Question: In this assignment, you will solve a version of the specific factors model to see how trade can create both winners and losers through its

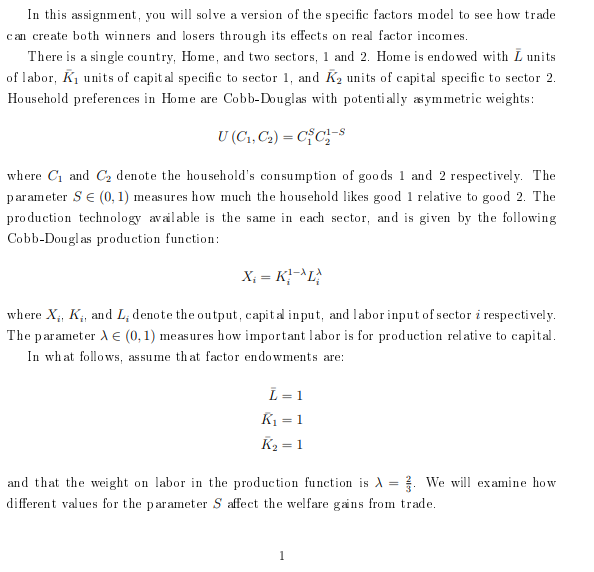

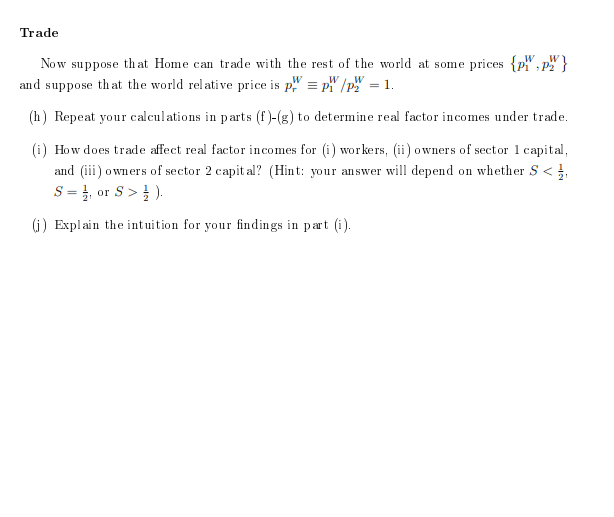

In this assignment, you will solve a version of the specific factors model to see how trade can create both winners and losers through its effects on real factor incomes. There is a single country, Home, and two sectors, 1 and 2 . Home is endowed with L units of labor, K1 units of capital specific to sector 1 , and K2 units of capital specific to sector 2. Household preferences in Home are Cobb-Douglas with potentially aymmetric weights: U(C1,C2)=C1SC21S where C1 and C2 denote the household's consumption of goods 1 and 2 respectively. The p arameter S(0,1) measures how much the household likes good 1 relative to good 2. The production technology avalable is the same in each sector, and is given by the following Cobb-Douglas production function: Xi=Ki1Li where Xi,Ki, and Li denote the output, capital in put, and labor input of sector i respectively. The parameter (0,1) measures how important labor is for production relative to capital. In what follows, assume that factor endowments are: LK1K2=1=1=1 and that the weight on labor in the production function is =32. We will examine how different values for the parameter S affect the welfare gains from trade. First, we will solve for dem and and supply assuming that the goods prices p1 and p2 (and hence the relative price prp1/p2 ) are known. Let w,r1, and r2 denote the wage, rental rate of sector 1 capital, and rental r ate of sector 2 capital respectively. Demand The utility maximization problem for a household with income I is: maxC1,C2C1SC21Ss.t.p1C1+p2C2=I (a) What is equilibrium relative consumption, CrC1/C2, given goods prices? Supply The profit maximization problem for a firm in sector i is: maxKi,Li{piKi1LiriKiwLi} (b) Write down the first-order conditions for this problem. Now note that capital market clearing requires: Ki=Ki for i{1,2}. (c) What is the equilibrium relative allocation of labor across sectors, LrL1/L2, given goods prices? (d) What is equilibrium relative output, XrX1/X2, given goods prices? Autarky Now suppose that Home is in autarky. Goods market clearing therefore requires that consumption equals production: Ci=Xi for i{1,2}. (e) What is the equilibrium relative goods price pr in autarky? How does the relative price change with S ? Why? Now note that labor market clearing also requires: L1+L2=L. (f) What is the allocation of labor in each sector, L1 and L2 ? (g) What are real factor incomes in terms of goods 1 and 2, i.e. p1w,p2w,p1r1,p2r1,p1r2, and p2r2 ? Trade Now suppose that Home can trade with the rest of the world at some prices {p1W,p2W} and suppose that the world relative price is prWp1W/p2W=1. (h) Repeat your calculations in parts (f)-(g) to determine real factor incomes under trade. (i) How does trade affect real factor incomes for (i) workers, (ii) owners of sector 1 capital, and (iii) owners of sector 2 capital? (Hint: your answer will depend on whether S21) (j) Explain the intuition for your findings in part (i). In this assignment, you will solve a version of the specific factors model to see how trade can create both winners and losers through its effects on real factor incomes. There is a single country, Home, and two sectors, 1 and 2 . Home is endowed with L units of labor, K1 units of capital specific to sector 1 , and K2 units of capital specific to sector 2. Household preferences in Home are Cobb-Douglas with potentially aymmetric weights: U(C1,C2)=C1SC21S where C1 and C2 denote the household's consumption of goods 1 and 2 respectively. The p arameter S(0,1) measures how much the household likes good 1 relative to good 2. The production technology avalable is the same in each sector, and is given by the following Cobb-Douglas production function: Xi=Ki1Li where Xi,Ki, and Li denote the output, capital in put, and labor input of sector i respectively. The parameter (0,1) measures how important labor is for production relative to capital. In what follows, assume that factor endowments are: LK1K2=1=1=1 and that the weight on labor in the production function is =32. We will examine how different values for the parameter S affect the welfare gains from trade. First, we will solve for dem and and supply assuming that the goods prices p1 and p2 (and hence the relative price prp1/p2 ) are known. Let w,r1, and r2 denote the wage, rental rate of sector 1 capital, and rental r ate of sector 2 capital respectively. Demand The utility maximization problem for a household with income I is: maxC1,C2C1SC21Ss.t.p1C1+p2C2=I (a) What is equilibrium relative consumption, CrC1/C2, given goods prices? Supply The profit maximization problem for a firm in sector i is: maxKi,Li{piKi1LiriKiwLi} (b) Write down the first-order conditions for this problem. Now note that capital market clearing requires: Ki=Ki for i{1,2}. (c) What is the equilibrium relative allocation of labor across sectors, LrL1/L2, given goods prices? (d) What is equilibrium relative output, XrX1/X2, given goods prices? Autarky Now suppose that Home is in autarky. Goods market clearing therefore requires that consumption equals production: Ci=Xi for i{1,2}. (e) What is the equilibrium relative goods price pr in autarky? How does the relative price change with S ? Why? Now note that labor market clearing also requires: L1+L2=L. (f) What is the allocation of labor in each sector, L1 and L2 ? (g) What are real factor incomes in terms of goods 1 and 2, i.e. p1w,p2w,p1r1,p2r1,p1r2, and p2r2 ? Trade Now suppose that Home can trade with the rest of the world at some prices {p1W,p2W} and suppose that the world relative price is prWp1W/p2W=1. (h) Repeat your calculations in parts (f)-(g) to determine real factor incomes under trade. (i) How does trade affect real factor incomes for (i) workers, (ii) owners of sector 1 capital, and (iii) owners of sector 2 capital? (Hint: your answer will depend on whether S21) (j) Explain the intuition for your findings in part (i)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts