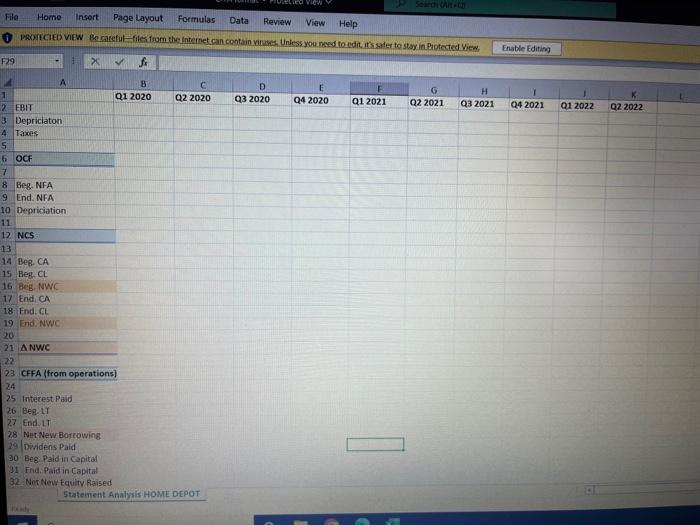

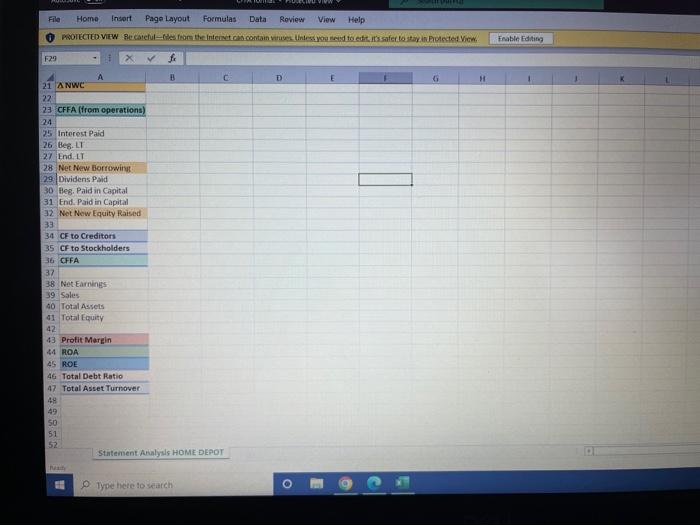

Question: In this assignment you are required to complete the estiamte of FCFF of Home Depot for 10 consecutive quaters (Q1 2020 to Q2 2022). Approachs

File Home Insert Page Layout Formulas Data Review View Help F29 =$xfx \begin{tabular}{|l|l|l|} \hline & & A \\ \hline 1 & & QI \\ \hline 2 & EBIT \\ \hline 3 & Depriciaton \\ 4 & Taxes \\ \hline 5 & \\ \hline 6 & OCF \\ \hline 7 & \\ \hline \end{tabular} 8 Beg. NFA 9 End. NFA 10 Depriciation 11 17. NCS: 14 Beg. CA Beg CL Heig. NWC Endi CA End. CL End: NWC NWC CFFA (from operations) interest Paid Beg. LT Find.LT 28 Net New Borrowing: 29 Dividens Paid 30 Beg. Paid in Capital 91 Fnd, Paid in Capital 32. Not New Equity Raised 5 tatement Analysis HoMe DCpoT Frable Fditing File Home Insert Page Layout Formulas Data Review View Help F29 =$xfx \begin{tabular}{|l|l|l|} \hline & & A \\ \hline 1 & & QI \\ \hline 2 & EBIT \\ \hline 3 & Depriciaton \\ 4 & Taxes \\ \hline 5 & \\ \hline 6 & OCF \\ \hline 7 & \\ \hline \end{tabular} 8 Beg. NFA 9 End. NFA 10 Depriciation 11 17. NCS: 14 Beg. CA Beg CL Heig. NWC Endi CA End. CL End: NWC NWC CFFA (from operations) interest Paid Beg. LT Find.LT 28 Net New Borrowing: 29 Dividens Paid 30 Beg. Paid in Capital 91 Fnd, Paid in Capital 32. Not New Equity Raised 5 tatement Analysis HoMe DCpoT Frable Fditing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts