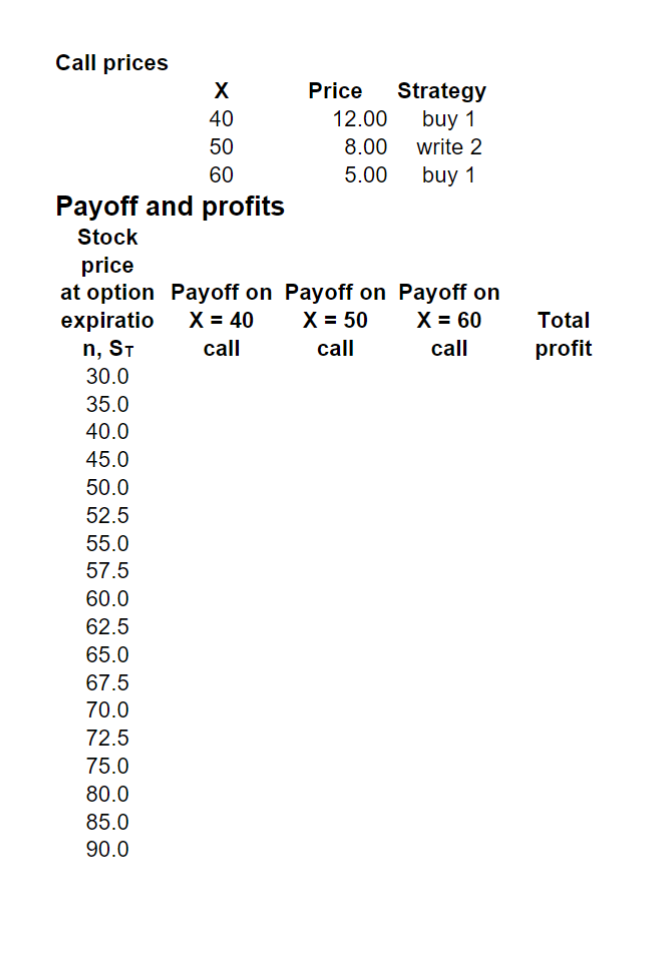

Question: In the first file, you need to construct the table of the Butterfly and the pay-off diagram. In the first file, you need to calculate

- In the first file, you need to construct the table of the Butterfly and the pay-off diagram.

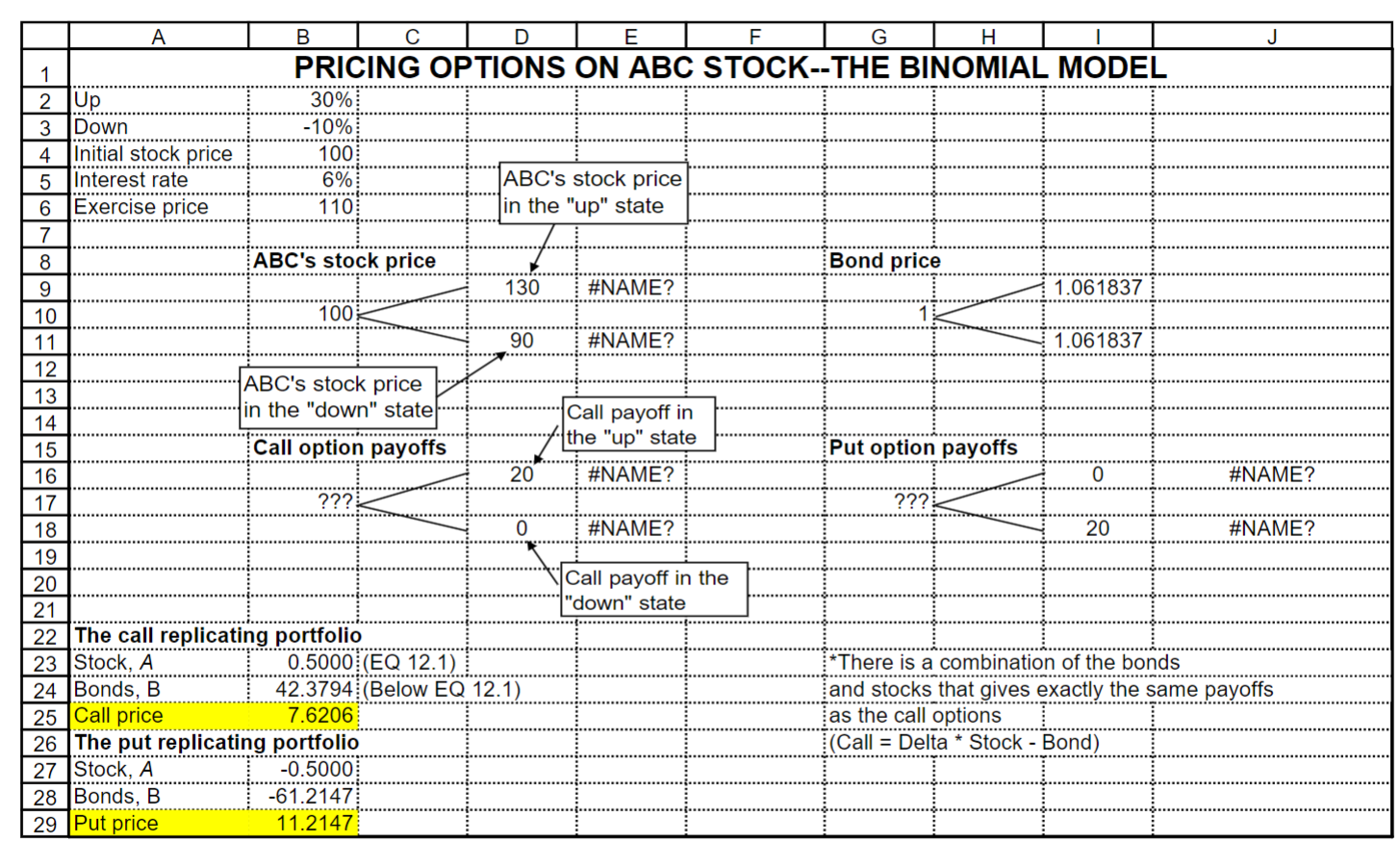

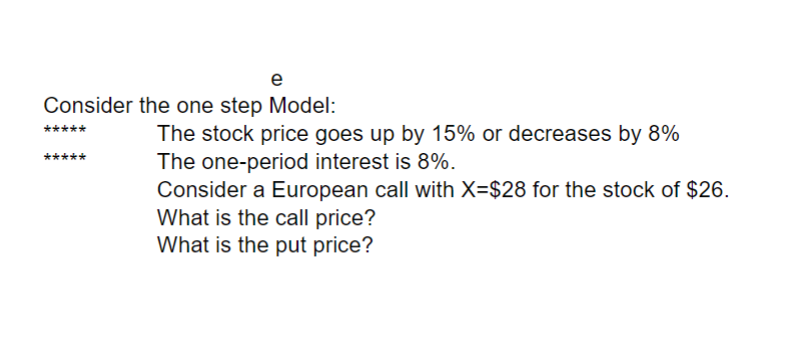

- In the first file, you need to calculate the call value based on the information in the Bin-Ex#1 as demonstrated in Demo-bin-one step worksheet.

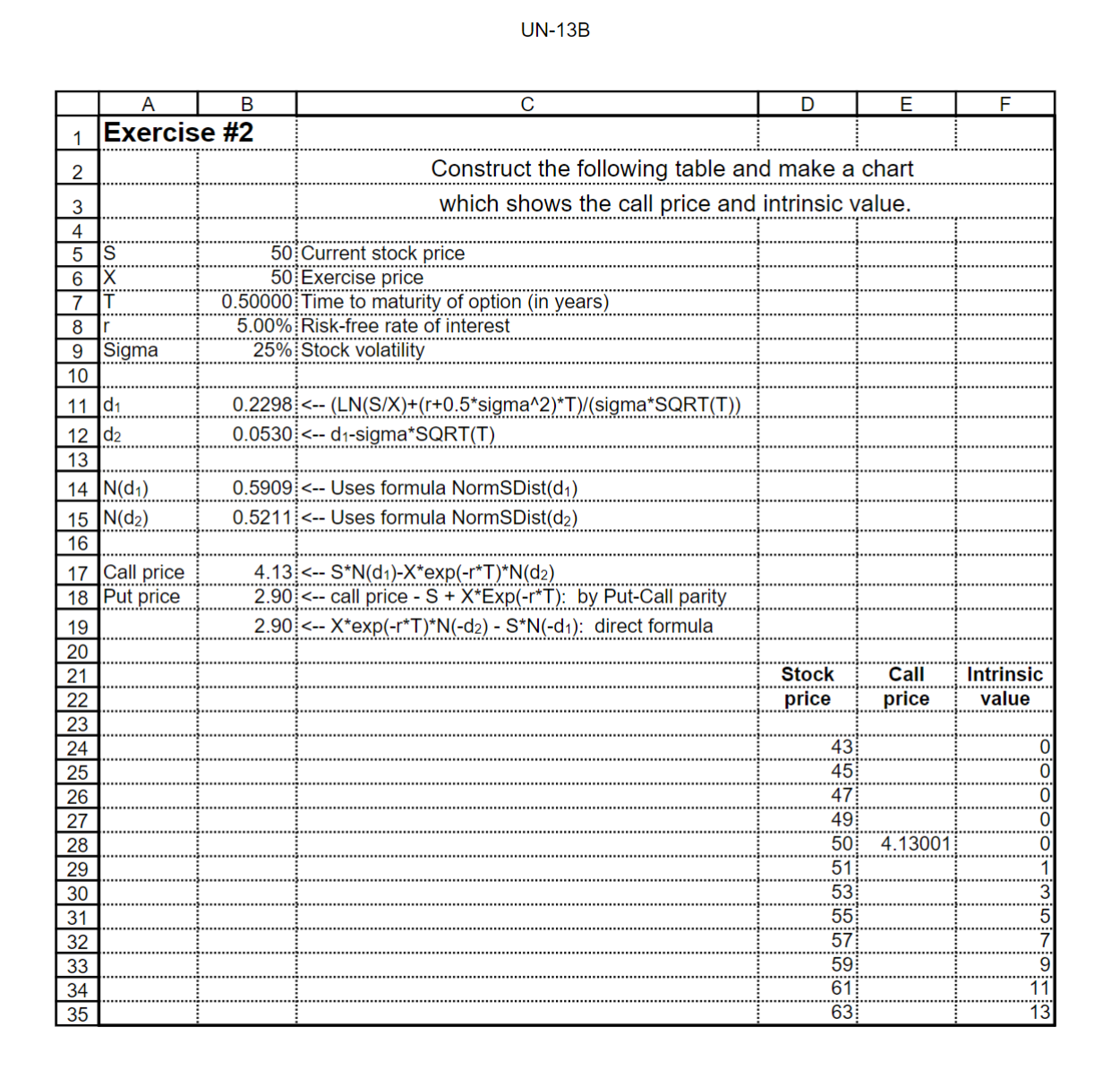

- In the second file, you may see the demo file for the call value when the stock price $50. You need to calculate call values when stock price changes to $43, $44, -------, $63, etc. Finally, you construct the profile based on the calculated call values.

PLEASE DEMONSTRATE IN EXCEL

PLEASE DEMONSTRATE IN EXCEL

Call prices X405060Price12.008.005.00Strategybuy1write2buy1 Payoff and profits Stock price at option Payoff on Payoff on Payoff on expiration,STX=40callX=50callX=60callTotalprofit 30.0 35.0 40.0 45.0 50.0 52.5 55.0 57.5 60.0 62.5 65.0 67.5 70.0 72.5 75.0 80.0 85.0 90.0 Consider the one step Model: ***** The stock price goes up by 15% or decreases by 8% The one-period interest is 8%. Consider a European call with X=$28 for the stock of $26. What is the call price? What is the put price? UN-13B Call prices X405060Price12.008.005.00Strategybuy1write2buy1 Payoff and profits Stock price at option Payoff on Payoff on Payoff on expiration,STX=40callX=50callX=60callTotalprofit 30.0 35.0 40.0 45.0 50.0 52.5 55.0 57.5 60.0 62.5 65.0 67.5 70.0 72.5 75.0 80.0 85.0 90.0 Consider the one step Model: ***** The stock price goes up by 15% or decreases by 8% The one-period interest is 8%. Consider a European call with X=$28 for the stock of $26. What is the call price? What is the put price? UN-13B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts