Question: In conjunction with their analysis of capital projects (for example, a new manufacturing facility, or branch store or fleet of planes), financial managers must determine

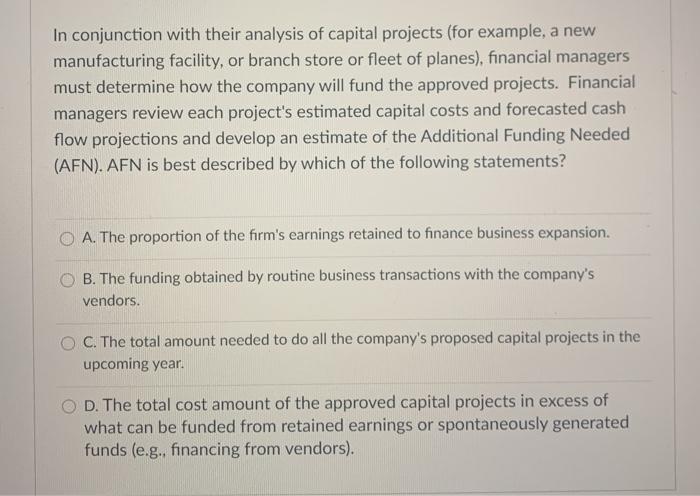

In conjunction with their analysis of capital projects (for example, a new manufacturing facility, or branch store or fleet of planes), financial managers must determine how the company will fund the approved projects. Financial managers review each project's estimated capital costs and forecasted cash flow projections and develop an estimate of the Additional Funding Needed (AFN). AFN is best described by which of the following statements? A. The proportion of the firm's earnings retained to finance business expansion. B. The funding obtained by routine business transactions with the company's vendors. O C. The total amount needed to do all the company's proposed capital projects in the upcoming year. D. The total cost amount of the approved capital projects in excess of what can be funded from retained earnings or spontaneously generated funds (e.g., financing from vendors)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts