Question: In the problems below, you can use a risk premium of 5.5% and a tax rate of 40% if either is not specified. All work

In the problems below, you can use a risk premium of 5.5% and a tax rate of 40% if either is not specified.

All work and answers must be done/shown in an Excel Spreadsheet

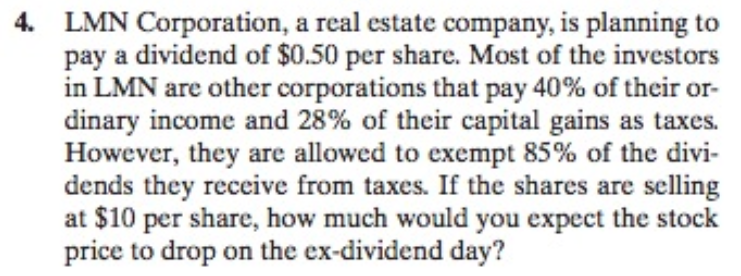

4. LMN Corporation, a real estate company, is planning to pay a dividend of $0.50 per share. Most of the investors in LMN are other corporations that pay 40% of their ordinary income and 28% of their capital gains as taxes. However, they are allowed to exempt 85% of the dividends they receive from taxes. If the shares are selling at $10 per share, how much would you expect the stock price to drop on the ex-dividend day? 4. LMN Corporation, a real estate company, is planning to pay a dividend of $0.50 per share. Most of the investors in LMN are other corporations that pay 40% of their ordinary income and 28% of their capital gains as taxes. However, they are allowed to exempt 85% of the dividends they receive from taxes. If the shares are selling at $10 per share, how much would you expect the stock price to drop on the ex-dividend day

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts