Question: In applying the currency carry trade borrowing from a single funding-currency country and investing into a single investment-currency country implies that the investor takes

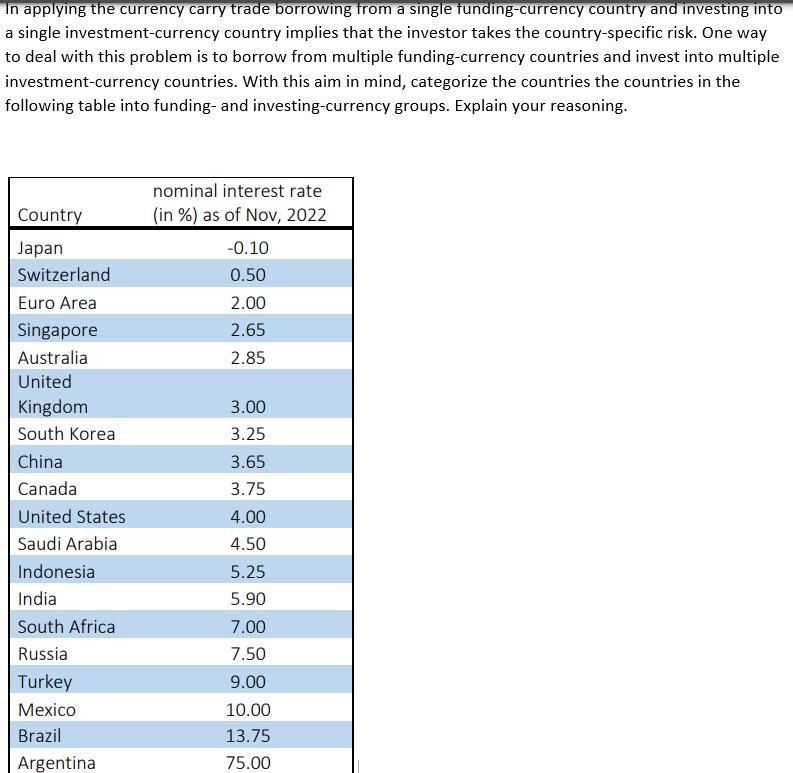

In applying the currency carry trade borrowing from a single funding-currency country and investing into a single investment-currency country implies that the investor takes the country-specific risk. One way to deal with this problem is to borrow from multiple funding-currency countries and invest into multiple investment-currency countries. With this aim in mind, categorize the countries the countries in the following table into funding- and investing-currency groups. Explain your reasoning. Country Japan Switzerland Euro Area Singapore Australia United Kingdom South Korea China Canada United States Saudi Arabia Indonesia India South Africa Russia Turkey Mexico Brazil Argentina nominal interest rate (in %) as of Nov, 2022 -0.10 0.50 2.00 2.65 2.85 3.00 3.25 3.65 3.75 4.00 4.50 5.25 5.90 7.00 7.50 9.00 10.00 13.75 75.00

Step by Step Solution

3.59 Rating (149 Votes )

There are 3 Steps involved in it

The most popular way to invest in currencies is by trading currencies in the forex b... View full answer

Get step-by-step solutions from verified subject matter experts