Question: In this assignment, you are to create and evaluate a startup company similar to the company assigned to you in FIN 1 practice - based

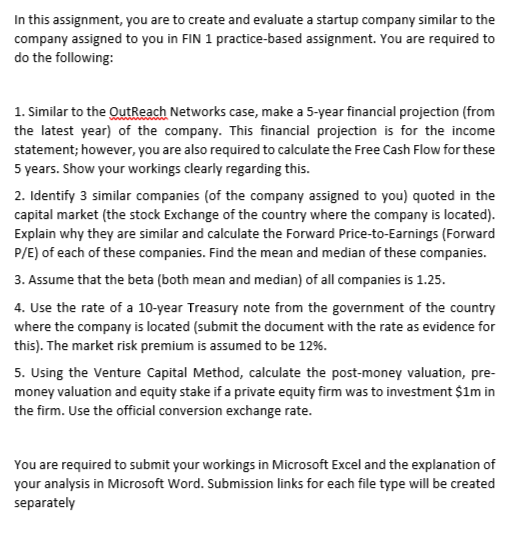

In this assignment, you are to create and evaluate a startup company similar to the

company assigned to you in FIN practicebased assignment. You are required to

do the following:

Similar to the OutReach Networks case, make a year financial projection from

the latest year of the company. This financial projection is for the income

statement; however, you are also required to calculate the Free Cash Flow for these

years. Show your workings clearly regarding this.

Identify similar companies of the company assigned to you quoted in the

capital market the stock Exchange of the country where the company is located

Explain why they are similar and calculate the Forward PricetoEarnings Forward

of each of these companies. Find the mean and median of these companies.

Assume that the beta both mean and median of all companies is

Use the rate of a year Treasury note from the government of the country

where the company is located submit the document with the rate as evidence for

this The market risk premium is assumed to be

Using the Venture Capital Method, calculate the postmoney valuation, pre

money valuation and equity stake if a private equity firm was to investment $ in

the firm. Use the official conversion exchange rate.

You are required to submit your workings in Microsoft Excel and the explanation of

your analysis in Microsoft Word. Submission links for each file type will be created

separately

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock