolio in a market weighted, passive index fund. If investors want to pursue factors, a multi factor approach would be best. The excess return of three of the factors disappear when properly adjusting for risk, but the size factor seems to have outperformed in the past. Investors should consider tilting their portfolios towards smallers stocks, but not too much as it is unclear if this outperformance will continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts