Question: In the spreadsheet, you will find data on the returns of Berkshire Hathaway, the returns of its portfolio of public stocks (computed via Berkshire's 13F

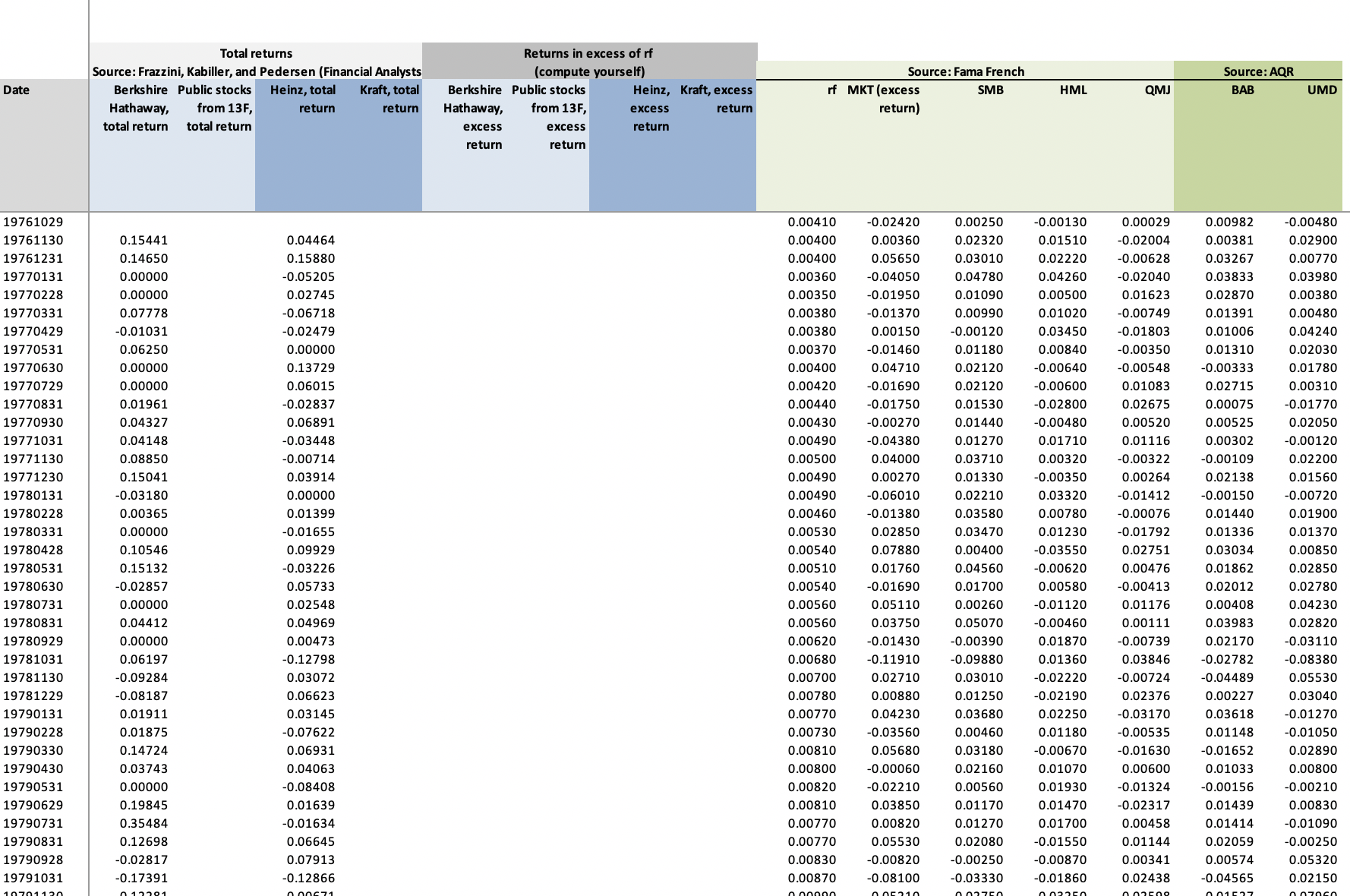

In the spreadsheet, you will find data on the returns of Berkshire Hathaway, the returns of its portfolio of public stocks (computed via Berkshire's 13F filings to the SEC), several factor returns, and the returns of Heinz and Kraft. Compute the factor loadings and annualized alpha of Berkshire Hathaway with respect to the following factor models and interpret the results:

- The 1-factor market model.

- The Fama-French 3-factor model with SMB and HML

- The 5-factor model consisting of the FF 3-factor model augmented with BAB and QMJ.

how do run regressions on this information, what formula and data columns do use

Date 19761029 19761130 19761231 19770131 19770228 19770331 19770429 19770531 19770630 19770729 19770831 19770930 19771031 19771130 19771230 19780131 19780228 19780331 19780428 19780531 19780630 19780731 19780831 19780929 19781031 19781130 19781229 19790131 19790228 19790330 19790430 19790531 19790629 19790731 19790831 19790928 19791031 10701120 Total returns Source: Frazzini, Kabiller, and Pedersen (Financial Analysts Berkshire Public stocks Heinz, total Kraft, total return Hathaway, return from 13F, total return total return 0.15441 0.14650 0.00000 0.00000 0.07778 -0.01031 0.06250 0.00000 0.00000 0.01961 0.04327 0.04148 0.08850 0.15041 -0.03180 0.00365 0.00000 0.10546 0.15132 -0.02857 0.00000 0.04412 0.00000 0.06197 -0.09284 -0.08187 0.01911 0.01875 0.14724 0.03743 0.00000 0.19845 0.35484 0.12698 -0.02817 -0.17391 012281 0.04464 0.15880 -0.05205 0.02745 -0.06718 -0.02479 0.00000 0.13729 0.06015 -0.02837 0.06891 -0.03448 -0.00714 0.03914 0.00000 0.01399 -0.01655 0.09929 -0.03226 0.05733 0.02548 0.04969 0.00473 -0.12798 0.03072 0.06623 0.03145 -0.07622 0.06931 0.04063 -0.08408 0.01639 -0.01634 0.06645 0.07913 -0.12866 0.00671 Returns in excess of rf (compute yourself) Berkshire Public stocks Hathaway, from 13F, excess excess return return Heinz, Kraft, excess return excess return rf MKT (excess return) 0.00410 0.00400 0.00400 0.00360 0.00350 0.00380 0.00380 0.00370 0.00400 0.00420 0.00440 0.00430 0.00490 0.00500 0.00490 0.00490 0.00460 0.00530 0.00540 0.00510 0.00540 0.00560 0.00560 0.00620 0.00680 0.00700 0.00780 0.00770 0.00730 0.00810 0.00800 0.00820 0.00810 0.00770 0.00770 0.00830 0.00870 Source: Fama French SMB 0.00000 -0.02420 0.00360 0.05650 -0.04050 -0.01950 -0.01370 0.00150 -0.01460 0.04710 -0.01690 -0.01750 -0.00270 -0.04380 0.04000 0.00270 -0.06010 -0.01380 0.02850 0.07880 0.01760 -0.01690 0.05110 0.03750 -0.01430 -0.11910 0.02710 0.00880 0.04230 -0.03560 0.05680 -0.00060 -0.02210 0.03850 0.00820 0.05530 -0.00820 -0.08100 0.05210 0.00250 0.02320 0.03010 0.04780 0.01090 0.00990 -0.00120 0.01180 0.02120 0.02120 0.01530 0.01440 0.01270 0.03710 0.01330 0.02210 0.03580 0.03470 0.00400 0.04560 0.01700 0.00260 0.05070 -0.00390 -0.09880 0.03010 0.01250 0.03680 0.00460 0.03180 0.02160 0.00560 0.01170 0.01270 0.02080 -0.00250 -0.03330 0.02750 HML -0.00130 0.01510 0.02220 0.04260 0.00500 0.01020 0.03450 0.00840 -0.00640 -0.00600 -0.02800 -0.00480 0.01710 0.00320 -0.00350 0.03320 0.00780 0.01230 -0.03550 -0.00620 0.00580 -0.01120 -0.00460 0.01870 0.01360 -0.02220 -0.02190 0.02250 0.01180 -0.00670 0.01070 0.01930 0.01470 0.01700 -0.01550 -0.00870 -0.01860 0.02250 QMJ 0.00029 -0.02004 -0.00628 -0.02040 0.01623 -0.00749 -0.01803 -0.00350 -0.00548 0.01083 0.02675 0.00520 0.01116 -0.00322 0.00264 -0.01412 -0.00076 -0.01792 0.02751 0.00476 -0.00413 0.01176 0.00111 -0.00739 0.03846 -0.00724 0.02376 -0.03170 -0.00535 -0.01630 0.00600 -0.01324 -0.02317 0.00458 0.01144 0.00341 0.02438 003508 Source: AQR BAB 0.00982 0.00381 0.03267 0.03833 0.02870 0.01391 0.01006 0.01310 -0.00333 0.02715 0.00075 0.00525 0.00302 -0.00109 0.02138 -0.00150 0.01440 0.01336 0.03034 0.01862 0.02012 0.00408 0.03983 0.02170 -0.02782 -0.04489 0.00227 0.03618 0.01148 -0.01652 0.01033 -0.00156 0.01439 0.01414 0.02059 0.00574 -0.04565 001527 UMD -0.00480 0.02900 0.00770 0.03980 0.00380 0.00480 0.04240 0.02030 0.01780 0.00310 -0.01770 0.02050 -0.00120 0.02200 0.01560 -0.00720 0.01900 0.01370 0.00850 0.02850 0.02780 0.04230 0.02820 -0.03110 -0.08380 0.05530 0.03040 -0.01270 -0.01050 0.02890 0.00800 -0.00210 0.00830 -0.01090 -0.00250 0.05320 0.02150 0.07060

Step by Step Solution

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Dependent variable Excess return of Berkshire Hathaway Berkshire Public Stocks rf Independent variables 1factor model Market excess return MKT excess return FamaFrench 3factor model MKT excess return ... View full answer

Get step-by-step solutions from verified subject matter experts