Question: In the table below, how did they find the UNIT COST? C Solved: What do you think they Meet - ziu-kzwd-oyg Downloads X x |

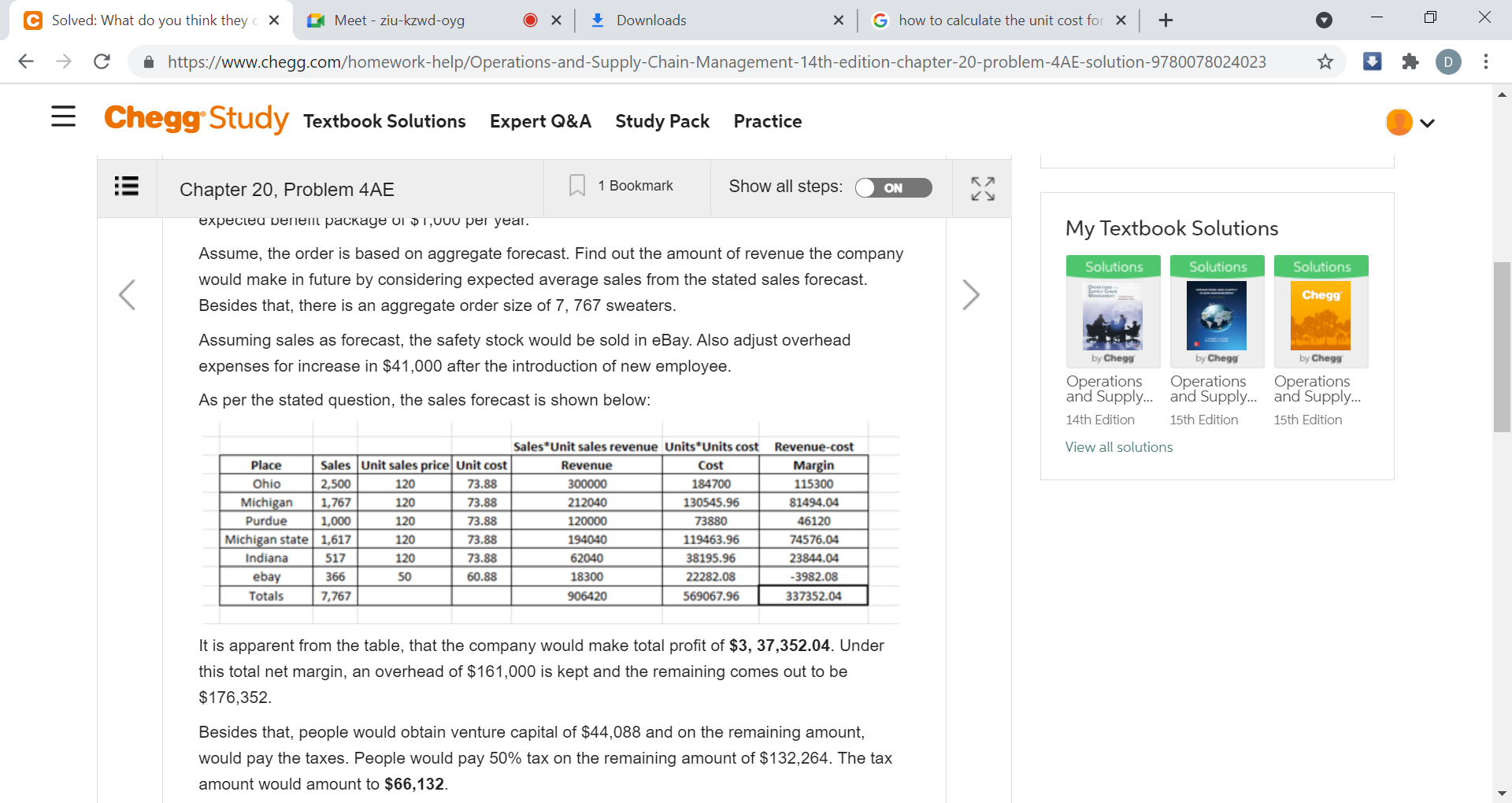

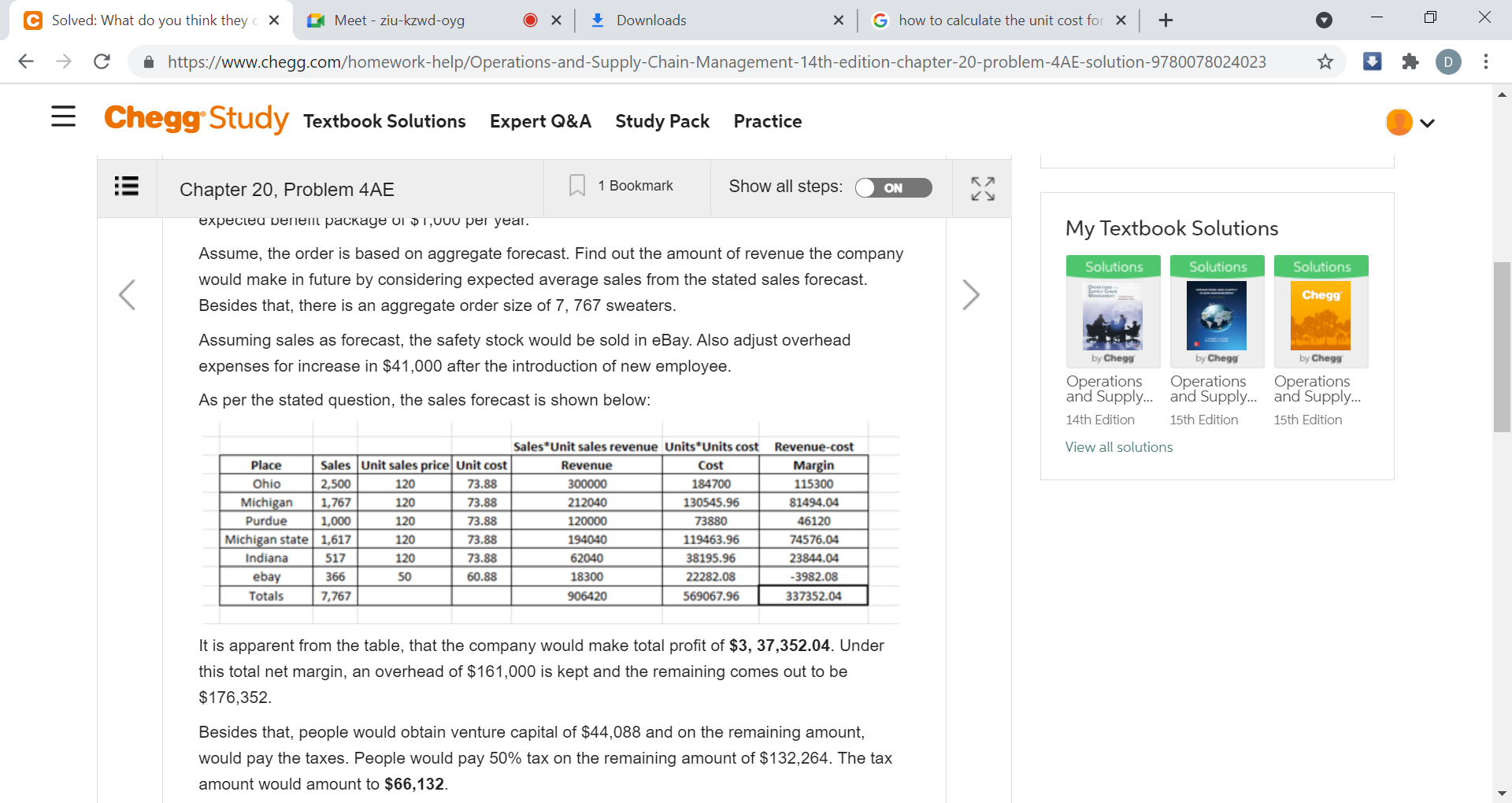

In the table below, how did they find the UNIT COST?

C Solved: What do you think they Meet - ziu-kzwd-oyg Downloads X x | G how to calculate the unit cost for x | + - { https://www.chegg.com/homework-help/Operations-and-Supply-Chain-Management-14th-edition-chapter-20-problem-4AE-solution-9780078024023 D = Chegg Study Textbook Solutions Expert Q&A Study Pack Practice 1 Bookmark Chapter 20, Problem 4AE Show all steps: ON RA Ky xt g 1,000 r. My Textbook Solutions Assume, the order is based on aggregate forecast. Find out the amount of revenue the company Solutions Solutions Solutions would make in future by considering expected average sales from the stated sales forecast. > Chegg Besides that, there is an aggregate order size of 7, 767 sweaters. Assuming sales as forecast, the safety stock would be sold in eBay. Also adjust overhead expenses for increase in $41,000 after the introduction of new employee. by Chega by Chegg by Chegg Operations Operations Operations and Supply... and Supply... and Supply... As per the stated question, the sales forecast is shown below: 14th Edition 15th Edition 15th Edition Revenue-cost View all solutions Margin 115300 81494.04 Sales*Unit sales revenue Units Units cost Place Sales Unit sales price Unit cost Revenue Cost Ohio 2,500 120 73.88 300000 184700 Michigan 1,767 120 73.88 212040 130545.96 Purdue 1,000 120 73.88 120000 73880 Michigan state 1,617 120 194040 119463.96 Indiana 517 120 73.88 62040 38195.96 ebay 366 50 60.88 18300 22282.08 Totals 906420 569067.96 46120 73.88 74576.04 23844.04 -3982.08 7,767 337352.04 It is apparent from the table, that the company would make total profit of $3, 37,352.04. Under this total net margin, an overhead of $161,000 is kept and the remaining comes out to be $176,352. Besides that, people would obtain venture capital of $44,088 and on the remaining amount, would pay the taxes. People would pay 50% tax on the remaining amount of $132,264. The tax amount would amount to $66,132