Question: In implementing the Treynor-Black Model for your group project, you have run the following regression of a single-index model for stock A, in excess monthly

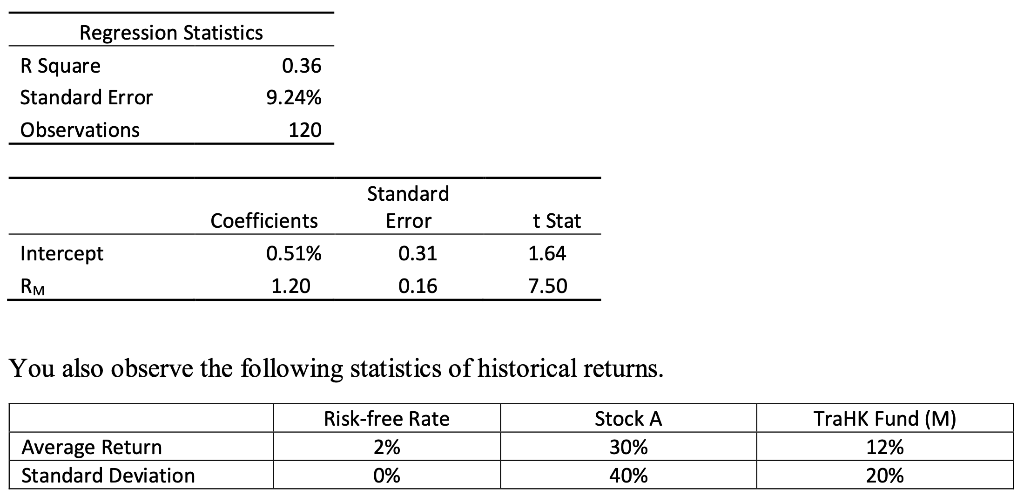

In implementing the Treynor-Black Model for your group project, you have run the following regression of a single-index model for stock A, in excess monthly returns.

The expected market return is 11% and current risk-free rate is 1%. The correlation coefficient between stock return and market return is 0.6.

Required:

-

(1) From the regression output, identify the stocks beta and alpha. [3 Marks]

-

(2) Calculate M2 and determine whether stock A outperformed the market? [4 Marks]

-

(3) If the intrinsic value of stock A is estimated to be $21, while its current stock price is $20,

what would be your estimate of expected return E(r) for stock A? Can you use the alpha

estimate from the regression? Explain. [6 Marks]

-

(4) If you form an equally weighted portfolio (P) with stock A and TraHK Fund, what would

be beta and expected return of the portfolio? [4 Marks]

-

(5) Show that the above portfolio P is better than investing 100% in stock A? [4 Marks]

-

(6) Suppose there is a call option on stock A, if the standard deviation of the stock return

increases, what would you expect the impact on stock price and call option price? Explain. [4 Marks]

Regression Statistics R Square 0.36 Standard Error 9.24% Observations 120 Standard Error Coefficients t Stat 0.31 1.64 Intercept RM 0.51% 1.20 0.16 7.50 You also observe the following statistics of historical returns. Average Return Standard Deviation Risk-free Rate 2% 0% Stock A 30% 40% TraHK Fund (M) 12% 20% Regression Statistics R Square 0.36 Standard Error 9.24% Observations 120 Standard Error Coefficients t Stat 0.31 1.64 Intercept RM 0.51% 1.20 0.16 7.50 You also observe the following statistics of historical returns. Average Return Standard Deviation Risk-free Rate 2% 0% Stock A 30% 40% TraHK Fund (M) 12% 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts