Question: In a simplified model for taxes, a person will pay: 10% on the first $40,000 earned; 20% on the next $50,000 earned; 40% on

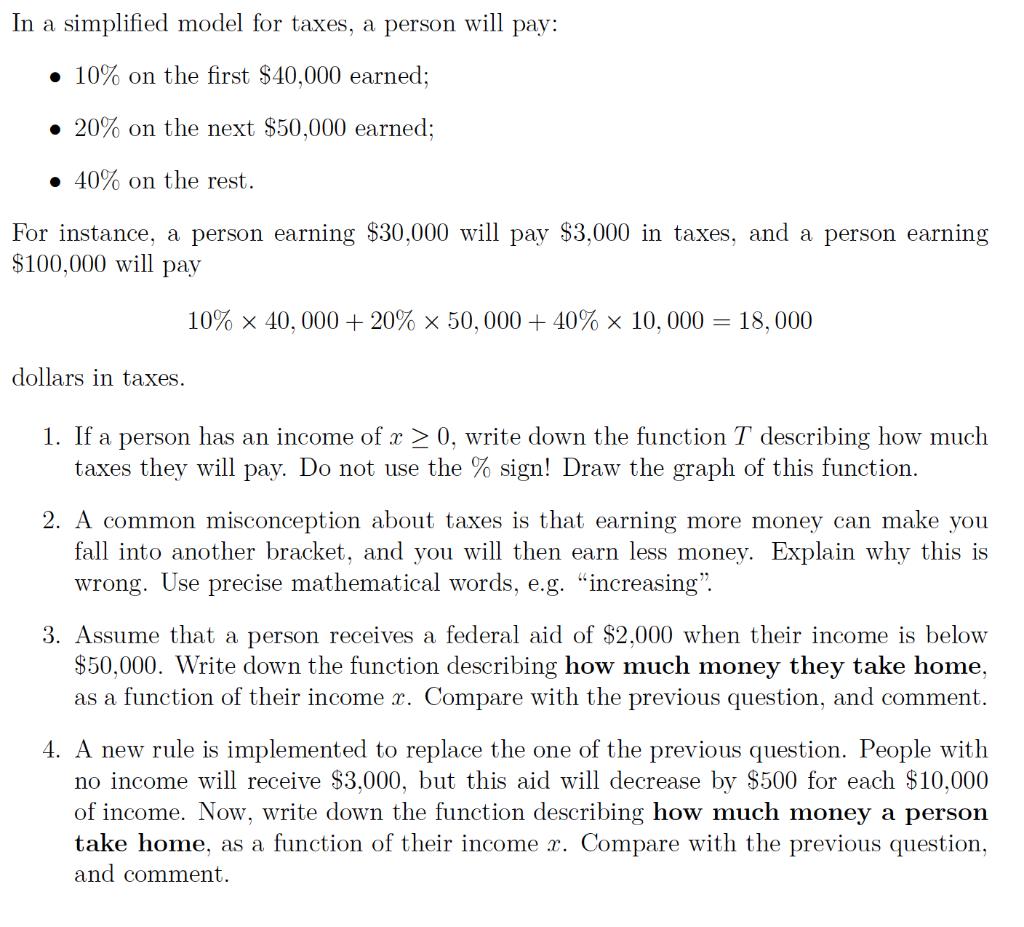

In a simplified model for taxes, a person will pay: 10% on the first $40,000 earned; 20% on the next $50,000 earned; 40% on the rest. For instance, a person earning $30,000 will pay $3,000 in taxes, and a person earning $100,000 will pay 10% 40,000 + 20% x 50,000+ 40% 10, 000 = 18,000 dollars in taxes. 1. If a person has an income of x 0, write down the function T describing how much taxes they will pay. Do not use the % sign! Draw the graph of this function. 2. A common misconception about taxes is that earning more money can make you fall into another bracket, and you will then earn less money. Explain why this is wrong. Use precise mathematical words, e.g. "increasing". 3. Assume that a person receives a federal aid of $2,000 when their income is below $50,000. Write down the function describing how much money they take home, as a function of their income x. Compare with the previous question, and comment. 4. A new rule is implemented to replace the one of the previous question. People with no income will receive $3,000, but this aid will decrease by $500 for each $10,000 of income. Now, write down the function describing how much money a person take home, as a function of their income x. Compare with the previous question, and comment.

Step by Step Solution

3.43 Rating (175 Votes )

There are 3 Steps involved in it

1 If the income of a person is 0x 40000 Tax on the income upto 40000 10 of x x01 I... View full answer

Get step-by-step solutions from verified subject matter experts