Question: In most finance examples we assumed that the decision maker was risk neutral. Risk neutral individuals and organizations make decisions based on expected wealth. Sometimes

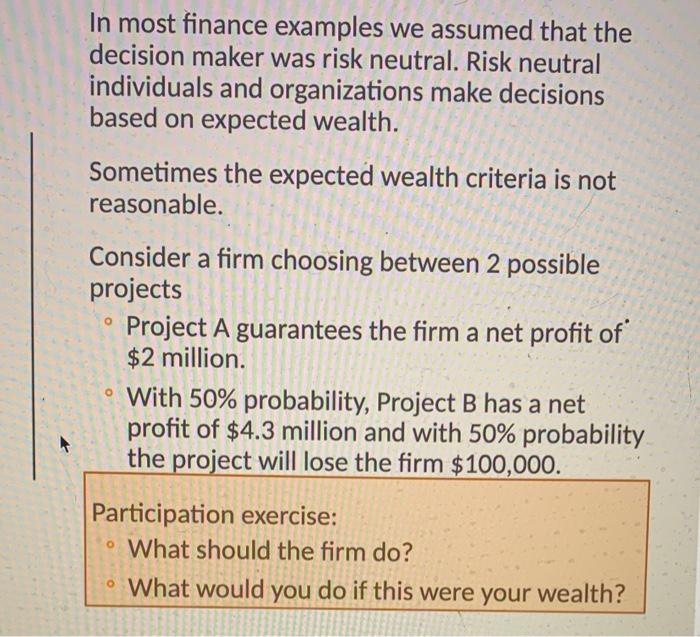

In most finance examples we assumed that the decision maker was risk neutral. Risk neutral individuals and organizations make decisions based on expected wealth. Sometimes the expected wealth criteria is not reasonable. Consider a firm choosing between 2 possible projects - Project A guarantees the firm a net profit of $2 million. With 50% probability, Project B has a net profit of $4.3 million and with 50% probability the project will lose the firm $100,000. Participation exercise: What should the firm do? What would you do if this were your wealth

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock