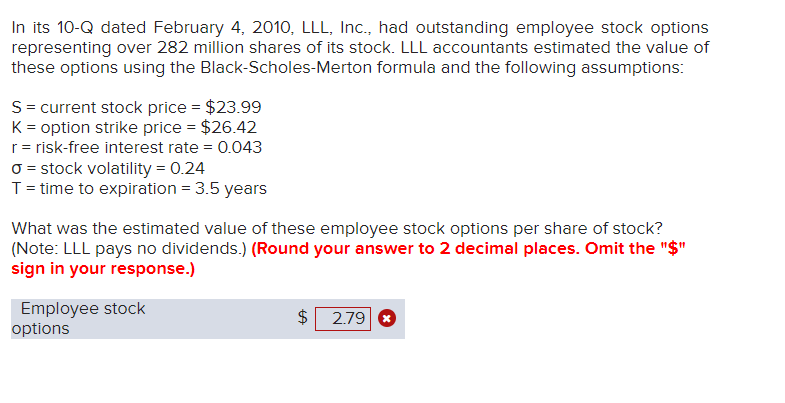

Question: In its 1 0 - Q dated February 4 , 2 0 1 0 , LLL , Inc., had outstanding employee stock options representing over

In its dated February LLL Inc., had outstanding employee stock options

representing over million shares of its stock. LLL accountants estimated the value of

these options using the BlackScholesMerton formula and the following assumptions:

current stock price $

option strike price $

riskfree interest rate

stock volatility

time expiration years

What was the estimated value of these employee stock options per share of stock?

Note: LLL pays no dividends.Round your answer to decimal places. Omit the $

sign in your response.

Employee stock

optionsIn its Q dated February LLL Inc., had outstanding employee stock options representing over million shares of its stock. LLL accountants estimated the value of these options using the BlackScholesMerton formula and the following assumptions:

S current stock price $

K option strike price $

r riskfree interest rate

sigma stock volatility

T time to expiration years

What was the estimated value of these employee stock options per share of stock? Note: LLL pays no dividends.Round your answer to decimal places. Omit the $ sign in your response.

Employee stock options $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock