Question: In Copy Paste Toint Painter LED Merge & Center $ % 8-% Conditional fomatas Formatting Tables Styles Font 2 Clipboard Alignment S Number H9 fo

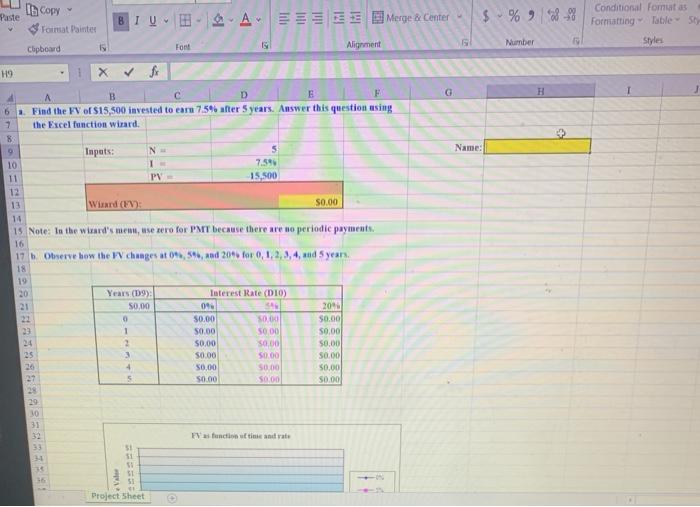

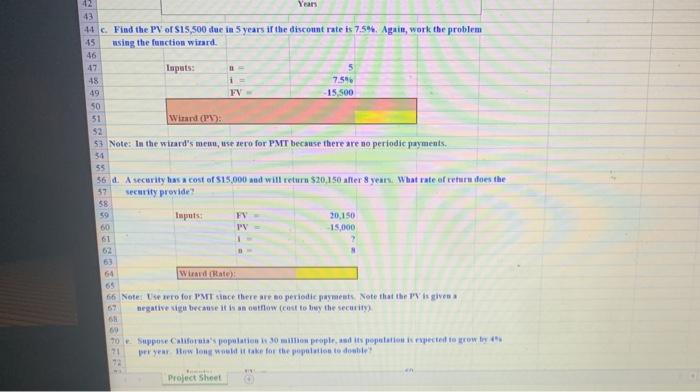

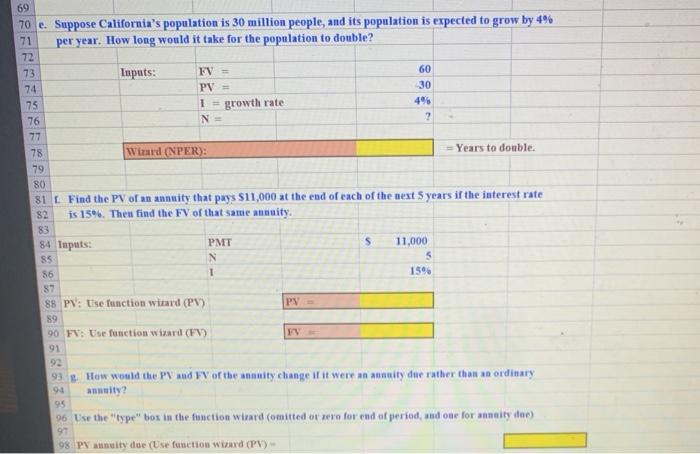

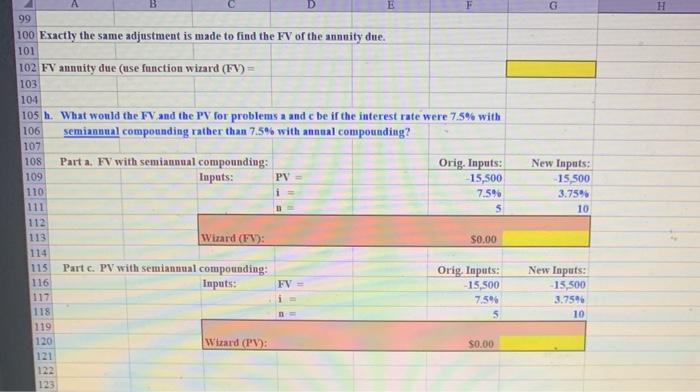

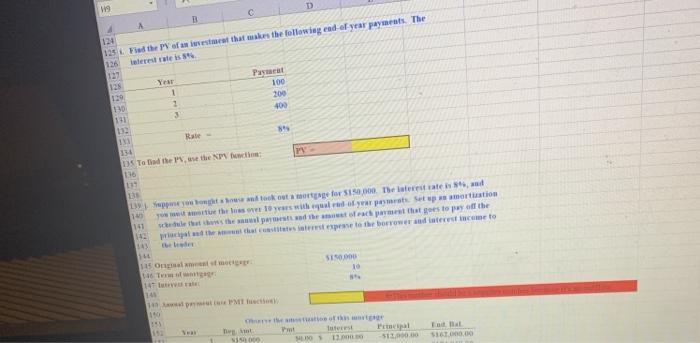

In Copy Paste Toint Painter LED Merge & Center $ % 8-% Conditional fomatas Formatting Tables Styles Font 2 Clipboard Alignment S Number H9 fo H Name: 6 . Find the FV of $15,500 invested to earn 75% after 5 years. Answer this question asing the Excel function wizard 8 9 Inputs: 5 10 7.595 11 PN 15,500 12 13 Wizard (FV): 50.00 14 Note: In the wird's menu, use pero for PMT because there are no periodic payments 16 17 Observe how the IV changes at 09,5%, and 2016 for 0, 1, 2, 3, 4, and 5 years 18 19 20 Years (19) Interest Rate (10) 21 50,00 09 21 S0.00 0.00 50.00 23 1 50.00 5000 50.00 24 2 50.00 50,00 50.00 35 50.00 S0.00 50.00 26 4 50.00 50.00 50.00 5 50.00 S000 50.00 2048 29 JO 31 Function time and rate 33 31 . Project Sheet 7.5 43 44 c. Find the PV of SI5,500 due in 5 years if the discount rate is 75%. Again, work the problem -15 using the function wizard. 46 47 Luputs: 5 48 FV 15.500 50 51 Wizard (PV) 52 53 Note: In the wizard's menu, use zero for PMT because there are no periodic payments. 54 49 55 36 d. A security has a cost of $15,000 and will return $20,150 after 3 years. What rate of return does the security provide 57 58 59 60 Inputs: FV 20,150 -15,000 62 64 Wandtato: 55 66 Noter se pro for PMT since there are o periodic payments. Note that they is given negative because it is an ow cost to buy the security SH 60 70. Suppose California's population 130 million people sits population is pected to grow by 21 per year. How long take for the population to double 72 Project Sheet 69 70 e. Suppose California's population is 30 million people, and its population is expected to grow by 4% 71 per year. How long would it take for the population to double? 72 73 Inputs: FV = 60 74 PV = 30 75 1 = growth rate 4% 76 N= 2 77 78 Wizard (NPER): = Years to double 79 80 81 L Find the PV of an annuity that pays $11,000 at the end of each of the next 5 years if the interest rate 82 is 15%. Then find the FV of that same annuity. 83 84 Inputs: PMT S 11,000 85 N 5 86 1 159 87 88 PV: Use function wizard (PV) PV 89 90 FV: Use function wizard (PV) 91 92 93. How would the PV and FV of the nuity change if it were an annuity due rather than an ordinary annuity? 96 Use the "type" box in the function wind (omitted or were for end of period, and one for anoty doe) 97 98 PV annuity due (Use function wizard (PV) 94 95 E G 99 100 Exactly the same adjustment is made to find the FV of the annuity due. 101 102 FV annuity due (use function wizard (FV) = 103 104 105 h. What would the FV and the PV for problems a and e be if the interest rate were 7.5% with semiannual compounding rather than 7.5% with anomal compounding? Parta. FV with semiannual compounding: Inputs: PV Orig. Inputs: 15,500 7.5% New Inputs: -15,500 3.75% 10 Wizard (FV): S0.00 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 Part c. PV with semiannual compounding: Inputs: FV = Orig. Inputs: -15,500 7.59 New Inputs: 13,500 3.7596 10 Wizard (PV): S0.00 9 B 124 12 Fid they of an investment that makes the following end of year payments. The Year 1 2 Pay 100 200 400 130 89 Rate 13 To the use them to Support you took out more for 5150,000. The latest rated the 10 with all of your payment Setup mortation that the payment of each payment that of the the other status expense to the borrowed interest SI 10 15 O 14 T 141 10 14 PM 110 Toft SI Eitt 536.000.00 SIENOS In Copy Paste Toint Painter LED Merge & Center $ % 8-% Conditional fomatas Formatting Tables Styles Font 2 Clipboard Alignment S Number H9 fo H Name: 6 . Find the FV of $15,500 invested to earn 75% after 5 years. Answer this question asing the Excel function wizard 8 9 Inputs: 5 10 7.595 11 PN 15,500 12 13 Wizard (FV): 50.00 14 Note: In the wird's menu, use pero for PMT because there are no periodic payments 16 17 Observe how the IV changes at 09,5%, and 2016 for 0, 1, 2, 3, 4, and 5 years 18 19 20 Years (19) Interest Rate (10) 21 50,00 09 21 S0.00 0.00 50.00 23 1 50.00 5000 50.00 24 2 50.00 50,00 50.00 35 50.00 S0.00 50.00 26 4 50.00 50.00 50.00 5 50.00 S000 50.00 2048 29 JO 31 Function time and rate 33 31 . Project Sheet 7.5 43 44 c. Find the PV of SI5,500 due in 5 years if the discount rate is 75%. Again, work the problem -15 using the function wizard. 46 47 Luputs: 5 48 FV 15.500 50 51 Wizard (PV) 52 53 Note: In the wizard's menu, use zero for PMT because there are no periodic payments. 54 49 55 36 d. A security has a cost of $15,000 and will return $20,150 after 3 years. What rate of return does the security provide 57 58 59 60 Inputs: FV 20,150 -15,000 62 64 Wandtato: 55 66 Noter se pro for PMT since there are o periodic payments. Note that they is given negative because it is an ow cost to buy the security SH 60 70. Suppose California's population 130 million people sits population is pected to grow by 21 per year. How long take for the population to double 72 Project Sheet 69 70 e. Suppose California's population is 30 million people, and its population is expected to grow by 4% 71 per year. How long would it take for the population to double? 72 73 Inputs: FV = 60 74 PV = 30 75 1 = growth rate 4% 76 N= 2 77 78 Wizard (NPER): = Years to double 79 80 81 L Find the PV of an annuity that pays $11,000 at the end of each of the next 5 years if the interest rate 82 is 15%. Then find the FV of that same annuity. 83 84 Inputs: PMT S 11,000 85 N 5 86 1 159 87 88 PV: Use function wizard (PV) PV 89 90 FV: Use function wizard (PV) 91 92 93. How would the PV and FV of the nuity change if it were an annuity due rather than an ordinary annuity? 96 Use the "type" box in the function wind (omitted or were for end of period, and one for anoty doe) 97 98 PV annuity due (Use function wizard (PV) 94 95 E G 99 100 Exactly the same adjustment is made to find the FV of the annuity due. 101 102 FV annuity due (use function wizard (FV) = 103 104 105 h. What would the FV and the PV for problems a and e be if the interest rate were 7.5% with semiannual compounding rather than 7.5% with anomal compounding? Parta. FV with semiannual compounding: Inputs: PV Orig. Inputs: 15,500 7.5% New Inputs: -15,500 3.75% 10 Wizard (FV): S0.00 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 Part c. PV with semiannual compounding: Inputs: FV = Orig. Inputs: -15,500 7.59 New Inputs: 13,500 3.7596 10 Wizard (PV): S0.00 9 B 124 12 Fid they of an investment that makes the following end of year payments. The Year 1 2 Pay 100 200 400 130 89 Rate 13 To the use them to Support you took out more for 5150,000. The latest rated the 10 with all of your payment Setup mortation that the payment of each payment that of the the other status expense to the borrowed interest SI 10 15 O 14 T 141 10 14 PM 110 Toft SI Eitt 536.000.00 SIENOS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts