Question: PLEASE ANSWER IN PSEUDO CODE Take this in account on how to write the PSEUDO. THANK YOU Descriptions Let's assume that you are working for

PLEASE ANSWER IN PSEUDO CODE

Take this in account on how to write the PSEUDO. THANK YOU

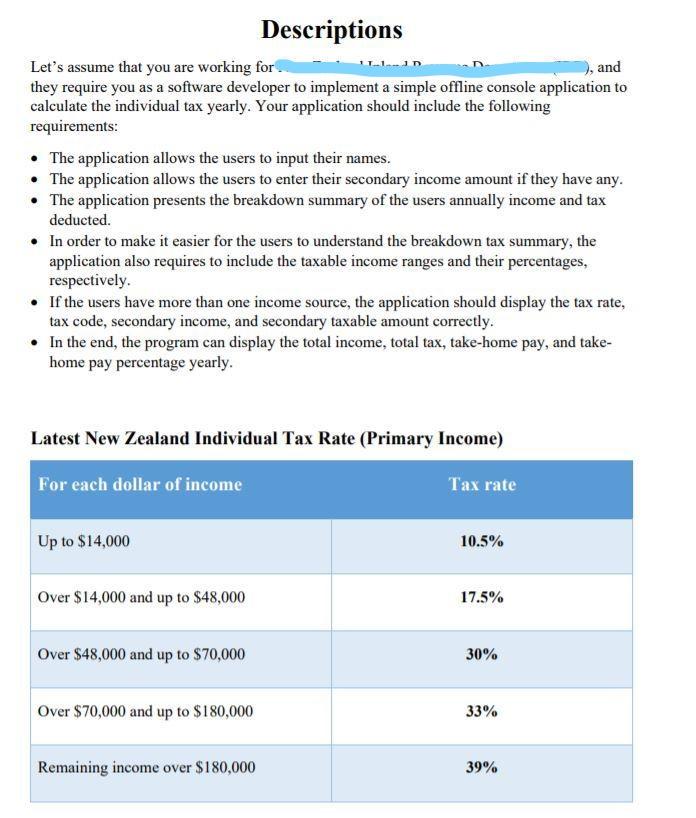

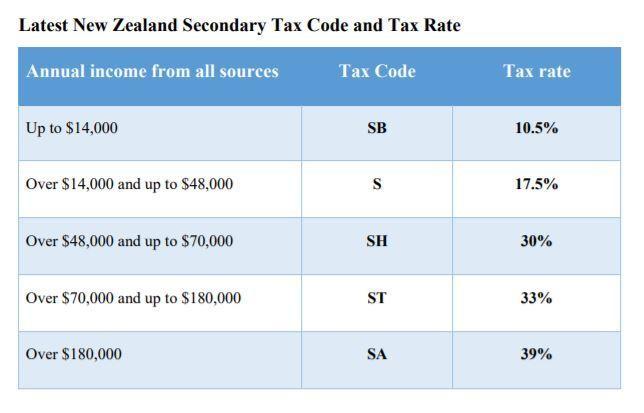

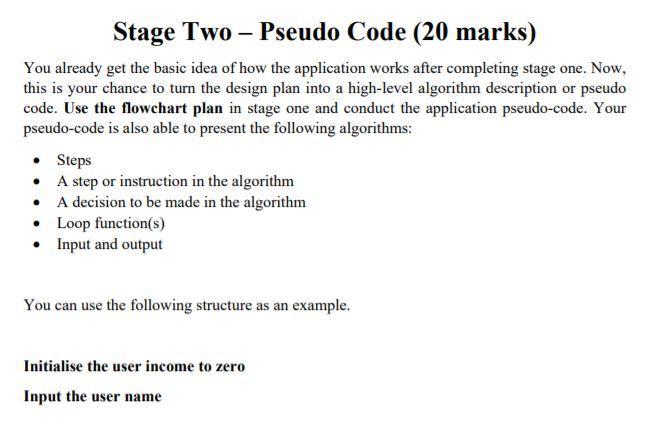

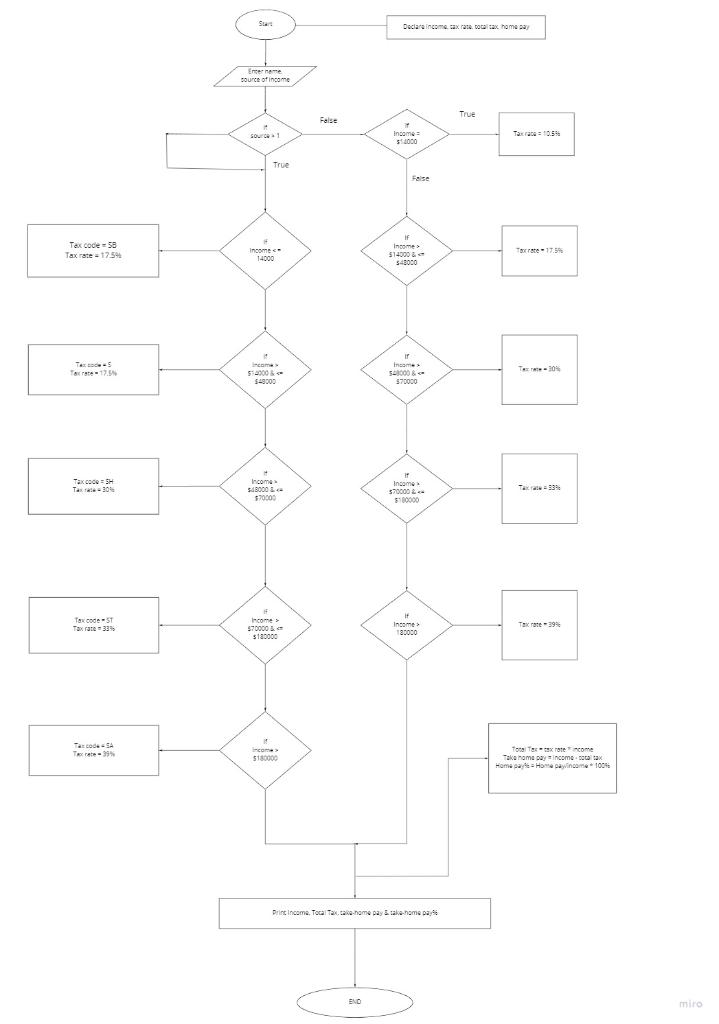

Descriptions Let's assume that you are working for LID ), and they require you as a software developer to implement a simple offline console application to calculate the individual tax yearly. Your application should include the following requirements: The application allows the users to input their names. The application allows the users to enter their secondary income amount if they have any. The application presents the breakdown summary of the users annually income and tax deducted. In order to make it easier for the users to understand the breakdown tax summary, the application also requires to include the taxable income ranges and their percentages, respectively. If the users have more than one income source, the application should display the tax rate, tax code, secondary income, and secondary taxable amount correctly. In the end, the program can display the total income, total tax, take-home pay, and take- home pay percentage yearly. Latest New Zealand Individual Tax Rate (Primary Income) For each dollar of income Tax rate Up to $14,000 10.5% Over $14,000 and up to $48,000 17.5% Over $48,000 and up to $70,000 30% Over $70,000 and up to $180,000 33% Remaining income over $180,000 39% Latest New Zealand Secondary Tax Code and Tax Rate Annual income from all sources Tax Code Tax rate Up to $14,000 SB 10.5% Over $14,000 and up to $48,000 S 17.5% Over $48,000 and up to $70,000 SH 30% Over $70,000 and up to $180,000 ST 33% Over $180,000 SA 39% Stage Two - Pseudo Code (20 marks) You already get the basic idea of how the application works after completing stage one. Now, this is your chance to turn the design plan into a high-level algorithm description or pseudo code. Use the flowchart plan in stage one and conduct the application pseudo-code. Your pseudo-code is also able to present the following algorithms: Steps A step or instruction in the algorithm A decision to be made in the algorithm Loop function(s) Input and output You can use the following structure as an example, Initialise the user income to zero Input the user name Start Declare income tax rate, total tax home Ename COUNCE of income True Felse + Source TO Income 34000 True False Tex code 58 Tax rate 12.54 Income 14000 IF Income 5140008 S4300 Torste 17.5 TES Tarte 17. + Income 5:2000 $49000 IT Income 528000 & 570000 T304 Taxcode=SH Taxade - 304 Income 345000 L $70009 Income $70000& 5100000 Tax code EST Tax rate - 33% Income 570000 $120000 H Income 180000 TEXT19 Tad SA Tree Income $10000 Total Texte Take home pay income tax Home Home Wincome 100 Print Income Tocal Tax.co.nome pa take home pa END miro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts