Question: In the most recent year, which was a bad one, the company made only $40 million in net income. It expects next year to

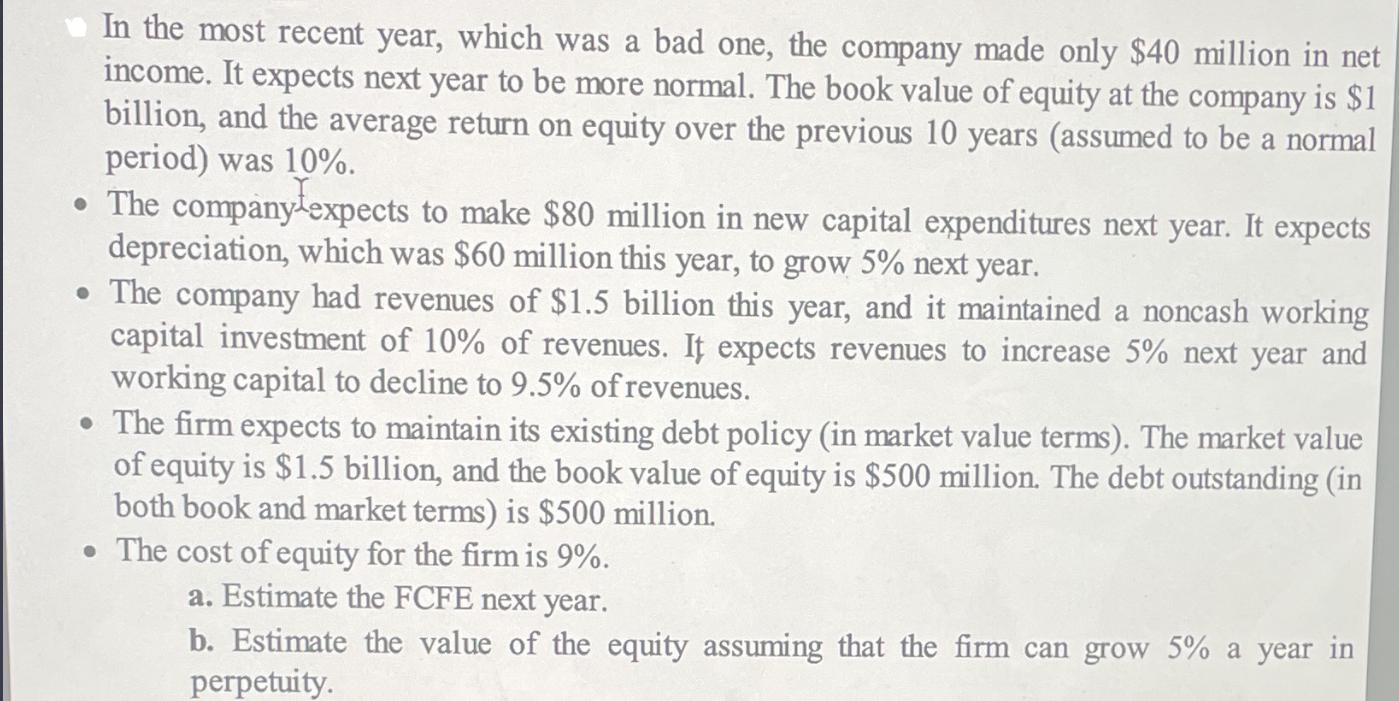

In the most recent year, which was a bad one, the company made only $40 million in net income. It expects next year to be more normal. The book value of equity at the company is $1 billion, and the average return on equity over the previous 10 years (assumed to be a normal period) was 10%. The company expects to make $80 million in new capital expenditures next year. It expects depreciation, which was $60 million this year, to grow 5% next year. The company had revenues of $1.5 billion this year, and it maintained a noncash working capital investment of 10% of revenues. It expects revenues to increase 5% next year and working capital to decline to 9.5% of revenues. The firm expects to maintain its existing debt policy (in market value terms). The market value of equity is $1.5 billion, and the book value of equity is $500 million. The debt outstanding (in both book and market terms) is $500 million. The cost of equity for the firm is 9%. a. Estimate the FCFE next year. b. Estimate the value of the equity assuming that the firm can grow 5% a year in perpetuity.

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

a To calculate ECFE Het income 40 million Capital expenditure 80million Depreciation Gomilli... View full answer

Get step-by-step solutions from verified subject matter experts