Question: 9. (LO 2) Wales Remodeling applies revaluation accounting to equipment that is recorded on its books at 800,000, with 100,000 of accumulated depreciation after

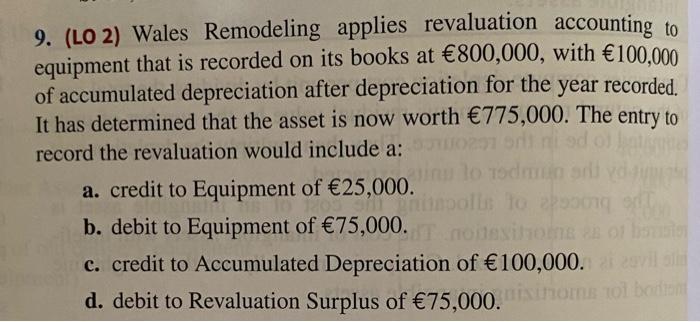

9. (LO 2) Wales Remodeling applies revaluation accounting to equipment that is recorded on its books at 800,000, with 100,000 of accumulated depreciation after depreciation for the year recorded. It has determined that the asset is now worth 775,000. The entry to record the revaluation would include a: 0291 51 lo todmin d polls to 22000g edo noitexihome of borister 28 c. credit to Accumulated Depreciation of 100,000. ai zavil sli d. debit to Revaluation Surplus of 75,000. nisinoms 101 bodom a. credit to Equipment of 25,000. 11 A b. debit to Equipment of 75,000.

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

The entry to record the revaluation would include a Here the correct option is b Debit to Equipment ... View full answer

Get step-by-step solutions from verified subject matter experts