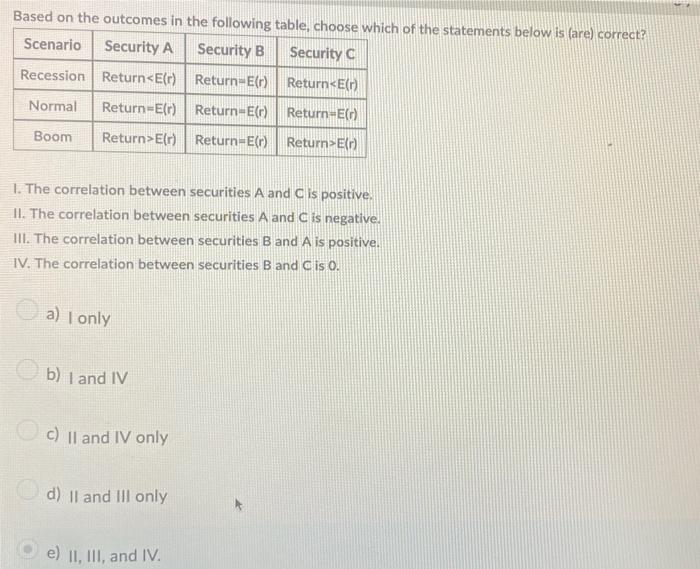

Question: Based on the outcomes in the following table, choose which of the statements below is (are) correct? Scenario Security A Security B Security C

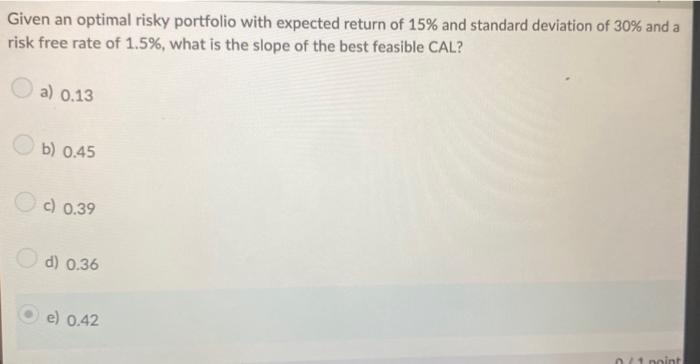

Based on the outcomes in the following table, choose which of the statements below is (are) correct? Scenario Security A Security B Security C Recession Return E(r) 1. The correlation between securities A and C is positive. II. The correlation between securities A and C is negative. III. The correlation between securities B and A is positive. IV. The correlation between securities B and C is 0. a) I only b) I and IV c) II and IV only d) II and III only e) II, III, and IV. Given an optimal risky portfolio with expected return of 15% and standard deviation of 30% and a risk free rate of 1.5%, what is the slope of the best feasible CAL? a) 0.13 b) 0.45 c) 0.39 d) 0.36 e) 0.42 0/1 point

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

1st PART QUESTION ANSWER Option E II III IV EXPLANATION The return of the ... View full answer

Get step-by-step solutions from verified subject matter experts