Question: You are borrowing $63,000 to purchase a new car, and you are considering two loan options. The first is a 5 year loan with

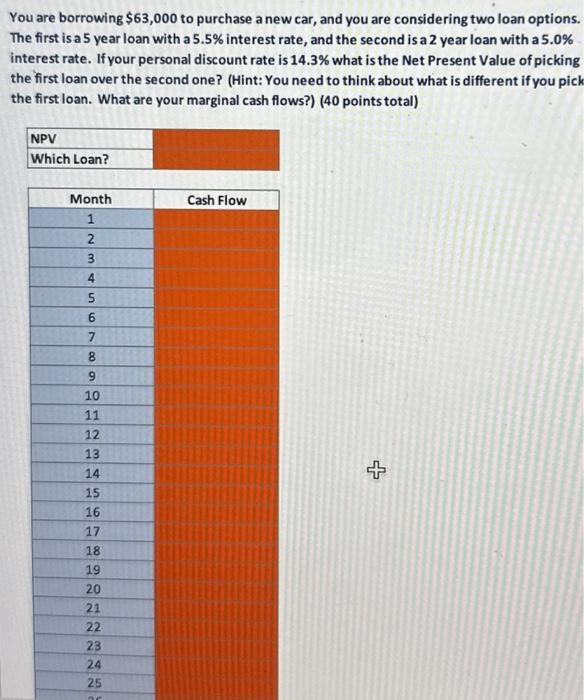

You are borrowing $63,000 to purchase a new car, and you are considering two loan options. The first is a 5 year loan with a 5.5% interest rate, and the second is a 2 year loan with a 5.0% interest rate. If your personal discount rate is 14.3 % what is the Net Present Value of picking the first loan over the second one? (Hint: You need to think about what is different if you pick the first loan. What are your marginal cash flows?) (40 points total) NPV Which Loan? Month 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 ar Cash Flow

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below 1 Answer In an economy capital per work... View full answer

Get step-by-step solutions from verified subject matter experts