Question: In an economy, there are many identically distributed projects with 1 year of the investment horizon, and the (net) rate of return on each

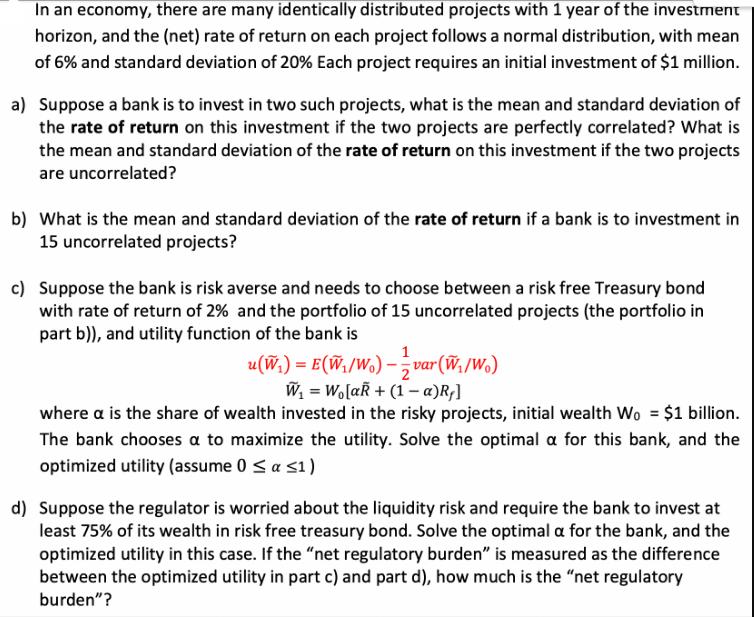

In an economy, there are many identically distributed projects with 1 year of the investment horizon, and the (net) rate of return on each project follows a normal distribution, with mean of 6% and standard deviation of 20% Each project requires an initial investment of $1 million. a) Suppose a bank is to invest in two such projects, what is the mean and standard deviation of the rate of return on this investment if the two projects are perfectly correlated? What is the mean and standard deviation of the rate of return on this investment if the two projects are uncorrelated? b) What is the mean and standard deviation of the rate of return if a bank is to investment in 15 uncorrelated projects? c) Suppose the bank is risk averse and needs to choose between a risk free Treasury bond with rate of return of 2% and the portfolio of 15 uncorrelated projects (the portfolio in part b)), and utility function of the bank is u(W) = E(W/W) - var (W/W.) W =W [aR + (1 - a)R] where a is the share of wealth invested in the risky projects, initial wealth Wo = $1 billion. The bank chooses a to maximize the utility. Solve the optimal a for this bank, and the optimized utility (assume 0 a 1) d) Suppose the regulator is worried about the liquidity risk and require the bank to invest at least 75% of its wealth in risk free treasury bond. Solve the optimal a for the bank, and the optimized utility in this case. If the "net regulatory burden" is measured as the difference between the optimized utility in part c) and part d), how much is the "net regulatory burden"?

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Attempt a The mean of the rate of return on the investment will be the same as the mean of the rate of return on each project which is 6 The standard ... View full answer

Get step-by-step solutions from verified subject matter experts