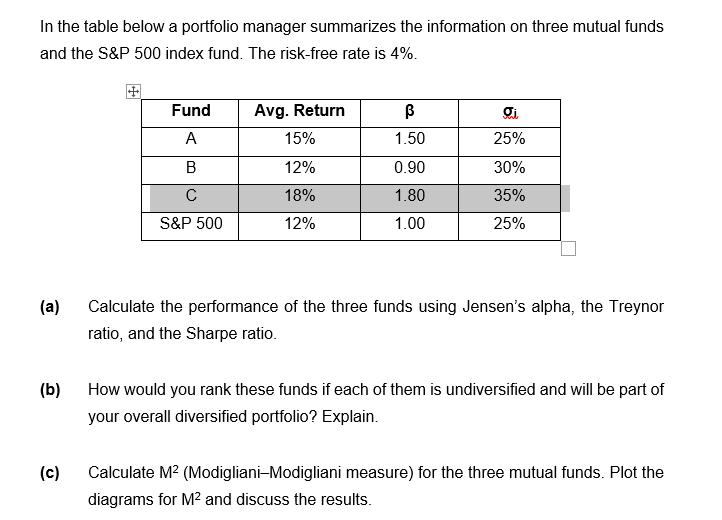

Question: In the table below a portfolio manager summarizes the information on three mutual funds and the S&P 500 index fund. The risk-free rate is

In the table below a portfolio manager summarizes the information on three mutual funds and the S&P 500 index fund. The risk-free rate is 4%. (a) Fund Avg. Return i A 15% 1.50 25% B 12% 0.90 30% C 18% 1.80 35% S&P 500 12% 1.00 25% Calculate the performance of the three funds using Jensen's alpha, the Treynor ratio, and the Sharpe ratio. (b) How would you rank these funds if each of them is undiversified and will be part of your overall diversified portfolio? Explain. (c) Calculate M (Modigliani-Modigliani measure) for the three mutual funds. Plot the diagrams for M and discuss the results.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts