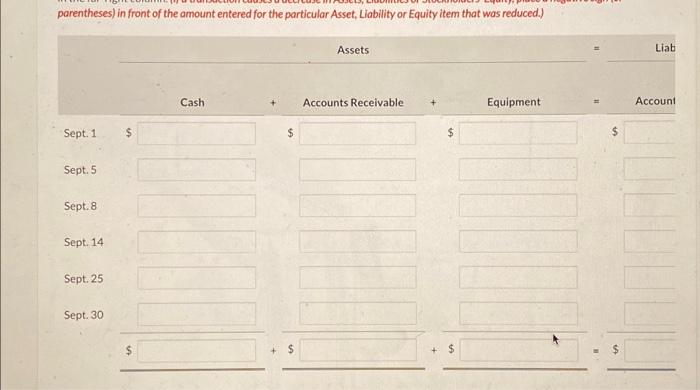

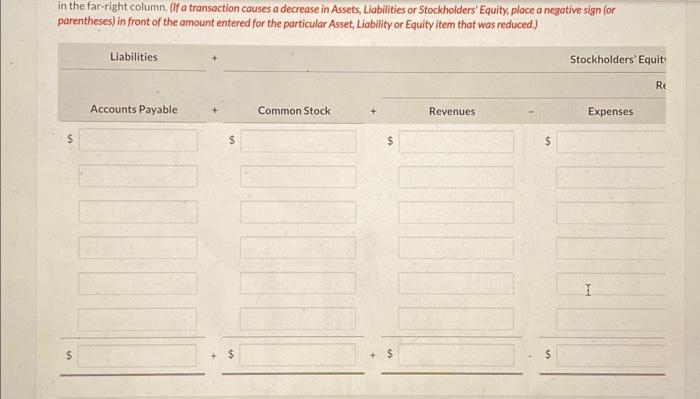

Question: in the far-right column. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of

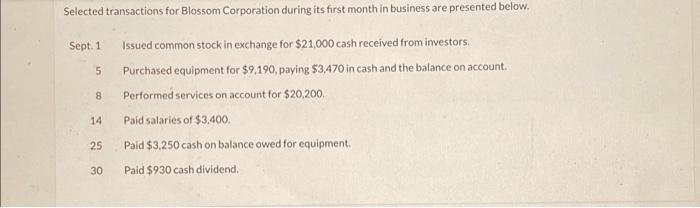

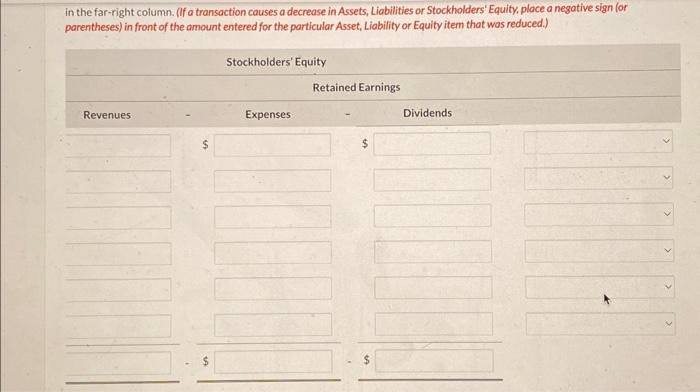

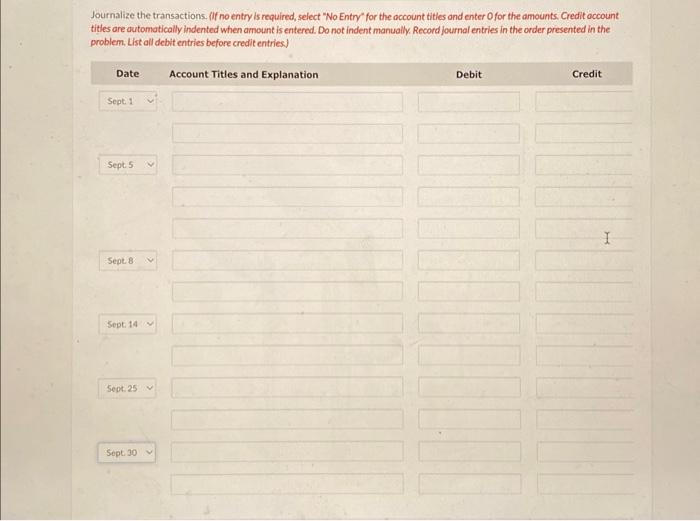

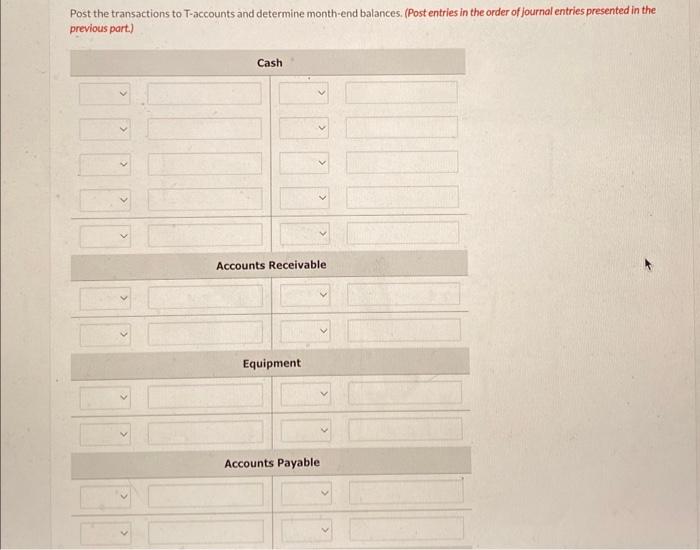

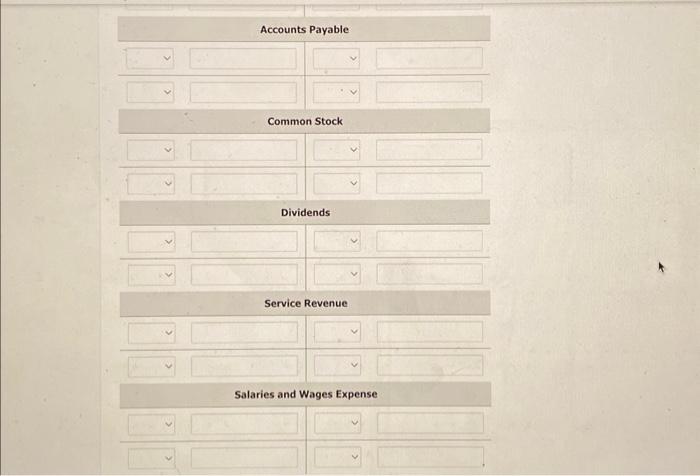

in the far-right column. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) in the far-right column. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Selected transactions for Blossom Corporation during its first month in business are presented below. Sept. 1 Issued common stock in exchange for $21,000 cash received from investors. 5 Purchased equipment for $9,190, paying $3,470 in cash and the balance on account. 8 Performed services on account for $20,200. 14 Paid salaries of $3,400. 25 Paid $3,250 cash on balance owed for equipment. 30 Paid $930 cash dividend. Post the transactions to T-accounts and determine month-end balances. (Post entries in the order of journal entries presented in the previous part.) Accounts Payable Common Stock Dividends Service Revenue Salaries and Wages Expense Journalize the transactions. If no entry is required, select "No Entry" for the occount tities and enter Ofor the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts