Question: In financing its $160M project, Lee Corp. (i) issues $26M par value of preferred stocks, (ii) $60M par value of long-term debt, and (iii)

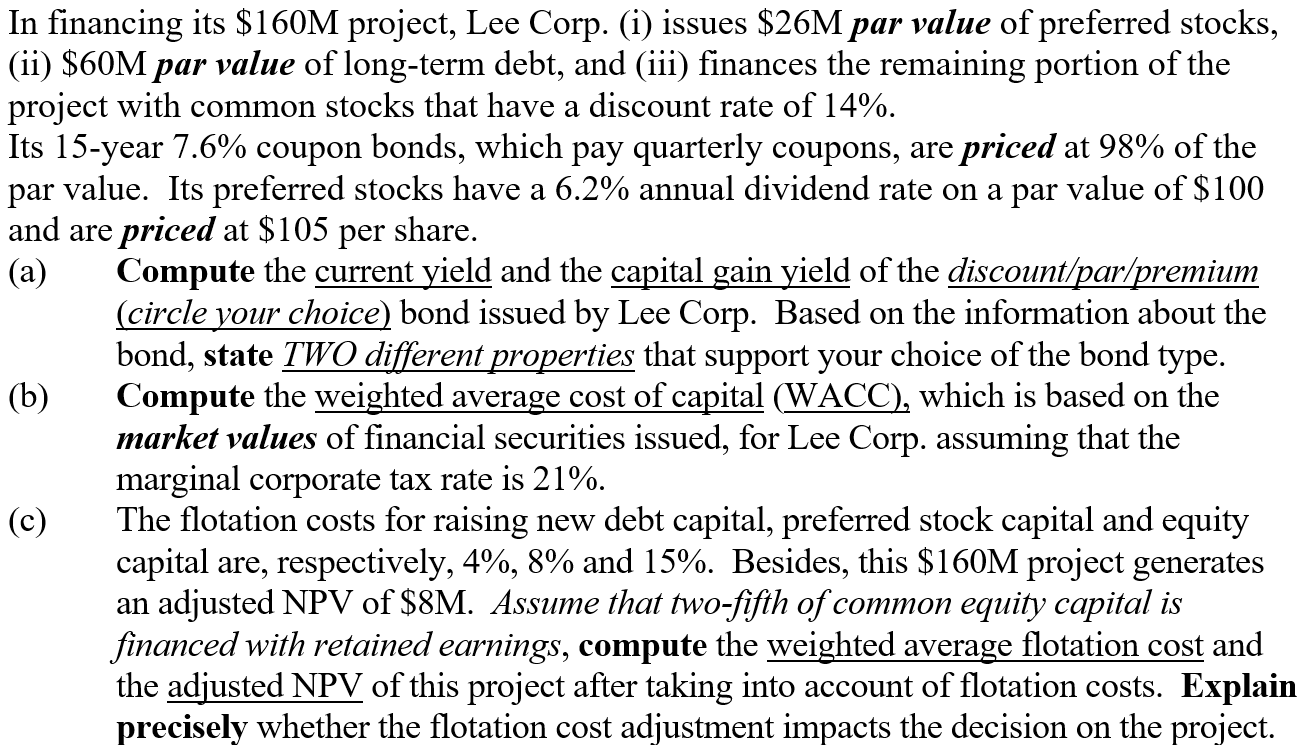

In financing its $160M project, Lee Corp. (i) issues $26M par value of preferred stocks, (ii) $60M par value of long-term debt, and (iii) finances the remaining portion of the project with common stocks that have a discount rate of 14%. Its 15-year 7.6% coupon bonds, which pay quarterly coupons, are priced at 98% of the par value. Its preferred stocks have a 6.2% annual dividend rate on a par value of $100 and are priced at $105 per share. (a) (b) (c) Compute the current yield and the capital gain yield of the discount/par/premium (circle your choice) bond issued by Lee Corp. Based on the information about the bond, state TWO different properties that support your choice of the bond type. Compute the weighted average cost of capital (WACC), which is based on the market values of financial securities issued, for Lee Corp. assuming that the marginal corporate tax rate is 21%. The flotation costs for raising new debt capital, preferred stock capital and equity capital are, respectively, 4%, 8% and 15%. Besides, this $160M project generates an adjusted NPV of $8M. Assume that two-fifth of common equity capital is financed with retained earnings, compute the weighted average flotation cost and the adjusted NPV of this project after taking into account of flotation costs. Explain precisely whether the flotation cost adjustment impacts the decision on the project.

Step by Step Solution

There are 3 Steps involved in it

a Calculating the current yield and capital gain yield for the bond issued by Lee Corp Current Yield ... View full answer

Get step-by-step solutions from verified subject matter experts