Question: In May 2 0 2 1 , Suni Kumar, a business analyst at National Cement Company, embarked on a critical project: estimating the cost of

In May Suni Kumar, a business analyst at National Cement Company, embarked on a critical project: estimating the cost of capital for a prospective cement works project in Bangalore. As one of India's leading cement manufacturers, the company needed to determine the project's financial viability. Suni's task was to calculate the corporate cost of capital, considering various sources of finance. With financial statements in hand and complexities surrounding debt structures, equity components, and capital structure targets, Suni faced a challenging journey to provide a precise estimate, making this his first significant project at the company.Read this case study Download case studyEmeritusand use your knowledge to address the following topics:What is the project cost of capital? How does it differ from the corporate cost of capital? Is there any difference in this case?Suni could attempt to calculate the companys cost of debt from data on interest expense and the average level of debt. Use the data in Exhibits and to calculate the companys cost of debt using this procedure, keeping in mind the warning from the accounting team.Estimate the cost of equity capital using the i CAPM and ii dividend discount models. Which estimate is the most appropriate? Justify your answer.Critique the colleagues suggestions that Suni could estimate the cost of equity using either the dividend yield or the earnings yield on National Cements stock.Which tax rate should Suni use for National Cement? Justify your answer.Calculate the cost of capital of National Cement using i target capital structure weights, ii book value weights, and iii market value weights. Use the costs of debt estimates from Question in your calculations.What cost of capital figure should Suni recommend for use in the evaluation of the project proposal? Justify your answer.

COST OF CAPITAL CASE STUDY

NATIONAL CEMENT COMPANY LTD

It was midMay and Suni Kumar, a business analyst in the National Cement Company, was working against the clock. National Cement was one of India's leading cement manufacturers with annual capacity of nearly million tons per annum. The company was contemplating the construction of a new stateoftheart cement works in Bangalore with a capacity of million tons per annum but would only proceed with the project if it made economic sense. His team was undertaking the feasibility study for the project and he had been tasked with estimating the cost of capital that should be used in the project evaluation. His team wanted an answer within a few days. What was the project's cost of capital? And how could this be estimated?

This was Suni's first big project since he had joined the company and he wanted to do a thorough job. He had completed a MBA programme several years earlier and was familiar with the concept of the cost of capital. Although he had been asked for an estimate of the project's cost of capital, he was confident that what he needed to do in this case was to estimate was the corporate cost of capital.

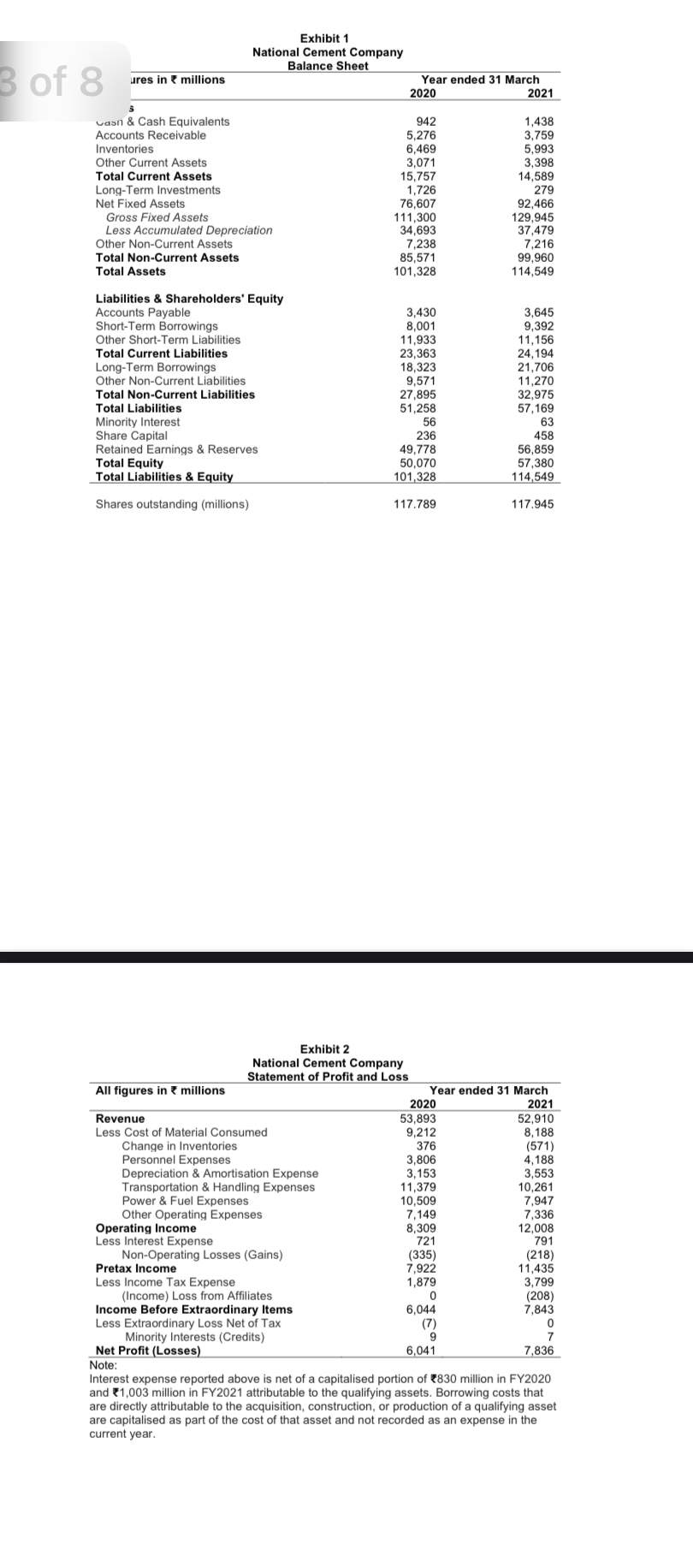

From what he recalled about the corporate cost of capital he knew he would need to assemble estimates of the costs of the major sources of finance the company employed and then combine them according to proportions the company financed itself. But before he could begin he obviously needed a copy of the company's most recent financial statements. The accounting team was busy finalising the financial statements for the year ended March and they provided him with a draft set and some explanatory notes. see Exhibits to The accounting team also provided a tenyear summary of important data. See Exhibit When he told one of the accounting team that he intending using the financial statements to help calculate the costs of the various sources of funding, he was warned that the interest expense in the Statement of Profit and Loss understated the true cost of the company's debt.

With that warning in mind, Suni though he would first begin to calculate the cost of debt. The balance sheet showed that National Cement had some million of short and longterm debt at the end of FY This comprised a mixture of commercial paper million shortterm loans from banks million term loans from banks million soft loans from the Government million and nonconvertible debentures million The commercial paper was issued at yields of between and and the shortterm bank loans carried variable interest rates of between and These obligations were secured over the company's accounts receivable and inventories. The term loans carried variable interest rates tied to the repo rate and threemonth and oneyear treasury bil

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock