Question: in excel with cell reference only please. only need after one year question and if the property is sold after 72 pmt question 2. An

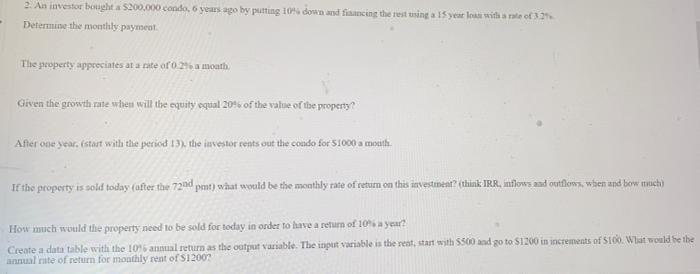

2. An investor bought a 200.000 .condo, 6 years ago by putting 10% down and financing the rest using a 15 years with a rate of 3 Determine the monthly payment The property appreciates at a rate of 0 24 month, Given the growth rate when will the equity equal 20% of the value of the property? After one year. Estast with the period 13), the investor rents out the condo for 51000 a most If the property is solf today after the 72nd pet) wat would be the monthly rate of return on this investment? (think IRR. inflows and outflow, when and bow much How much would the property need to be sold for today in order to have a retum of 10 year? Create a datatable with the 10% annual return as the output variable. The input variable is the rest start with 5500 and go to S1200 in increments of S100. What would be the annual rate of return for monthly rent of $12002 2. An investor bought a 200.000 .condo, 6 years ago by putting 10% down and financing the rest using a 15 years with a rate of 3 Determine the monthly payment The property appreciates at a rate of 0 24 month, Given the growth rate when will the equity equal 20% of the value of the property? After one year. Estast with the period 13), the investor rents out the condo for 51000 a most If the property is solf today after the 72nd pet) wat would be the monthly rate of return on this investment? (think IRR. inflows and outflow, when and bow much How much would the property need to be sold for today in order to have a retum of 10 year? Create a datatable with the 10% annual return as the output variable. The input variable is the rest start with 5500 and go to S1200 in increments of S100. What would be the annual rate of return for monthly rent of $12002

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts