Question: In a short paragraph below, explain the cash flow statement to Amy. How is her company doing? Address operating, investing and financing activities. Does cash

In a short paragraph below, explain the cash flow statement to Amy. How is her company doing? Address operating, investing and financing activities. Does cash flow from operating activities cover cash flow from investing and financing activities? What does this mean?

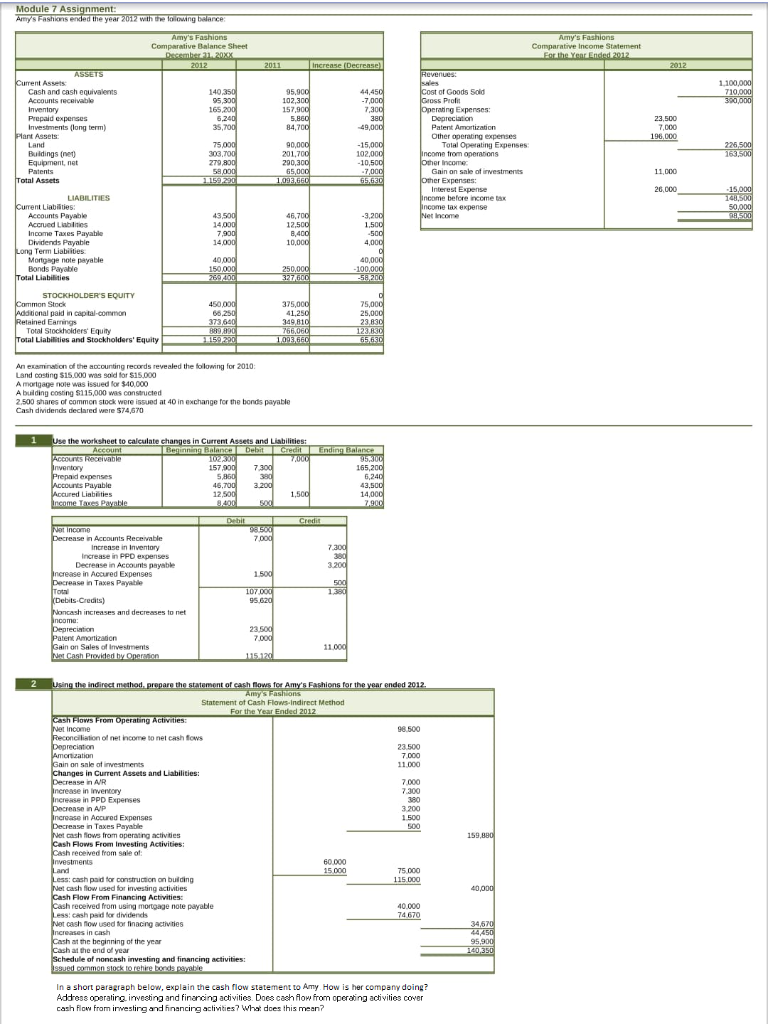

Module 7 Assignment: Amy's Fashions ended the year 20112 with the flowing balance Amy's Fashions Comparative Balance Sheet Desambe _20XX Amy's Fashions Comparative Income Statement For the Year Ended 2012 2011 Increase (Decrease) 2012 Current Assets Cash and cash oquivalents 140.350 95 300 165,200 5.240 35,700 95.900 102,300 157,900 5.860 84,700 44,450 -7,000 7,300 Cost of Goods Sold Gross Profit Operating Expenses: Prepaid expenses Investments (long term) -49,000 22.500 7.000 196,000 226,500 151500 Buldings (net) Equipment, net 75.000 303,700 279,800 59,000 1 159.290 90,000 201.700 200,300 65.000 LEGED -15,000 102,000 -10,500 -7000 65,630 Patent Amortization Other operating expenses Total Operating Expenses Income from operations other income Gain on sale of investments Other Expenses: Interest Expense Income before income tax income tax expense 11,000 Total Assets 26.000 LIABILITIES Current Liabilities: 15,000 140.500 50.000 DO Pev 43500 14.000 7,900 14,000 46,700 12.500 B.400 10,000 -3,200 1,500 .500 4,000 Accrued Liabilities Income Taxes Payable Dividends Payable Long Term Liabilities Mortgage note payable Bonds Pavable Total Liabilities 40.000 150.000 269400 250.000 327,600 40,000 100.000 -58200 450 000 65.250 75,000 25.000 STOCKHOLDER'S EQUITY Common Stock Additional paid in capital common Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 375,000 41.250 349 1 766,060 100660 8998901 1159,290 123,830 65,630 An examination of the accounting records revealed the following for 2010: Land costing $15.000 was sold for $15.000 Amortgage role was issued $40.000 A building cong $115,000 was constructed 2.500 shares of common stock were issued at 40 in exchange for the bonds payable Cash dividends declared were 574,670 Use the worksheet to calculate changes in Current Assets and Liabilities: Beginning balance Debit Credit 7.000 157 900 7.300 Prepaid expenses 5,860 46.700 Accured Liabilities 12.500 1,500 Income Ta Payable Ending BALANCE 9500 165,200 6,240 42.500 Debit Credit Decrease in Accounts Receivable Increase in Inventory Increase in PPD expenses Decrease in Accounts payable Increase in Accured Expenses Decrease in Taxes Payable 1.500 107 pod 95.620 Debits.Credits) Noncash increases and decreases to net Income: 23500 7.000 Patent Amortization Gain on Sales of investments Na Cash Provided by Operation 15.120 2 Using the indirect method, prepare the statement of cash flows for Amy's Fashions for the year ended 2012 Amy's Fashions Statement of Cash Flows-Indirect Method For the Year Ended 2012 Cash Hows From Operating Activities: Net Income 98.500 Reconciliation of net income to nei cash flows Depreciation 23.500 Amortization Gain on sale of investments 11.000 Changes in Current Assets and Liabilities: Decrease in AR Increase in inventory Increase in PPD Expenses Decrease in AP Increase in Accured Expenses Decrease in Taxes Payable Net cash flows from operating activities Cash Flows From Investing Activities: Cash received from sale of Investments 15 000 75 000 Less: cash paid for construction on bulding Net cash flow used for investing activities Cash Flow From Financing Activities: Cash received from using mortgage note payable Less: cash paid for dividends 74 670 Net cash flow used for finding activities Increases in cash Cash at the beginning of the year Cash at the end of year Schedule of noncash investing and financing activities: Issued common stock foreire bonds payable 40.000 40 000 95.900 140,350 In a short paragraph below, explain the cash flow statement to Amy How is her company doing? Address operating investing and financing activities. Does cash flow from operating activities cover cash flow from investing and financing activities? What does this mean

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts