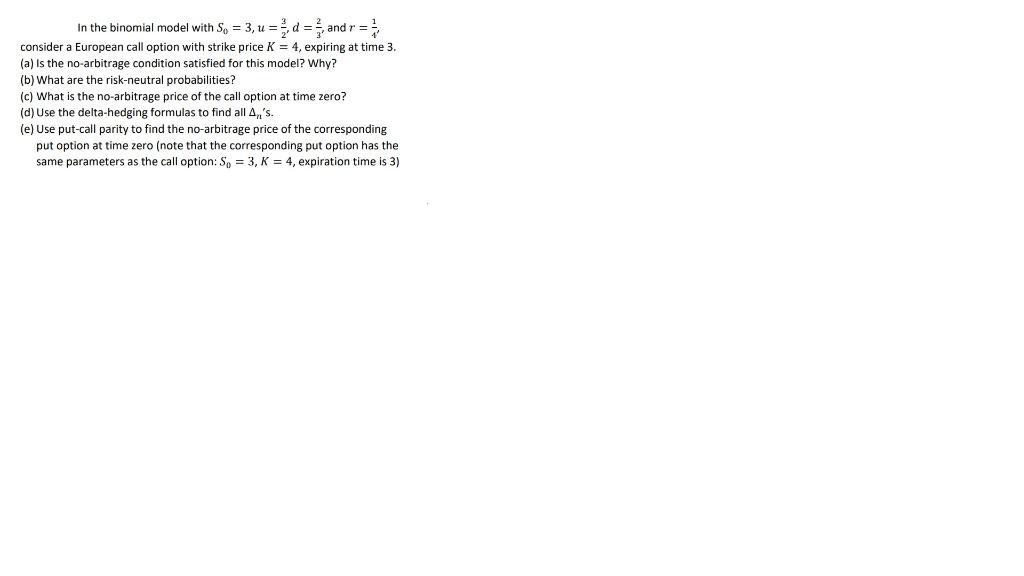

Question: In the binomial model with So=3,u= d = and r = consider a European call option with strike price K = , expiring at

In the binomial model with So=3,u= d = and r = consider a European call option with strike price K = , expiring at time 3. (a) is the no-arbitrage condition satisfied for this model? Why? (b) What are the risk-neutral probabilities? (c) What is the no-arbitrage price of the call option at time zero? (d) Use the delta-hedging formulas to find all A,,'s. (e) Use put-call parity to find the no-arbitrage price of the corresponding put option at time zero (note that the corresponding put option has the same parameters as the call option: So = 3, K = 4, expiration time is 3) In the three-period binomial model, suppose that S = 3, u = = d = . Assume that the interest rate is r=. Consider a lookback option that pays off V (max S) - S Osns3 At time 3. (a) What are the risk-neutral probabilities? (b) What is the no-arbitrage price of the option at time zero? (c) Use the delta-hedging formulas to find all A,,'s.

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

a To determine if the noarbitrage condition is satisfied in this binomial model we need to check if there exist any arbitrage opportunities ie opportu... View full answer

Get step-by-step solutions from verified subject matter experts