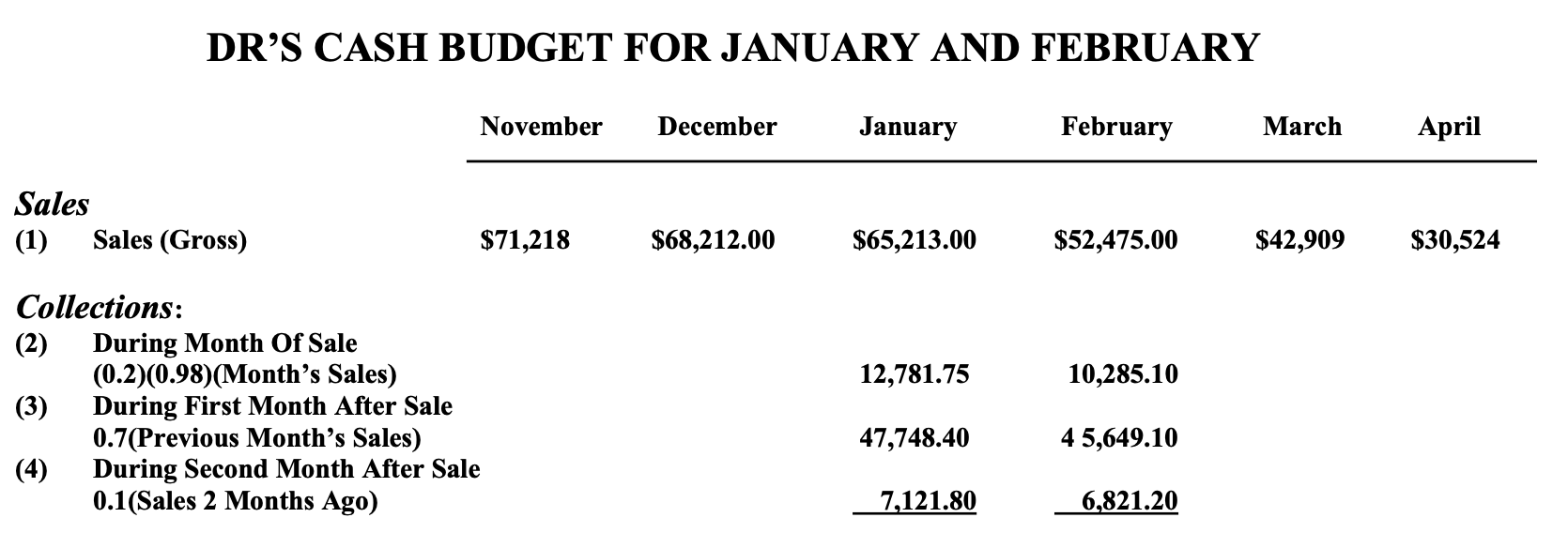

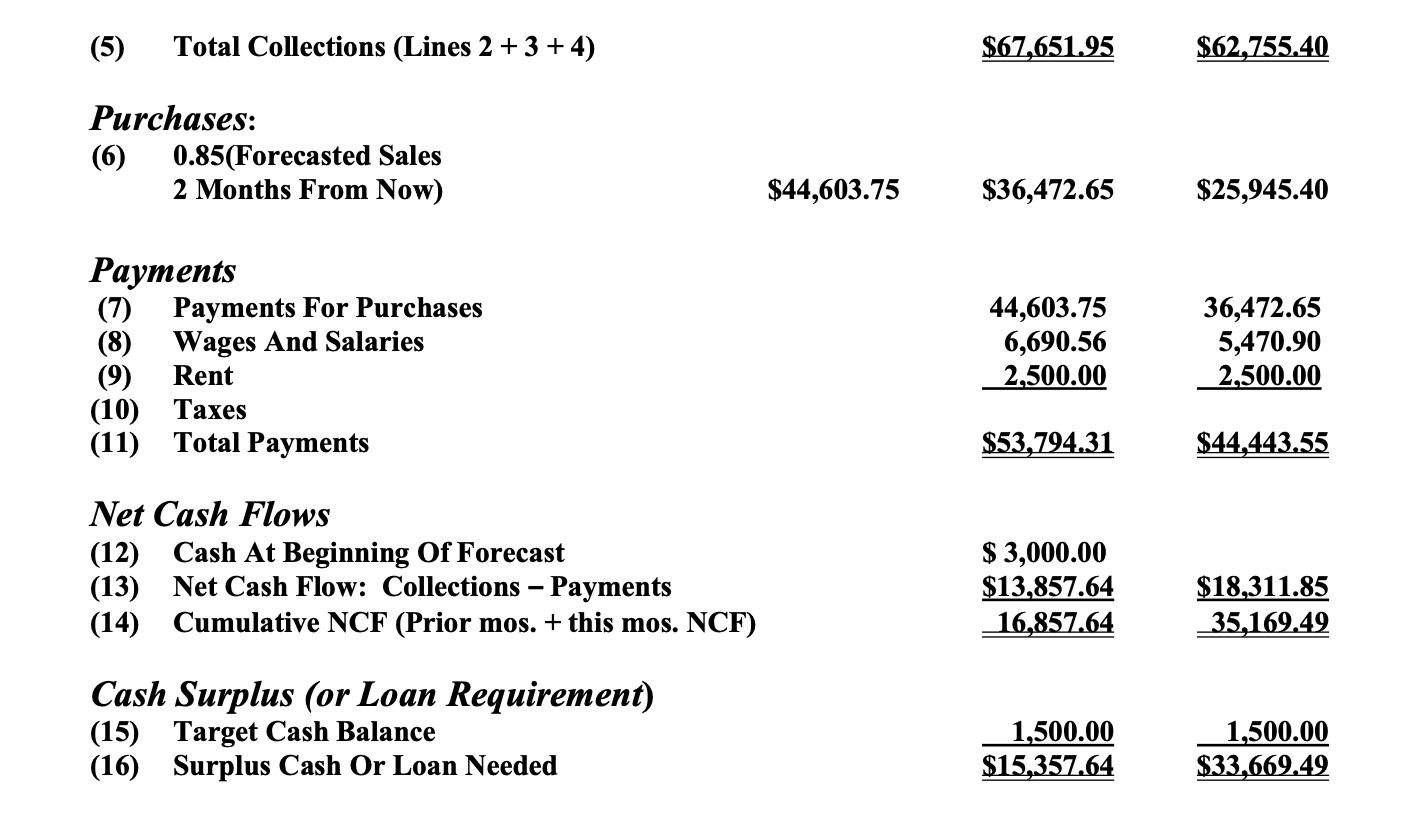

Question: In an attempt to better understand RR s cash position, Smith developed a cash budget. Data for the first 2 months of the year are

In an attempt to better understand RRs cash position, Smith developed a cash budget. Data for the first 2 months of the year are shown below. (Note that Smiths preliminary cash budget does not account for interest income or interest expense.) She has the figures for the other months, but they are not shown. After looking at the cash budget, answer the following questions.

Part 1. What does the cash budget show regarding the target cash level?

Part 2. Should depreciation expense be explicitly included in the cash budget? Why or why not?

DRS CASH BUDGET FOR JANUARY AND FEBRUARY November December January February March April Sales (1) Sales (Gross) $71,218 $68,212.00 $65,213.00 $52,475.00 $42,909 $30,524 12,781.75 10,285.10 Collections: (2) During Month Of Sale (0.2)(0.98)(Month's Sales) (3) During First Month After Sale 0.7(Previous Month's Sales) (4) During Second Month After Sale 0.1(Sales 2 Months Ago) 47,748.40 4 5,649.10 7,121.80 6,821.20 (5) Total Collections (Lines 2 + 3 + 4) $67,651.95 $62,755.40 Purchases: (6) 0.85(Forecasted Sales 2 Months From Now) $44,603.75 $36,472.65 $25,945.40 Payments (7) Payments For Purchases (8) Wages And Salaries (9) Rent (10) Taxes (11) Total Payments 44,603.75 6,690.56 2,500.00 36,472.65 5,470.90 2,500.00 $53,794.31 $44,443.55 Net Cash Flows (12) Cash At Beginning Of Forecast (13) Net Cash Flow: Collections Payments (14) Cumulative NCF (Prior mos. + this mos. NCF) $ 3,000.00 $13,857.64 16,857.64 $18,311.85 _35,169.49 Cash Surplus (or Loan Requirement) (15) Target Cash Balance (16) Surplus Cash Or Loan Needed 1,500.00 $15,357.64 1,500.00 $33,669.49

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts