Question: In this assignment, you will use a Monte Carlo simulation to investigate the effect of randomness in returns on an individual's future retirement wealth. Saving

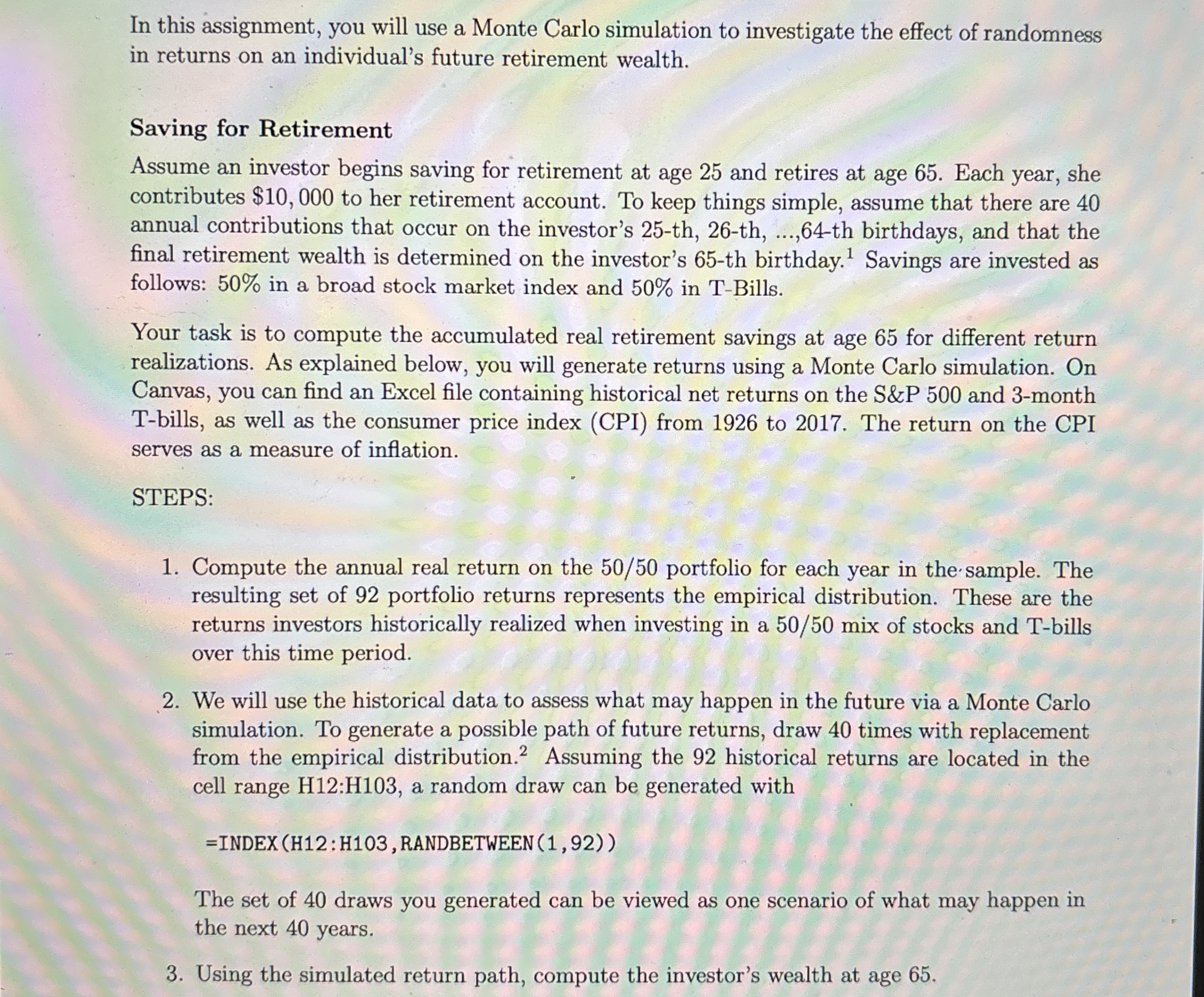

In this assignment, you will use a Monte Carlo simulation to investigate the effect of randomness

in returns on an individual's future retirement wealth.

Saving for Retirement

Assume an investor begins saving for retirement at age and retires at age Each year, she

contributes $ to her retirement account. To keep things simple, assume that there are

annual contributions that occur on the investor's ththth birthdays, and that the

final retirement wealth is determined on the investor's th birthday. Savings are invested as

follows: in a broad stock market index and in TBills.

Your task is to compute the accumulated real retirement savings at age for different return

realizations. As explained below, you will generate returns using a Monte Carlo simulation. On

Canvas, you can find an Excel file containing historical net returns on the S&P and month

Tbills, as well as the consumer price index CPI from to The return on the CPI

serves as a measure of inflation.

STEPS:

Compute the annual real return on the portfolio for each year in the sample. The

resulting set of portfolio returns represents the empirical distribution. These are the

returns investors historically realized when investing in a mix of stocks and Tbills

over this time period.

We will use the historical data to assess what may happen in the future via a Monte Carlo

simulation. To generate a possible path of future returns, draw times with replacement

from the empirical distribution. Assuming the historical returns are located in the

cell range H:H a random draw can be generated with

INDEx:RANDBETWEEN

The set of draws you generated can be viewed as one scenario of what may happen in

the next years.

Using the simulated return path, compute the investor's wealth at age

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock