Question: In python please. Consider a portfolio of investable instruments. Each instrument has an expected return and variance per year. The total variance of the portfolio

In python please.

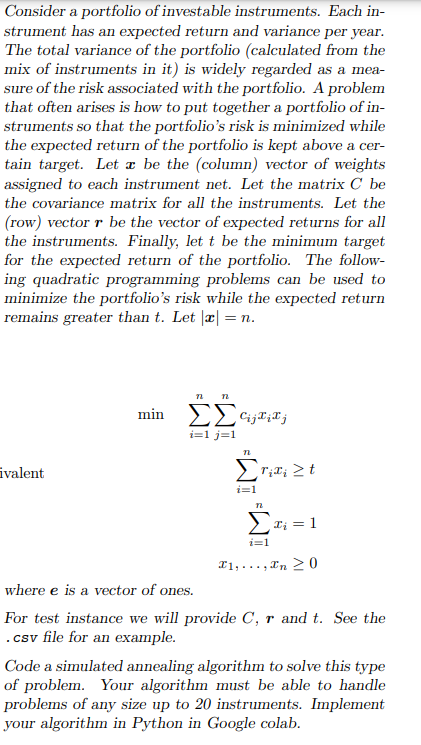

Consider a portfolio of investable instruments. Each instrument has an expected return and variance per year. The total variance of the portfolio (calculated from the mix of instruments in it) is widely regarded as a measure of the risk associated with the portfolio. A problem that often arises is how to put together a portfolio of instruments so that the portfolio's risk is minimized while the expected return of the portfolio is kept above a certain target. Let x be the (column) vector of weights assigned to each instrument net. Let the matrix C be the covariance matrix for all the instruments. Let the (row) vector r be the vector of expected returns for all the instruments. Finally, let t be the minimum target for the expected return of the portfolio. The following quadratic programming problems can be used to minimize the portfolio's risk while the expected return remains greater than t. Let x=n. mini=1nj=1ncijxixji=1nrixiti=1nxi=1x1,,xn0 where e is a vector of ones. For test instance we will provide C,r and t. See the . csv file for an example. Code a simulated annealing algorithm to solve this type of problem. Your algorithm must be able to handle problems of any size up to 20 instruments. Implement your algorithm in Python in Google colab

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts