Question: In the current year, Johnice started a profitable business as a sole proprietor. Johnice made $38.000 in her first year of operation. What two forms

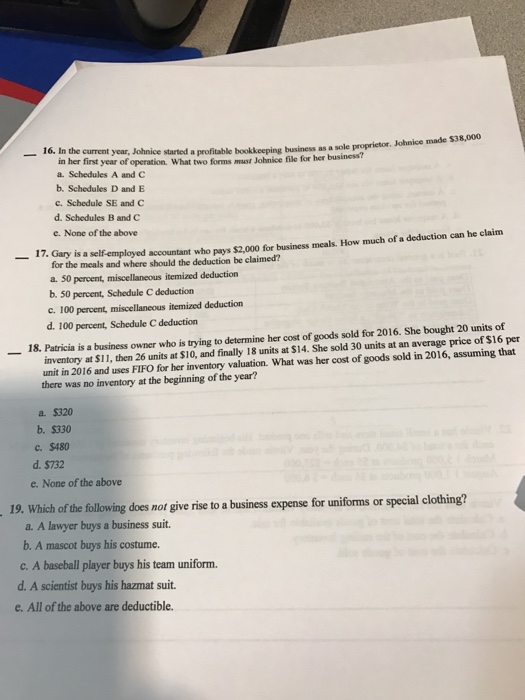

In the current year, Johnice started a profitable business as a sole proprietor. Johnice made $38.000 in her first year of operation. What two forms must johnice file her business? a. Schedules A and C b. Schedules D and E c. Schedules SE and C. d. a. Schedules B and C e. None of the above Gary is a self-employed accountant who pay $2,000 for business meals. How much of a deduction can he claim for the meals and where should the deduction be claimed? a. 50 percent, miscellaneous itemized deduction b. 50 percent, Schedule C deduction c. 100 percent, miscellaneous itemized deduction d. 100 percent, Schedule C deduction Patricia is a business owner who is trying to determine her cost of goods sold for 2016. She bought 20 units of inventory at $11, then 26 units at $10, and finally 18 units at S14. She sold 30 units at an average assuming that there was no inventory at the begging of the year? a. $320 b. $330 c. $480 d. $732 e. None of the above Which of the following does not give rise to a business expense for uniforms or special clothing? a. A lawyer buys a business suit. b. A mascot buys his costume. c. A baseball player buys his team uniform. d. A scientist buys his hazmat suit. e. All of the above are deductible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts