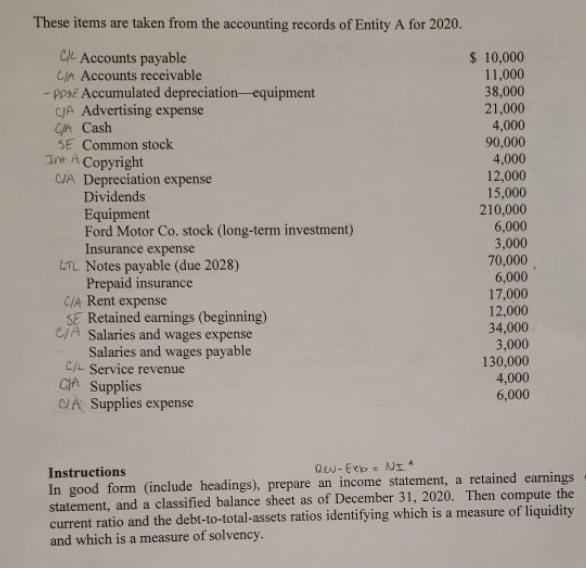

Question: These items are taken from the accounting records of Entity A for 2020. CL Accounts payable CJA Accounts receivable - ppsz Accumulated depreciation-equipment CJA

These items are taken from the accounting records of Entity A for 2020. CL Accounts payable CJA Accounts receivable - ppsz Accumulated depreciation-equipment CJA Advertising expense Cn Cash SE Common stock Ine A Copyright CJA Depreciation expense Dividends Equipment Ford Motor Co. stock (long-term investment) Insurance expense LTL Notes payable (due 2028) Prepaid insurance CIA Rent expense SE Retained earnings (beginning) CJA Salaries and wages expense Salaries and wages payable CIL Service revenue CIA Supplies UA Supplies expense $ 10,000 11,000 38,000 21,000 4,000 90,000 4,000 12,000 15,000 210,000 6,000 3,000 70,000 6,000 17,000 12,000 34,000 3,000 130,000 4,000 6,000 Qw- Exb = NI Instructions In good form (include headings), prepare an income statement, a retained earnings statement, and a classified balance sheet as of December 31, 2020. Then compute the current ratio and the debt-to-total-assets ratios identifying which is a measure of liquidity and which is a measure of solvency.

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts