Question: In Problem 3, what is the net present value (NPV) of Synerdyne's expansion project? Give the answer as a dollar amount with 2 decimals but

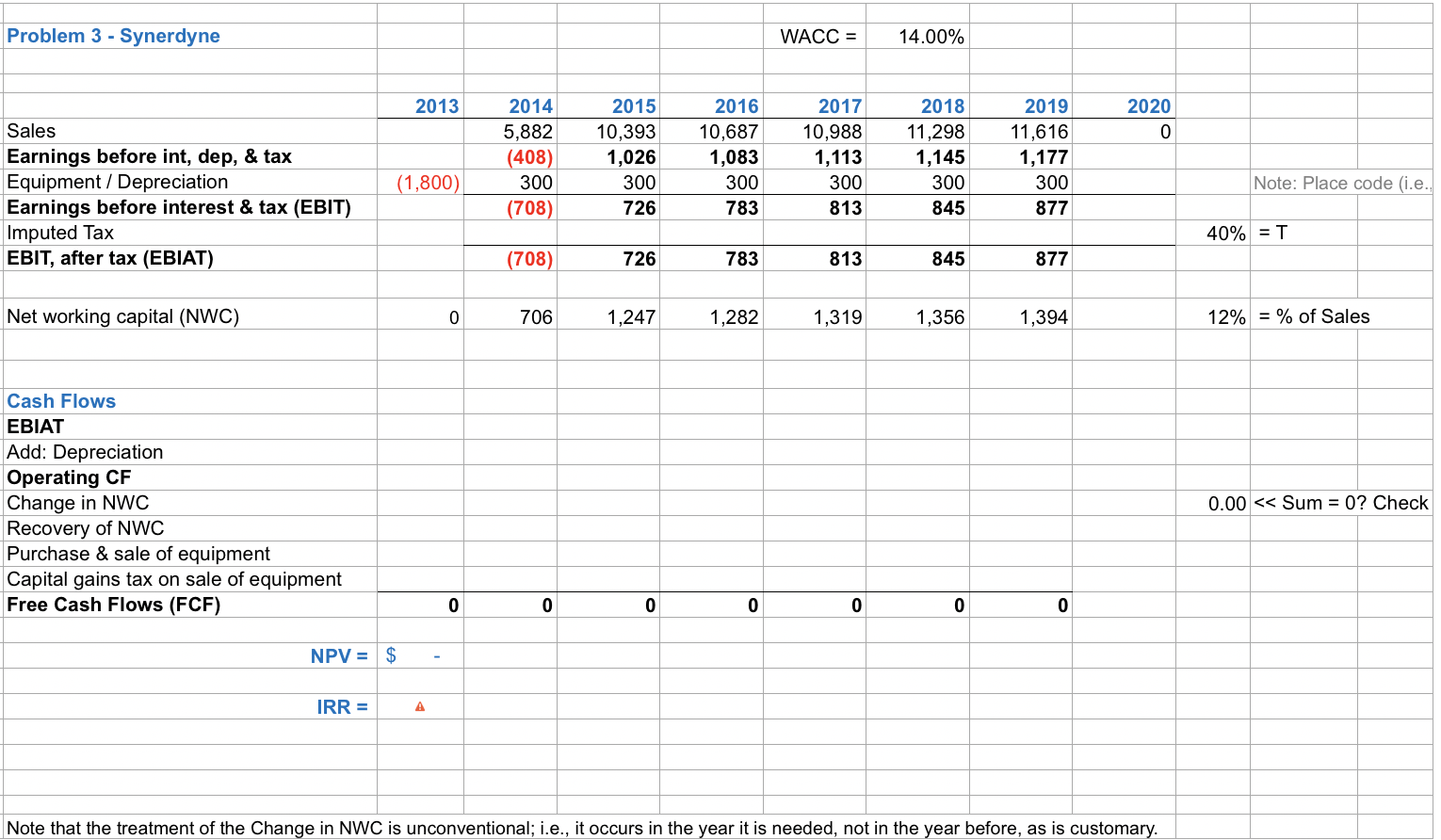

In Problem 3, what is the net present value (NPV) of Synerdyne's expansion project? Give the answer as a dollar amount with 2 decimals but do not write the $ symbol; e.g., if the answer is -$1,234.56 you should write -1234.56 in the answer box. Notice that you should not include the separator comma. IMPORTANT: As is done in the two tables provided for this problem, you should disregard the thousands in all your calculations, as well as in your answer. Thus, for example, you will input the investment of $1,800,000 in 2013 as -1,800 for calculation purposes.

The years in the second table (the one that depicts net working capital) are wrong. Instead of 2003, 2004, ..., 2009, 2010 they should be labeled 2013, 2014, , 2019, 2020.

- The initial investment occurs in year 2013.

- Assume that taxes are symmetric; that is, if the firm has positive EBIT it pays taxes, but if it has negative EBIT it receives a tax refund. By the way, this is a realistic assumption given that we are analyzing an investment project within the firm, and not the entire firm.

- The Net Working Capital (NWC) shown in the second table (the one with the incorrect year labels) is cumulative. You will need to calculate the INCREMENTAL NWC for each year. As an example, the firm needs to invest $541 in incremental NWC in 2015. Assume, as stated in the text, that all the cumulative NWC is recovered at the end of 2019. As a check, it is good practice to verify that the sum of all the changes in NWC, including the recovery of NWC, over the life of the project is zero (0); make sure that this is the case!

- Dont forget to include the capital gains tax in 2019 that results from the sale of the equipment.

Problem 3 - Synerdyne WACC = 14.00% 2013 2020 2014 5,882 (408) 300 (708) 2015 10,393 1,026 2016 10,687 1,083 2017 10,988 1,113 300 813 2018 11,298 1,145 300 2019 11,616 1,177 300 877 (1,800) Sales Earnings before int, dep, & tax Equipment / Depreciation Earnings before interest & tax (EBIT) Imputed Tax EBIT, after tax (EBIAT) 300 300 Note: Place code i.e. 726 783 845 40% = T (708) 726 783 813 845 877 Net working capital (NWC) 0 706 1,247 1,282 1,319 1,356 1,394 12% = % of Sales Cash Flows EBIAT Add: Depreciation Operating CF Change in NWC Recovery of NWC Purchase & sale of equipment Capital gains tax on sale of equipment Free Cash Flows (FCF) 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts