Question: In this assignment, you'll be visualizing and interpreting data regarding Current Ratio vs Current Cash Debt Coverage and Profit Margin on Sales vs Payout Ratio

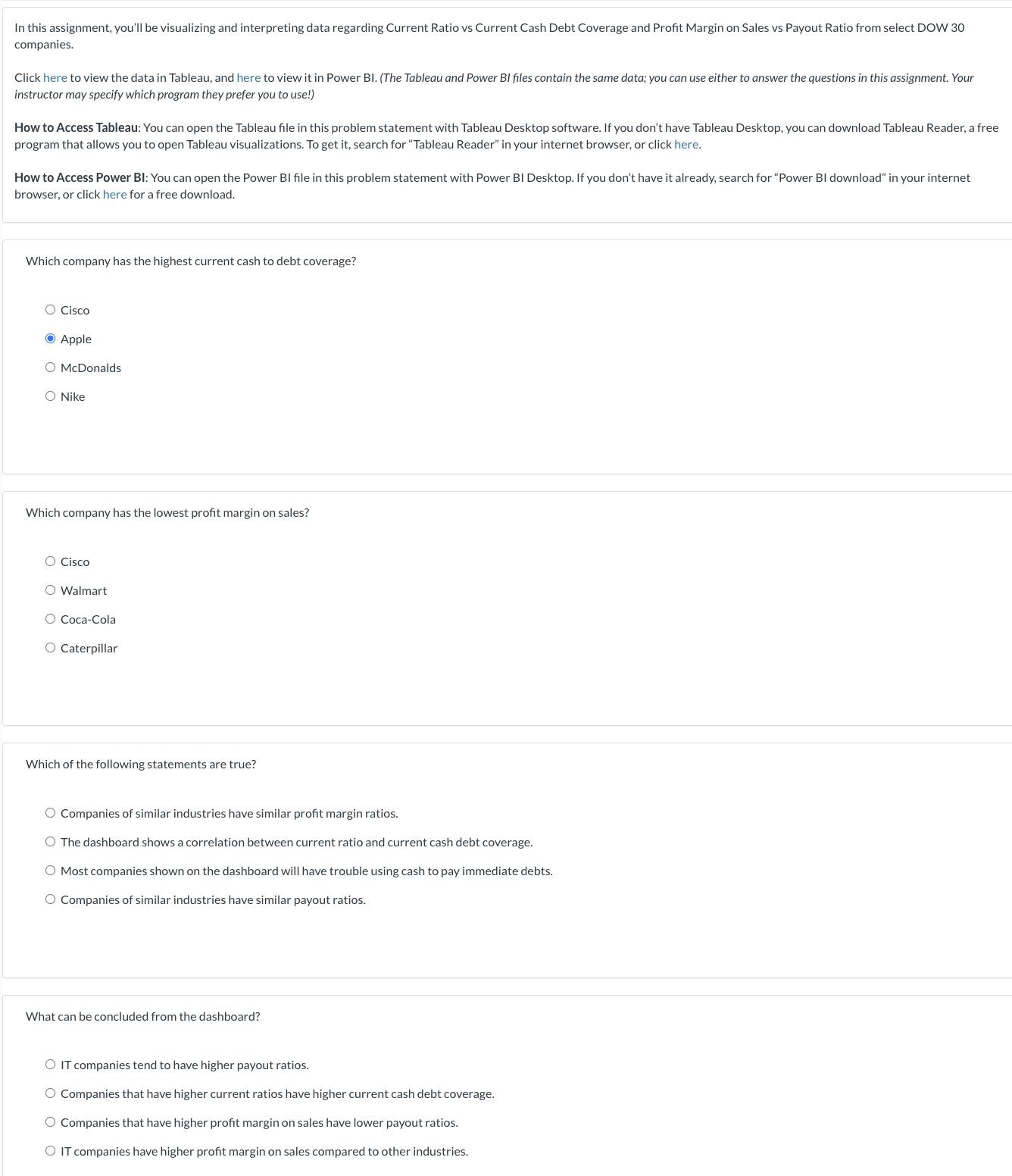

In this assignment, you'll be visualizing and interpreting data regarding Current Ratio vs Current Cash Debt Coverage and Profit Margin on Sales vs Payout Ratio from select DOW

companies.

Click here to view the data in Tableau, and here to view it in Power BIThe Tableau and Power BI files contain the same data; you can use either to answer the questions in this assignt. Your

instructor may specify which program they prefer you to use!

How to Access Tableau: You can open the Tableau file in this problem statement with Tableau Desktop software. If you don't have Tableau Desktop, you can download Tableau Reader, a free

program that allows you to open Tableau visualizations. To get it search for "Tableau Reader" in your internet browser, or click here.

How to Access Power BI: You can open the Power BI file in this problem statement with Power BI Desktop. If you don't have it already, search for "Power BI download" in your internet

browser, or click here for a free download.

Which company has the highest current cash to debt coverage?

Cisco

Apple

McDonalds

Nike

Which company has the lowest profit margin on sales?

Cisco

Walmart

CocaCola

Caterpillar

Which of the following statements are true?

Companies of similar industries have similar profit margin ratios.

The dashboard shows a correlation between current ratio and current cash debt coverage.

Most companies shown on the dashboard will have trouble using cash to pay immediate debts.

Companies of similar industries have similar payout ratios.

What can be concluded from the dashboard?

IT companies tend to have higher payout ratios.

Companies that have higher current ratios have higher current cash debt coverage.

Companies that have higher profit margin on sales have lower payout ratios.

IT companies have higher profit margin on sales compared to other industries.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock