Question: in c++ using the atached photo. This is really ASAP! 1. Define a class named PropertyInfo, It calculates based on the current value of the

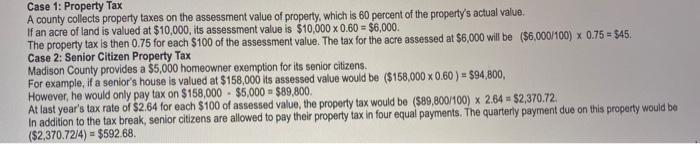

Case 1: Property Tax A county collects property taxes on the assessment value of property, which is 60 percent of the property's actual value. If an acre of land is valued at $10,000, its assessment value is $10,000 x0.60 = $6,000. The property tax is then 0.75 for each $100 of the assessment value. The tax for the acre assessed at $6,000 will be ($6,000/100) x 0.75 = 545. Case 2: Senior Citizen Property Tax Madison County provides a $5,000 homeowner exemption for its senior citizens. For example, if a senior's house is valued at $158,000 its assessed value would be (5158,000 X 0.60 ) = $94,800, However, he would only pay tax on $158,000 - $5,000 - $89,800 At last year's tax rate of $2.64 for each $100 of assessed value, the property tax would be ($89,800/100) x 2.64 = $2,370.72 In addition to the tax break, senior citizens are allowed to pay their property tax in four equal payments. The quarterly payment due on this property would be ($2,370.72/4) - $592.68

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts