Question: In option trading, a bull spread strategy involves the simultaneous purchase and sale of either call options or put options with different strike prices but

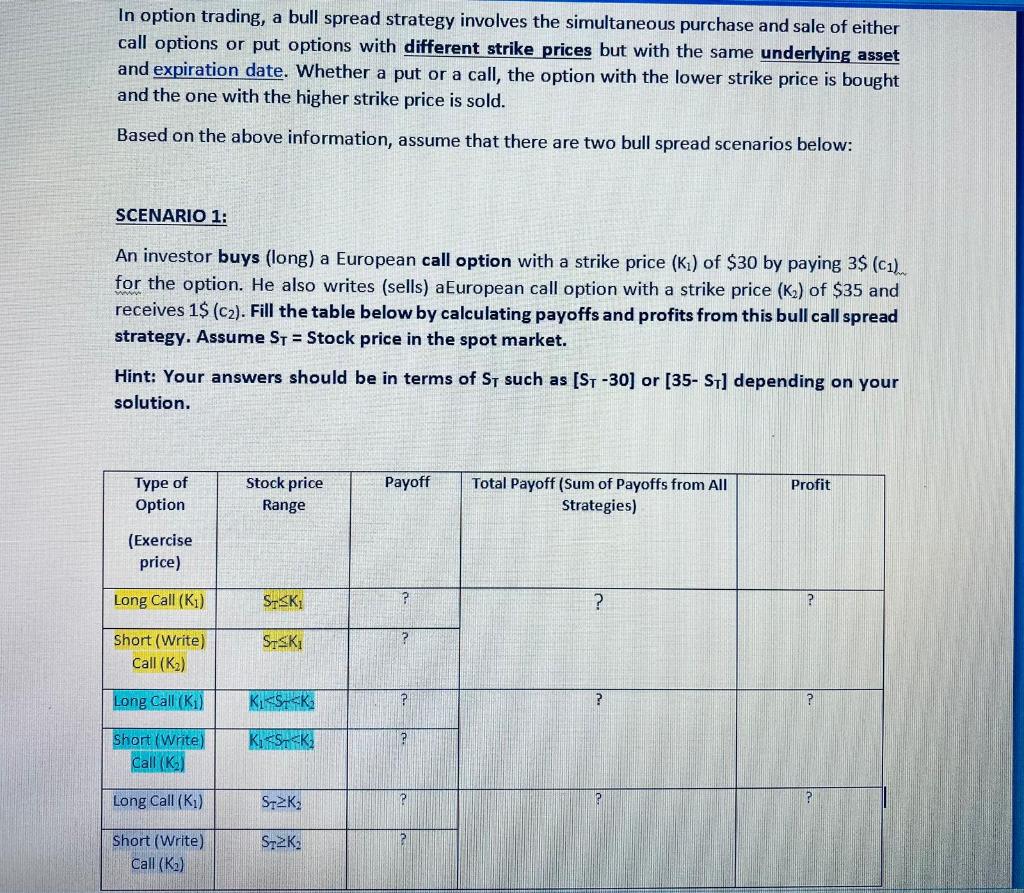

In option trading, a bull spread strategy involves the simultaneous purchase and sale of either call options or put options with different strike prices but with the same underlying asset and expiration date. Whether a put or a call, the option with the lower strike price is bought and the one with the higher strike price is sold. Based on the above information, assume that there are two bull spread scenarios below: SCENARIO 1: An investor buys (long) a European call option with a strike price (Kn) of $30 by paying 3$ (C1). for the option. He also writes (sells) a European call option with a strike price (K2) of $35 and receives 1$ (c2). Fill the table below by calculating payoffs and profits from this bull call spread strategy. Assume ST = Stock price in the spot market. Hint: Your answers should be in terms of St such as [ST -30] or [35- ST] depending on your solution. Payoff Profit Type of Option Stock price Range Total Payoff (Sum of Payoffs from All Strategies) (Exercise price) Long Call(K) SISK ? ? Short (Write) Call (K2) SISK ? Long Call (Ki) Ki SK ? K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts