Question: In C++. If you choose to use the code provided to you (this is not a trick of any type) please make sure that within

In C++.

If you choose to use the code provided to you (this is not a trick of any type) please make sure that within your header comment you cite what you have been given by stating the following:

"//time validation function pulled from October 14th announcement."

Code for function:

bool isValidTime(double t)

{

bool status = true; // Status flag, intitalized to true

// Determine if the time is invalid.

if (t 23.59 || t - static_cast

status = false;

// Return the status.

return status;

}

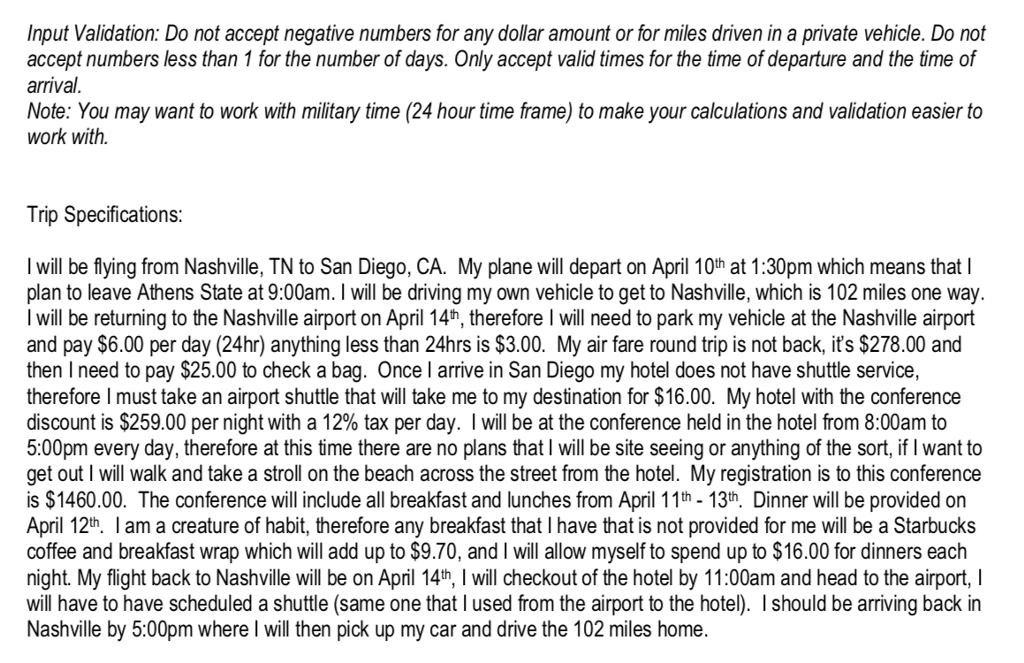

Also I have provided the layout of which the program should go.

There are some extra things that I have placed in the output. Your program does not have to have the the "Program Generated" information. The main part of your program output should include the calculations of how much was allowed to be spent, how much you actually spent, and what the difference is.

***********************************************

How many days were spent on the trip? 5

Enter the departure time (HH.MM): 9.00

Enter the return time (HH.MM): 18.30

Enter the amount of airfare: 278

Enter the amount spent on 'upgrades' (i.e. baggage, seats, etc.): 50

*************Program generated*******************

Your extra costs are not covered by your employer

Your full airFare is covered by your employer.

*********************************************************************

Enter the amount of your ground transportation fees for the entire trip: 32

*************Program generated*******************

Your parking fee for day 1 is 3.00.

Your parking for the days that you are gone 24hours is 24.00.

Your parking fee for the last day is 3.00.

Your expenditure on parking was 30.00 this is not covered by your employer, it is part of your ground transportation allowance.

Your ground transportation charges that covers shuttles and your parking is 62.00.

You employer allows for $20.00/day which gives you a total of 100.00 to cover your costs for this trip.

You will have 38.00 left from what was allowed to assist with other expenses.

*********************************************************************

Enter the miles driven by a private vehicle during your entire trip: 204

*************Program generated*******************

You will receive 109.14 reimbursement for the miles you have driven.

*********************************************************************

Enter the amount of registration fees: 1460

Your employer will cover the registration fee in full

Enter the nightly hotel rate: 259

*************Program generated*******************

Your hotel total with tax is 1160.32.

With tax your employer will cover a total of 403.20 for your hotel stay

You will be responsible for the difference of 757.12.

********************************************************

Let's determine your meal expenses:

Day 1:

Enter the amount spent for breakfast: 9.7

Enter the amount spent for lunch: 12

Enter the amount spent for dinner: 16

Day 2:

Enter the amount spent for breakfast: 0

Enter the amount spent for lunch: 0

Enter the amount spent for dinner: 16

Day 3:

Enter the amount spent for breakfast: 0

Enter the amount spent for lunch: 0

Enter the amount spent for dinner: 16

Day 4:

Enter the amount spent for breakfast: 0

Enter the amount spent for lunch: 0

Enter the amount spent for dinner: 0

Day 5:

Enter the amount spent for breakfast: 9.7

Enter the amount spent for lunch: 12

Enter the amount spent for dinner: 16

Your total meal cost is: 107.40.

Your total spending for meals allowed is: 150.00.

You will receive the difference of 42.60 for not using up your full meal allowance.

*************************************************

Total expenses: $3117.72

Allowable expenses: $2500.34

Your out of pocket coverage for the trip is: $617.38

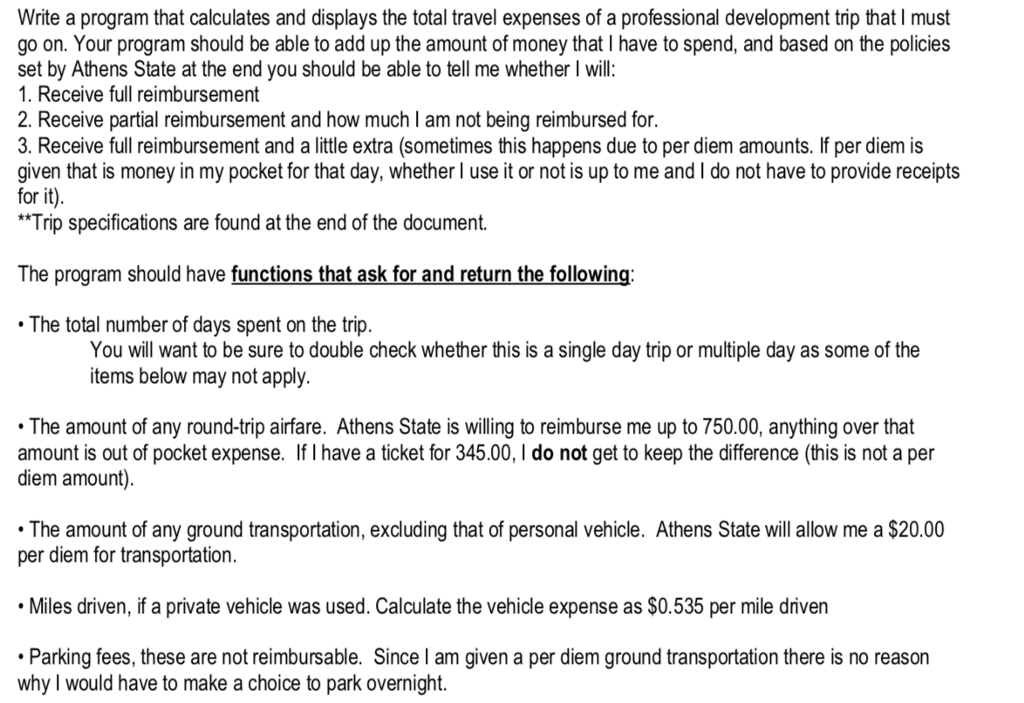

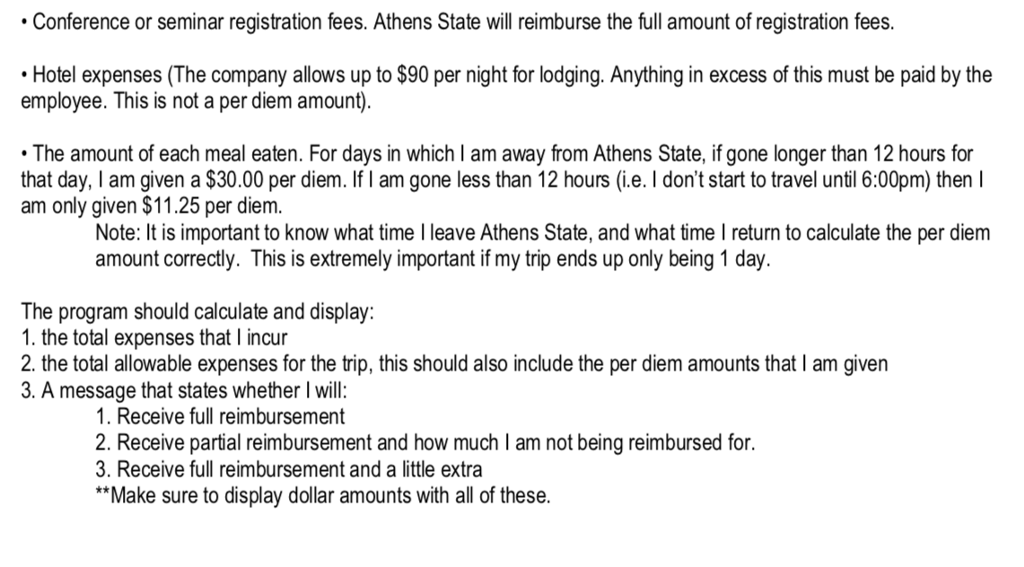

Write a program that calculates and displays the total travel expenses of a professional development trip that I must go on. Your program should be able to add up the amount of money that I have to spend, and based on the policies set by Athens State at the end you should be able to tell me whether I will: 1. Receive full reimbursement 2. Receive partial reimbursement and how much I am not being reimbursed for. 3. Receive full reimbursement and a little extra (sometimes this happens due to per diem amounts. If per diem is given that is money in my pocket for that day, whether l use it or not is up to me and I do not have to provide receipts for it) HTrip specifications are found at the end of the document. The program should have functions that ask for and return the following: The total number of days spent on the trip. You will want to be sure to double check whether this is a single day trip or multiple day as some of the tems below may not apply. The amount of any round-trip airfare. Athens State is willing to reimburse me up to 750.00, anything over that amount is out of pocket expense. If I have a ticket for 345.00, I do not get to keep the difference (this is not a per diem amount). The amount of any ground transportation, excluding that of personal vehicle. Athens State will allow me a $20.00 per diem for transportation. Miles driven, if a private vehicle was used. Calculate the vehicle expense as $0.535 per mile driven Parking fees, these are not reimbursable. Since I am given a per diem ground transportation there is no reason why I would have to make a choice to park overnight

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts