Question: In C Language Stage Three Application (60 marks) Use the application pseudo-code in stage two to implement the final console application to calculate the users

In C Language

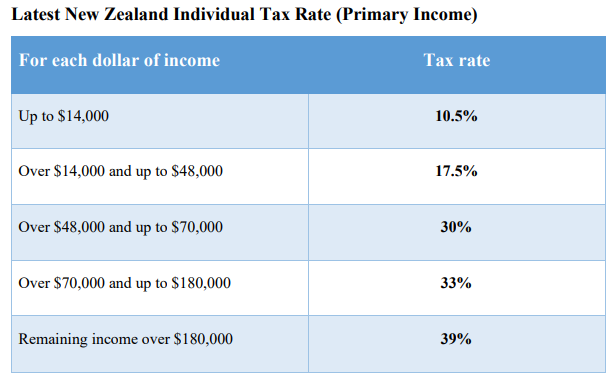

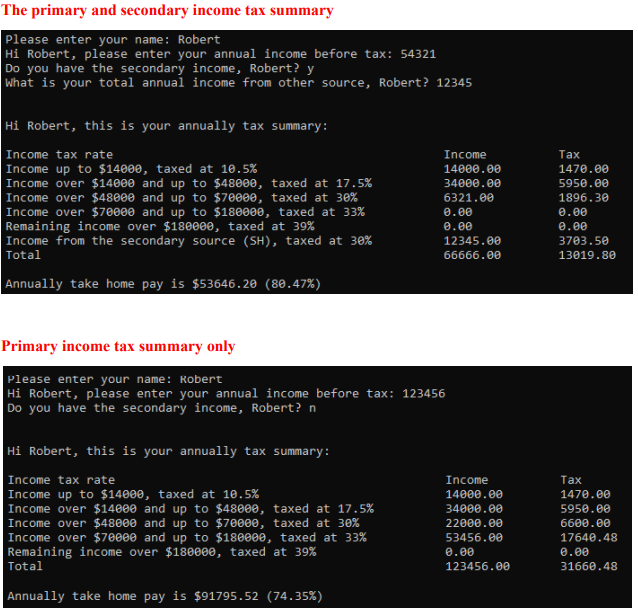

Stage Three Application (60 marks) Use the application pseudo-code in stage two to implement the final console application to calculate the users annually income tax. Consider the following screenshots for the output samples. Make sure all income and tax values are rounded to 2 decimal places, and your code should be named and commented correctly

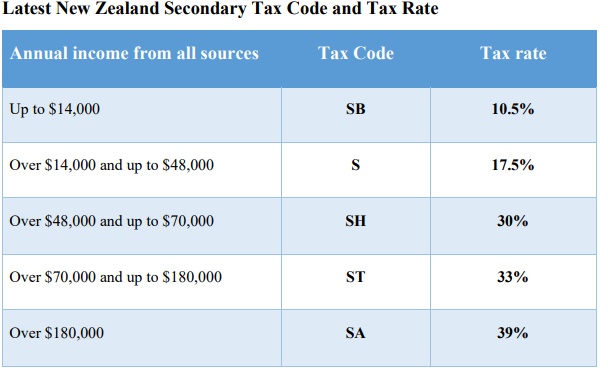

Latest New Zealand Secondary Tax Code and Tax Rate Annual income from all sources Tax Code Tax rate Up to $14,000 SB 10.5% Over $14,000 and up to $48,000 S 17.5% Over $48,000 and up to $70,000 SH 30% Over $70,000 and up to $180,000 ST 33% Over $180,000 SA 39% Latest New Zealand Individual Tax Rate (Primary Income) For each dollar of income Tax rate Up to $14,000 10.5% Over $14,000 and up to $48,000 17.5% Over $48,000 and up to $70,000 30% Over $70,000 and up to $180,000 33% Remaining income over $180,000 39% The primary and secondary income tax summary Please enter your name: Robert Hi Robert, please enter your annual income before tax: 54321 Do you have the secondary income, Robert? y What is your total annual income from other source, Robert? 12345 Hi Robert, this is your annually tax summary: Income tax rate Income up to $14000, taxed at 10.5% Income over $14000 and up to $48000, taxed at 17.5% Income over $48000 and up to $70000, taxed at 30% Income over $70000 and up to $180000, taxed at 33% Remaining income over $180000, taxed at 39% Income from the secondary source (SH), taxed at 30% Total Income 14 . 34000.00 6321.00 0.ee 0.00 12345.00 66666.00 Tax 1470.00 5950.00 1896.30 0.00 0.00 3703.50 13019.80 Annually take home pay is $53646.20 (80.47%) Primary income tax summary only Please enter your name: Robert Hi Robert, please enter your annual income before tax: 123456 Do you have the secondary income, Robert? n Hi Robert, this is your annually tax summary: Income tax rate Income up to $14000, taxed at 10.5% Income over $14000 and up to $48000, taxed at 17.5% Income over $48000 and up to $70000, taxed at 30% Income over $70000 and up to $180000, taxed at 33% Remaining income over $180000, taxed at 39% Total Annually take home pay is $91795.52 (74.35%) Income 14000.00 34000.00 22800.00 53456.00 @.00 123456.00 Tax 1470.00 5950.00 6600.ee 17640.48 @.00 31660.48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts