Question: Review View A+ 1 AaBaceod Accode AaBbCD abbccde AaBb Accot Accoat Accede ABCODE IE, No Spacing Hesagt Heading 3 ph Emphasis Inne Emp JUHINE PRICE

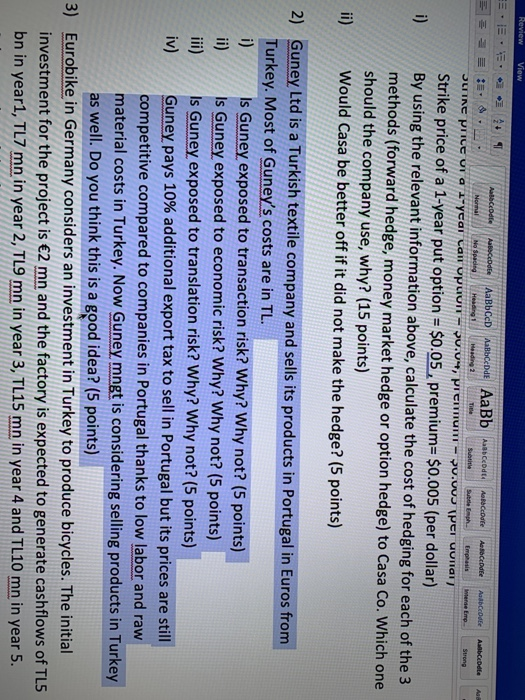

Review View A+ 1 AaBaceod Accode AaBbCD abbccde AaBb Accot Accoat Accede ABCODE IE, No Spacing Hesagt Heading 3 ph Emphasis Inne Emp JUHINE PRICE Or a 1-year can opuUIT PU.04, Premium - Pu.worper uuniary Normal Abedia A T Strong i) Strike price of a 1-year put option = $0.05 , premium= $0.005 (per dollar) By using the relevant information above, calculate the cost of hedging for each of the 3 methods (forward hedge, money market hedge or option hedge) to Casa Co. Which one should the company use, why? (15 points) Would Casa be better off if it did not make the hedge? (5 points) ii) 2) Guney Ltd is a Turkish textile company and sells its products in Portugal in Euros from Turkey. Most of Guney's costs are in TL. i) Is Guney exposed to transaction risk? Why? Why not? (5 points) Is Guney exposed to economic risk? Why? Why not? (5 points) Is Guney exposed to translation risk? Why? Why not? (5 points) Guney pays 10% additional export tax to sell in Portugal but its prices are still competitive compared to companies in Portugal thanks to low labor and raw material costs in Turkey. Now Guney mngt is considering selling products in Turkey as well. Do you think this is a good idea? (5 points) 3) Eurobike in Germany considers an investment in Turkey to produce bicycles. The initial investment for the project is 2 mn and the factory is expected to generate cashflows of TL5 bn in year1, TL7 mn in year 2, TL9 mn in year 3, TL15 mn in year 4 and TL10 mn in year 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts